Pentax 2008 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2008 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

to market changes and allow us to sustain a measure of

profitability through cost competitiveness even when product

prices fall in the face of difficult market conditions. Concerning

capital investments, from approximately one year prior we have

carefully considered which areas to be aggressive in and which to

narrow down, and have taken actions accordingly. We intend to

pursue the same policy in the year ahead and the years following,

channeling the minimum required level of financial resources into

primarily frontline technology areas.

It has been approximately eight years since I took up the

position of CEO. The scale of the Hoya Group businesses has

grown substantially since then, but many improvements still need

to be made in the operation and organizational structure of the

businesses. With the addition of the Pentax business, I believe we

have an excellent opportunity to review our operations from the

ground up during the upcoming fiscal year. The Company has so

far ridden the wave of market growth to achieve solid performance

gains, a ride that has for too long lulled certain segments into

contentment with current levels of success. It is difficult to change

what one has become accustomed to, and the change requires

vast expenditures of energy. However, we believe some areas

require reform from the standpoint of sharpening our competitive

edge. Rather than fearing change, we intend to bring the

Company back to its roots and commence with efforts to bring

about such changes. I would like to start by changing the mentality

of each Group employee to put such measures into practice.

Business Portfolio Management and a

Medium- to Long-Term Vision to Support

Sustained Growth

Hoya’s concept of business portfolio management is a business

philosophy that entails retaining and subsuming several different

businesses within the Group simultaneously and balancing them

to sustain profitability, stability and growth overall. This is Hoya’s

basic attitude regarding management.

As with living things, every undertaking follows a life cycle of

birth, growth, maturation and decline. In line with this process,

enduring expansion requires constant generation of new

businesses, or else the drawing in of new businesses from the

outside. As one business is being born, another business may be

removed from the portfolio once it has served its purpose.

My role as CEO is to continually tune the Group’s business

portfolio to the needs of the times. I consider it my highest

mission to ensure the continued growth of the business entity

that is the Hoya Group, through selection and winnowing of

businesses, appropriate allocation of resources and the

development of an optimal business portfolio.

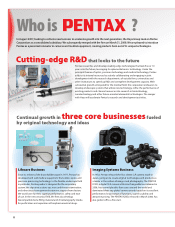

Based on this approach, in the fiscal year under review we

added the new portfolio elements of Pentax’s businesses to Hoya’s

existing business portfolio. This was part of a two- to three-year

effort to transform the Company, as well as one of the processes

toward paving a new path for Hoya’s growth over the next 10 years.

I see Hoya as an optics company. In that sense, I aim to

develop the Company’s businesses by leveraging its optical

technologies and maximizing opportunities for growth and profits

within those fields. Optics is one area that still has potential for

growth. I remain optimistic about the potential for new business

development in this domain.

Striving for Sustained Growth into the Future

through Management Integration with Pentax

I said before that Hoya is an optics company. In looking to the

next phase of the Company’s growth utilizing its optical

technologies, one business we had longed to enter at some point

was endoscopes and other medical devices. We explored this field

early on, but starting a business from the ground up takes time.

Instead, we deemed outside resources a more effective way of

keeping pace with the times, and settled on the business

integration with Pentax as a viable option.

The medical endoscope business is very attractive, and one in

which Pentax possesses superb technologies and development

capabilities. The medical endoscope business shows tremendous

potential. I would like to consciously cultivate this business into a

pillar to support the Hoya Group’s growth 10 to 20 years into the

future. Although I simply say the “medical equipment field,” this

market is expected to diversify. Limiting the domain to optical

technologies, which is an area of particular expertise for both

corporations, we can demonstrate undisputed competitive

advantages. To this end, we are aggressively investing

management resources to cultivate and develop new markets.

A Message to Our Stakeholders

6