Pentax 2008 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2008 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

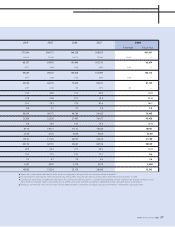

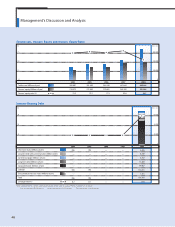

126,338

20,653

16.3

112,379

7,728

9,434

119,808

21,167

17.7

118,229

7,405

11,672

46,177

10,166

22.0

24,416

1,311

848

40,850

9,215

22.6

24,410

1,170

2,119

35,484

6,859

19.3

19,927

855

2,391

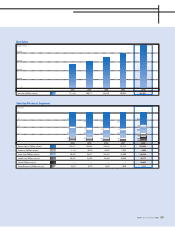

60,000

45,000

30,000

15,000

0

20

15

10

5

0

Net sales

(Millions of yen)

Operating income

(Millions of yen)

Operating

margin (%)

Assets

(Millions of yen)

Depreciation

(Millions of yen)

Capital expenditures

(Millions of yen)

104,457

20,370

19.5

98,243

6,444

7,958

2006 2007 2008

(Millions of yen)

20

15

10

5

0

(%)

120,000

90,000

60,000

30,000

0

Note: The operating margin above is calculated using net sales plus intersegment sales. Please

refer to details on page 78, Segment Information.

Net sales

(Millions of yen)

Operating income

(Millions of yen)

Operating

margin (%)

Assets

(Millions of yen)

Depreciation

(Millions of yen)

Capital expenditures

(Millions of yen)

Note: The operating margin above is calculated using net sales plus intersegment sales. Please

refer to details on page 78, Segment Information.

(%)(Millions of yen)

2006 2007 2008

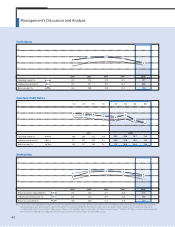

Management’s Discussion and Analysis

Eye Care (Health Care Division)

Net sales in the Vision Care Division rose 5.5%, to ¥126,338 million.

Sales in Japan were down 4.8%, as the market continued to contract.

Also, although sales of Hoya’s high-end eyeglass lenses rose, prices

were affected by downward pressure resulting from stiff competition

for low-end lenses. In Europe, the deceleration in consumer demand

grew more pronounced in the second half of the fiscal year, but by

focusing on high-value-added products throughout the fiscal year

Hoya succeeded in increasing sales in this market 10.0% year on year.

Asia-Pacific sales in this division surged 20.0%, as the Company met

expanding regional demand for high-value-added products. North

American sales remained flat, as the subprime loan issue prompted an

economic slowdown and affected the propensity to consume.

Operating income in this division declined 2.4% during the year, to

¥20,653 million, and the operating margin came to 16.3%. This

decrease in profitability was attributable partly to our aggressive

marketing activities targeting eyeglass stores in Japan and overseas,

which we view as an investment in future growth, as well as to

expenditures on upgrades to maintain cutting-edge factories in Asia.

Capital expenditures in this division were down 19.2% from the

preceding term, to ¥9,434 million. This investment went toward IT

systems linking Hoya’s plants with customers’ eyeglass stores, as well as

efforts to raise production system efficiency.

Net sales in the Health Care Division rose 13.0% from the previous year,

to ¥46,177 million. Heightened efforts to attract customers to our Eye

City chain of directly managed contact lens specialty stores through

consulting-based sales and enhanced after-sales services succeeded in

raising store sales even though the overall number of stores in the chain

decreased. Boosting sales in Japan and overseas were highly regarded

products such as soft yellow lenses—post-cataract-surgery IOLs.

The division’s operating income increased 10.3% during the year,

to ¥10,166 million, and its operating margin came to 22.0%. Although

the operating environment remained adverse, Hoya maintained

profitability through aggressive investment in marketing to ensure

future growth on the one hand, while cutting operating costs on the

other.

Eye Care (Vision Care Division)

44