Pentax 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

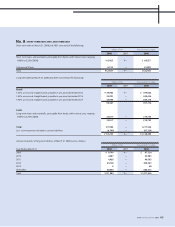

Stock price to volatility (Note 1)

Estimated time to exercise (Note 2)

Estimated dividends (Note 3)

Risk free rate (Note 4)

29.37%

5.38 years

¥65

1.07%

29.54%

5.88 years

¥65

1.11%

31.35%

6.38 years

¥65

1.15%

32.36%

6.88

¥65

1.20%

(a) (b) (c) (d)

Notes: 1. It is based on historical volatility of stock price for the period, corresponding to the estimated time to exercise, prior to the grant date.

2. It is assumed to be exercised in the middle of the exercise period due to the lack of enough data for other reasonable estimation.

3. It is based on the actual dividends for the year ended March 31, 2007.

4. It is based on interest rates on national government bonds with maturity corresponding to the estimated time to exercise.

2. Valuation Method for Fair Value of Stock Options

The 7th stock subscription rights granted for the year ended March 31, 2008 are valued as follows:

Fair value of stock subscription rights is valued for each of the following exercise periods.

(a) From October 1, 2008 to September 30, 2009

(b) From October 1, 2008 to September 30, 2010

(c) From October 1, 2008 to September 30, 2011

(d) From October 1, 2008 to September 30, 2017

a. Option-pricing model used: Black-Scholes model

b. Major assumptions used:

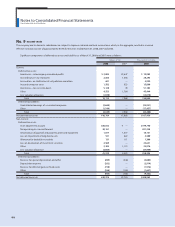

3. Estimation Methods for Number of Vested Stock Options

Only the actual number of stock options is reflected due to difficulty in estimating the number of stock options to be forfeited in the future.

4. Stock-based compensation expense is recorded on the consolidated statement of income for the year ended March 31, 2008 as follows:

Cost of sales ¥ 105 million

Selling, general and administrative expenses ¥ 311 million

No. 18 BUSINESS COMBINATIONS AND BUSINESS DIVESTITURES

Business combination — the purchase method

1. Name of the acquired company, description of its businesses,

major reasons for business combination, business combination

date, legal form for business combination, name of the concerned

company after business combination and ratio of acquired voting

rights

(1) Name of the acquired company and description of its businesses

Acquired company: Pentax Corporation

Business description: Manufacture, sale, etc. of life care products,

imaging systems and optical components

(2) Reasons for business combination

The Company and Pentax Corporation aim to establish strong

operating foundations by using management resources they

respectively own in a manner supplementary to each other. The

two companies also seek to create corporate value by developing

attractive products with optical and precision processing

technologies at which they excel and offering the products to a

broader range of customers.

Following the management integration, the Company and

Pentax Corporation are working to optimize their business

portfolios, and aim at further bolstering their competitiveness.

(3) Business combination date

August 14, 2007

(4) Legal form for business combination

Share acquisition

(5) Name of the concerned company after business combination

Pentax Corporation

(6) Ratio of acquired voting rights

90.58% (Note: The Company and Pentax Corporation merged in

March 2008. Details of their merger are stated in “business

combination—under common control.”)

2. Period of the acquired company’s results included in consolidated

financial statements for the consolidated fiscal year under review

The acquired company’s results during the period from October 1,

2007 to March 31, 2008 are consolidated.

3. Cost of acquiring the company and its breakdown

Share acquisition expenses ¥ 94,482 million

Direct expenditure on share acquisition 296 million

Acquisition cost ¥ 94,778 million

Notes to Consolidated Financial Statements

Hoya Corporation and Subsidiaries

74