Pentax 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

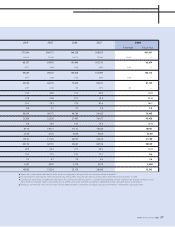

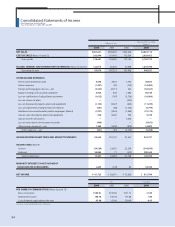

Retained earnings amounted to ¥373,888 million, partially based on

¥28,089 million in dividends paid from ¥81,725 million in net income.

Treasury stock declined ¥4,768 million, to ¥7,984 million. As a result,

total shareholders’ equity came to ¥388,067 million, and net assets

grew ¥27,481 million, compared with the previous fiscal year, to

¥394,626 million.

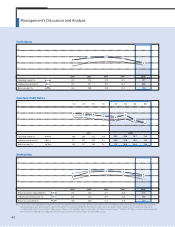

From the fiscal year ended March 31, 2007, the Company has

applied “Accounting Standard for Presentation of Net Assets in the

Balance Sheet” (Statement No. 5 issued by the Accounting Standards

Board of Japan on December 9, 2005) and “Guidance on Accounting

Standard for Presentation of Net Assets in the Balance Sheet”

(Guidance No. 8 issued by the Accounting Standards Board of Japan on

December 9, 2005), the Shareholders’ equity section has been replaced

by a net assets section, to which accumulated gains (losses) from

revaluation and translation adjustments, stock subscription rights and

minority interests have been added to shareholders’ equity. As a

replacement for the former shareholders’ equity, the Company uses

owners’ equity, which excludes stock subscription rights and minority

interests from net assets. The ratio of owners’ equity to total assets

(owners’ equity ratio; the former shareholders’ equity ratio) for the

fiscal year under review was 56.7%, a total of 24.9 percentage points

lower than the 81.6% in the previous fiscal year.

Shareholders’ Equity

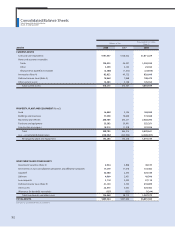

Total assets as of March 31, 2008, stood at ¥689,444 million, a 54.0%

increase, compared with a year earlier. The primary factor in this

substantial gain was the addition of the total assets of Pentax (¥204,853

million as of March 31, 2008), based on the merger of Hoya and Pentax.

Current assets grew 48.8% year on year, to ¥410,273 million. Major

contributing factors included a 50.4% increase in cash and cash

equivalents, to ¥181,467 million; a 27.8% rise in notes and accounts

receivable–trade, to ¥120,522 million; and a 66.6% increase in

inventories, to ¥82,822 million.

Non-current assets increased ¥107,234 million to ¥279,171 million,

owing to a considerable increase in goodwill and deferred tax assets

based on the merger with Pentax.

Concerning liabilities, increases in notes and accounts

payable–trade and income taxes payable, as well as an issue of straight

bonds to raise funds for the tender offer on Pentax’s shares, brought

total liabilities to ¥294,818 million—a ¥214,319 increase.

Total interest-bearing debt—short-term loans, long-term debt with

current maturities, commercial paper, other long-term debt, and

corporate bonds—reached ¥136,192 million, resulting in a 19.8% rate

of leverage.

Financial Position

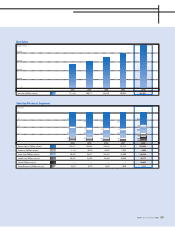

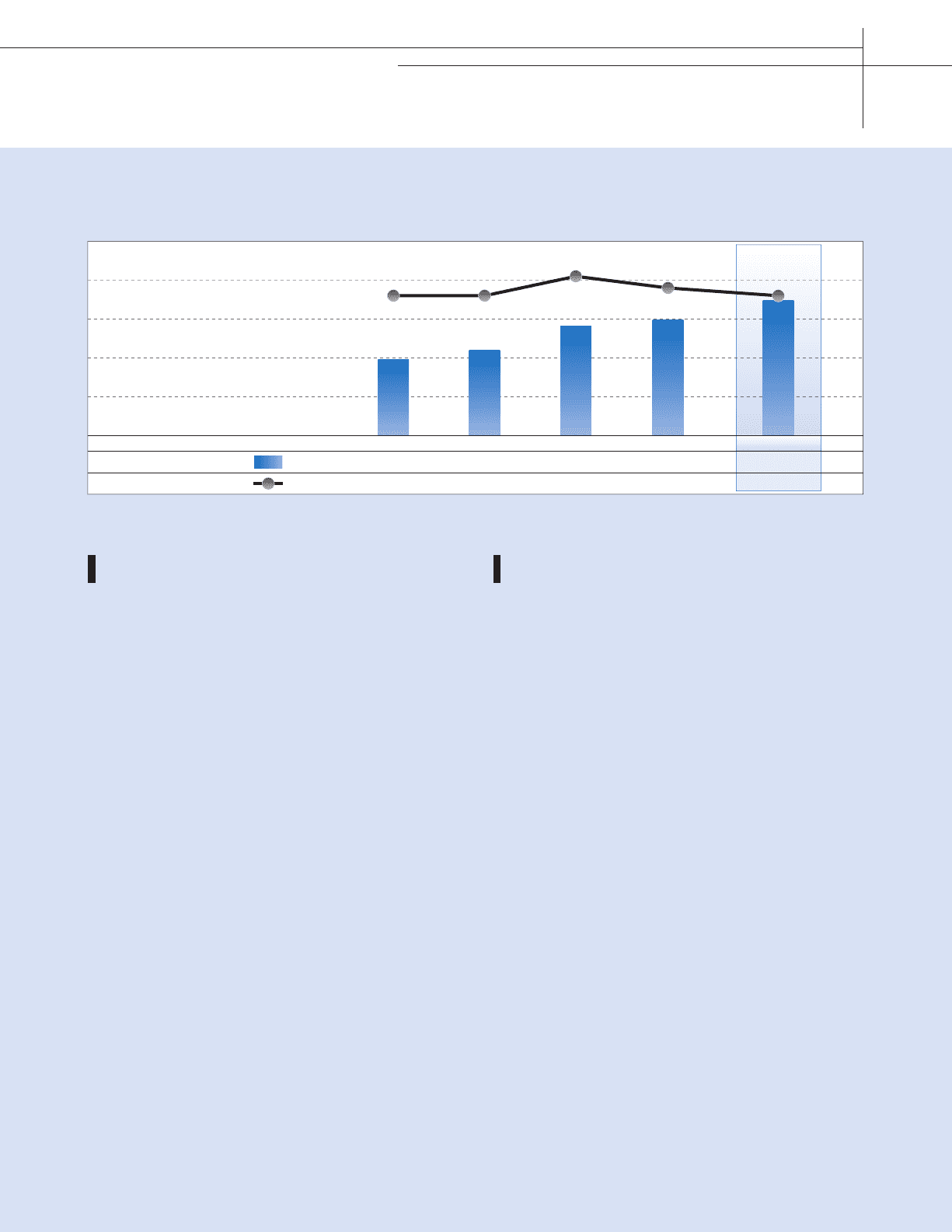

17,413

3.6

14,920

3.8

14,135

4.1

10,957

3.6

9,847

3.6

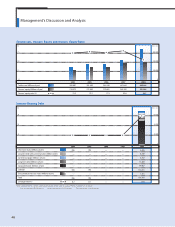

Research and Development Expenses

20,000

15,000

10,000

5,000

0

4.0

3.0

2.0

1.0

0

R&D expenses (Millions of yen)

R&D expenses/net sales (%)

2006 2007 200820052004

(%)(Millions of yen)

HOYA ANNUAL REPORT 2008 47