Pentax 2008 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2008 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

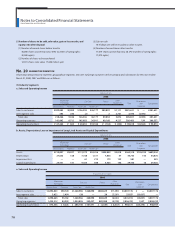

Business description: Manufacture of optical components

Combined company: Pentax Service Co., Ltd.

Business description: Repair of optical components

Combined company: Pentax Incubation Co., Ltd.

Business description: Research and development of medical

equipment

Business combination date

March 30, 2008

Legal form for business combination and name of the company

formed through business combination

The legal form for this business combination is merger by

absorption with Pentax Corporation as the surviving company.

The name of the company formed through business

combination is Pentax Corporation. No share issuance or capital

increase resulted from the merger.

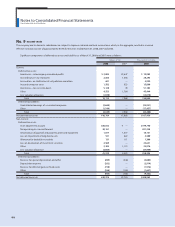

(2) Summary of accounting procedures

The merger stated above is eliminated in its entirety as an internal

transaction, as it corresponds to a transaction, etc. under common

control. Therefore, this merger has no impact on the consolidated

financial statements.

2. Merger of the Company and Pentax Corporation

(1) Names of companies involved in business combination,

description of their businesses, business combination date, legal

form for business combination, and name of the company formed

through business combination

Names of companies involved in business combination and

description of their businesses

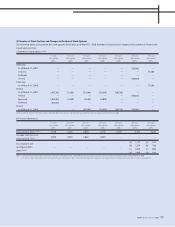

Combining company: Hoya Corporation (the Company)

Business description: Manufacture and sale, etc. of

electro-optics, vision care and healthcare products

Combined company: Pentax Corporation

Business description: Manufacture and sale, etc. of life care

products, imaging systems and optical components

Business combination date

March 31, 2008

Legal form for business combination and name of the company

formed through business combination

The legal form for this business combination is merger by

absorption with the Company as the surviving company and

Pentax Corporation as the company ceasing to exist. The name

of the company formed through business combination is Hoya

Corporation. No share issue or capital increase resulted from

the merger.

(2) Summary of accounting procedures

The merger stated above was treated in accordance with the

Accounting Standard for Business Combinations (issued by the

Business Accounting Council on October 31, 2003) and the

Implementation Guidance on Accounting Standard for Business

Combinations and Accounting Standard for Business Divestitures

(issued by the Accounting Standards Board of Japan on December

27, 2005). The assets and liabilities which the Company took over

from the ceased company were based on their book values

recorded on the day before the merger date. Their book values

were adjusted only when the Company adjusted the ceasing

company's book values in its consolidated financial statements.

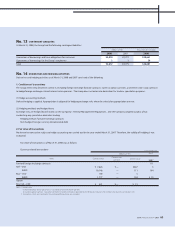

(3) Items relating to cash payment on merger to minority shareholders

Acquisition cost and its breakdown

Share acquisition expenses ¥ 9,757 million

Direct expenditure on share acquisition — million

Acquisition cost ¥ 9,757 million

Money paid for acquisition and its calculation method

(A) Consideration for acquired shares

¥ 770 was paid for each share acquired

(B) Method for calculating per-share payment

The amount of per-share payment was calculated

comprehensively in view of amounts calculated by

third-party organizations.

(C) Number of acquired shares and their valuation

Common stock 12,671,186 shares

Valuation ¥ 9,757 million

Amount of goodwill, reason for its recognition, amortization

method and period

(A) Amount of goodwill ¥ 4,507 million

(B) Reason for recognition

The goodwill resulted as the acquisition value of

additionally obtained Pentax shares exceeded the value of

net assets received for the additionally interest acquisition.

(C) Amortization method and amortization period

Straight-line amortization in 10 years

Notes to Consolidated Financial Statements

Hoya Corporation and Subsidiaries

76