Pentax 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

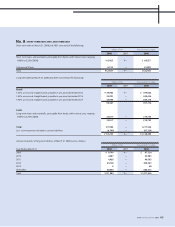

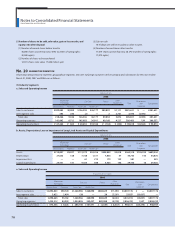

4. Amount of goodwill, reason for its recognition, amortization

method and period

(1) Amount of goodwill

¥ 27,225 million

(2) Reason for recognition

The market value of net assets at the time of business combination

fell short of the acquisition cost. For this reason, the difference is

recognized as goodwill.

(3) Amortization method and amortization period

Straight-line amortization in 10 years

5. Assets received and liabilities succeeded on the business

combination date, and their major constituents

Current assets ¥ 100,132 million

Fixed assets 74,056 million

Total assets ¥ 174,188 million

Current liabilities ¥ 67,822 million

Long-term liabilities 30,375 million

Total liabilities ¥ 98,197 million

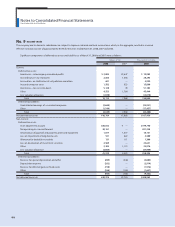

6. Estimated effects on consolidated statements of income for the

consolidated fiscal year under review in case business

combination is presumed to have been completed on the first day

of the fiscal year

Net sales ¥ 85,689 million

Operating income 956 million

Ordinary income -169 million

Income before income taxes and other items -1,725 million

Net income -1,195 million

Net income per share -2.76

(Method for calculating estimated amounts and important premises)

Estimated amounts were calculated retroactive to the first day of the

consolidated fiscal year under review, based on figures presented in

statements of income for the period from April 1, 2007 to September

30, 2007. Estimated net sales and losses stated above were calculated by

assuming that the business combination had been completed on the first

day of the consolidated fiscal year, and that the acquired company’s

voting rights had been owned at the rate of 100% from the first day.

The amounts stated above include adjustments for goodwill

amortization and interest cost, etc. These amounts have not been

verified through audit.

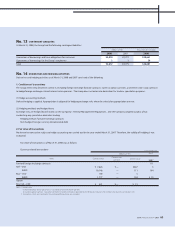

Business combination — under common control

(Summary of transaction)

The Company merged its five consolidated subsidiaries, namely Pentax

Optotech Co., Ltd., Pentax Tohoku Co., Ltd., Pentax Fukushima Co., Ltd.,

Pentax Service Co., Ltd. and Pentax Incubation Co., Ltd., into Pentax

Corporation effective March 30, 2008. The Company merged Pentax

Corporation by absorption on March 31, 2008.

(Major reason for business combination)

The Company and Pentax Corporation reached an agreement for

integrating their management for the purposes of establishing strong

operating foundations by using management resources in their

possession in a manner supplementary to each other, generating

synergies, and accelerating new growth for the future. Based on this

agreement, the Company made a tender offer to Pentax Corporation

and, as a result of the offer, made Pentax Corporation a consolidated

subsidiary.

The Company reached the conclusion that management mobility

and flexibility were essential for strengthening Pentax Corporation’s

core businesses and that integration in the form of a merger, as it had

originally planned, was the best way that allows Pentax Corporation

divisions to make business judgments and take business actions as

speedily as the Company’s divisions, and optimizes the distribution of

management resources in the integral framework of the Hoya Group,

instead of small subsidiary frameworks. The Company firmly believes

that the merger and integration of Pentax Corporation divisions into

itself make the Group organization flatter, compared with the maintenance

of Pentax Corporation as its subsidiary, and permit the Hoya Group to

make business judgments flexibly and speedily, and to achieve further

growth in new fields with appropriate resource distribution.

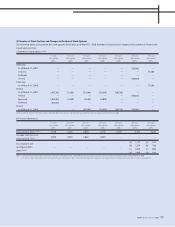

1. Merger involving six consolidated subsidiaries, namely, Pentax

Corporation, Pentax Optotech Co., Ltd., Pentax Tohoku Co., Ltd.,

Pentax Fukushima Co., Ltd., Pentax Service Co., Ltd., and Pentax

Incubation Co., Ltd.

(1) Names of companies involved in business combination,

description of their businesses, business combination date, legal

form for business combination, and name of the company formed

through business combination

Names of companies involved in business combination and

description of their businesses

Combining company: Pentax Corporation

Business description: Manufacture and sale, etc. of life care

products, imaging systems and optical components

Combined company: Pentax Optotech Co., Ltd.

Business description: Manufacture and sale of optical

components, precision components, machinery and tools

Combined company: Pentax Tohoku Co., Ltd.

Business description: Manufacture of medical equipment

Combined company: Pentax Fukushima Co., Ltd.

HOYA ANNUAL REPORT 2008 75