Pentax 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40.4%

(18.2)

0.4

0.1

(1.8)

1.8

(0.5)

—

(0.5)

—

—

—

—

0.6

22.3

40.4%

(17.1)

0.4

0.1

(1.5)

1.5

(0.2)

—

(0.7)

—

—

—

—

(0.9)

22.0

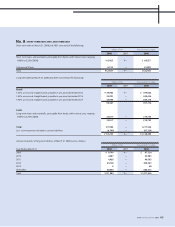

2008 20062007

Normal effective statutory tax rate

Lower or exemption income tax rates applicable to income in certain foreign countries

Expenses not permanently deductible for income tax purposes

Per capita portion

Non-taxable dividend income

Intercompany cash dividend and transactions

Equity in earnings of associated companies and retained earnings

Change in valuation allowance

Tax credit on reserch and development expenses

Foreign tax credit

Amortization of goodwill

The amount influence of merging

Consolidated adjustment on unrealized gain in inventories

Other—net

Accutual effective tax rate

40.4%

(20.1)

0.6

0.1

(1.6)

2.9

0.2

0.6

(0.8)

(1.4)

1.2

(9.0)

1.2

1.0

15.3

$1,811,229

(1,308)

$1,809,921

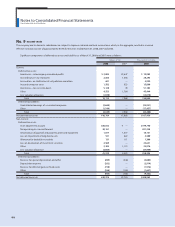

2008 2007 2008

Cash, time deposits and other cash equivalents

Time deposits with deposit terms of more than three months

Cash and cash equivalents at end of the year

¥181,467

(131)

¥181,336

¥120,622

(—)

¥120,622

Thousands of U.S. DollarsMillions of Yen

$1,738,587

271,744

(980,118)

(84,220)

945,993

226,051

$ 719,942

2008 2008

Assets

Goodwill

Liabilities

Minority interests

Cash paid for the capital

Cash and cash equivalents of consolidated subsidiaries

Cash paid in conjunction with the purchases of consolidated subsidiaries

¥174,189

27,226

(98,198)

(8,438)

94,779

22,648

¥ 72,131

Thousands of U.S. DollarsMillions of Yen

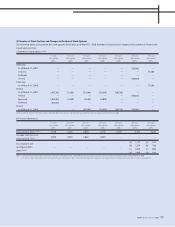

A reconcilation between the normal effective statutory tax rates and actual effective tax rates reflected in the accompanying consolidated

statements of income for the years ended March 31, 2008, 2007 and 2006 was as follows:

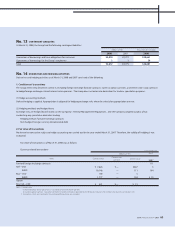

No. 10 RESEARCH AND DEVELOPMENT EXPENSES

Research and development expenses charged to income for the years ended March 31, 2008, 2007 and 2006 were ¥17,413 million ($173,795

thousand), ¥14,920 million, ¥14,135 million, respectively.

1. Reconciliation of cash and cash equivalents

A reconciliation of cash and cash equivalents between the consolidated balance sheets and the conslodated statement of cash flows at

March 31, 2008 and 2007 is as follows:

No. 11 SUPPLEMENTARY CASH FLOW INFORMATION

2. Purchases of newly consolidated subsidiaries

The Company started to consolidate Pentax and its subsidiaries at September 30, 2007. The following shows the reconciliation from the payment for

purchasing Pentax shares, which equals to the total of the assets and liabilities of the Pentax and its subsidiaries, to the payment for acquisition of

subsidiaries' shares which effects the scope of consolidation.

HOYA ANNUAL REPORT 2008 67