Pentax 2008 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2008 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

New Structure of the Hoya Group

HOYA

Strategic

Business

Units

PENTAX

Health

Care

Vision

Care

Optics

Memory

Disks

MasksBlanks

Optical

Components

Imaging

Systems

Life Care

Global Headquarters

store openings, due to the influence of medical fee reforms.

However, the chain attracted more customers and realized higher

revenues at existing stores, as a result of further improvements in

management efficiency and enhanced marketing activities. We

see this as a year where we widened our lead over our

competitors despite the inclement business climate.

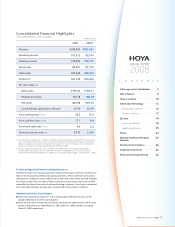

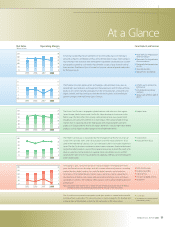

Pentax

Pentax Corporation—which became Hoya’s consolidated

subsidiary in the second half of the fiscal year—posted net sales of

¥89.0 billion and operating loss of ¥134 million. The EPK-i series

endoscope system that went on sale in the United States in May

2007 contributed to the sales increase. Also making a substantial

contribution were sales of the digital SLR camera Pentax K10D,

which earned three major global camera awards, evincing its

strong popularity in Japan and other countries.

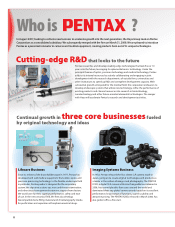

In the half-year following consolidation, the Company

reaffirmed the promise and growth potential of medical

endoscopes as key devices essential to the medical field. Going

forward, we expect doctors’ needs to become more sophisticated

and complex, encompassing the ability to not only view the

inside of patients’ bodies, but to actually diagnose and treat the

abnormalities discovered. We are proceeding with expansion in

the medical endoscope field, including treatment tools for use

with endoscopes, and other peripheral equipment.

Concerning the digital camera business, we are focusing on

digital SLR cameras, targeting mainly high amateur users, and some

business segments are already experiencing numerical performance

gains thanks to business narrowing and selection, strategic

product mixes and the establishment of new sales channels.

Our initial goal is to boost the operating margin of the Pentax

businesses—primarily medical devices and digital cameras—

non-inclusive of goodwill expenses, to 18% for the next three

years.

Outlook and Priority Measures for Fiscal 2009

Hoya expects to see ongoing severe external conditions

surrounding each of its businesses in the year ahead. In the global

economy as well, the U.S. subprime loan problem is spilling over

into Europe and Asia. The Hoya Group does not consider itself

immune to the influence of such externalities. However, far from

indicating any kind of loss of competitiveness, we believe the

Company has the muscular financial position and business

structure to maintain a degree of strength even in somewhat

adverse circumstances.

Each of the Company’s businesses are currently operating

well in comparison with one year ago, and these results are

manifesting in quantitative performance gains as well. In each

business, we have revised our operating structures to optimize

simplicity. These changes should enhance our ability to respond

HOYA ANNUAL REPORT 2008 5