Pentax 2008 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2008 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

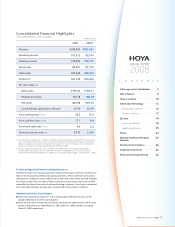

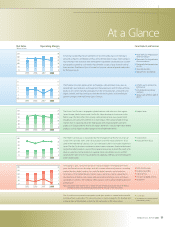

Net Sales

Operating Income and

Operating Margin

Return on Equity, Return on Assets

and Earnings per Share

(Billions of yen) (Billions of yen) (Yen) (%)(%)

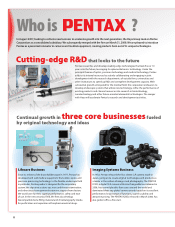

Note: Operating performance figures for Pentax and its subsidiaries are included in the consolidated results

from the second half of the fiscal year ended March 31, 2008 (October 1, 2007, to March 31, 2008).

(Fiscal years ended March 31)

2005 2006 2007

2008

2004

500

400

300

200

100

0

271.4

308.1

344.2

390.0

481.6

2005 2006 2007

2008

2004

140

120

100

80

60

40

20

0

30

20

10

0

68.1

101.0 107.2 20.0 21.2

14.0

87.74

144.71

189.01

14.4

20.6

2005 2006 2007

2008

2004

25.8 25.9

21.6

30

20

10

0

350

280

210

140

70

0

29.4

19.7

EPSROE ROA

84.9

171.71

27.1

17.8

193.50

95.0

25.1 27.6 27.5

results from the second half of the fiscal year, net sales were up a

substantial 23.5% compared with the preceding fiscal year.

However, operating income, ordinary income and net income

were down 11.3%, 2.7% and 2.0%, respectively.

Primary factors in the decrease in earnings included lingering

technical issues that occurred in certain products at the start of

the fiscal period and lower profitability due to more severe price

pressures in the midst of an overall rise in raw materials costs. The

amortization of goodwill following the acquisition of Pentax’s

shares, which was carried out from July through August 2007, also

began in the second half of the year, further depressing earnings.

Although Hoya takes great care in advancing each of its

businesses, in the fiscal year under review certain struggling

products weighed heavily on the Company’s overall performance.

I offer my sincere apologies for any concerns this may have caused.

Information Technology

Overall net sales in the Electro-Optics business were ¥209.8 billion

(down 4.3% compared with the preceding fiscal year), and

operating income came to ¥67.4 billion (down 15.8% compared

with the preceding fiscal year).

Mask blanks for semiconductor production sustained their

robust performance, primarily in high-precision products. In

semiconductor photomasks, focus on frontline products secured

revenues on a par with the previous fiscal year, despite the small

scale of the business. Although there were no significant changes

through the year in our performance in semiconductor-related

products or in the business environment, the semiconductor

industry appears to be experiencing a structural shift. The

advances in technology and higher development costs required

for miniaturization are limiting the number of semiconductor

producers able to accommodate the latest technologies, while

incentives to engage in cutting-edge development are

diminishing. This is resulting in ongoing harsh business conditions

as the number of semiconductor chip development models

declines, thereby stiffening competition in the photomask market

and leading to lower prices.

In the LCD panel market in the fiscal year under review, an

HOYA ANNUAL REPORT 2008 3