Pentax 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

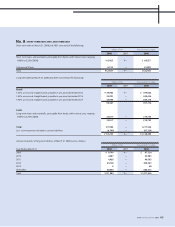

No. 5

IMPAIRMENT OF LONG-LIVED ASSETS

$208,594

(88,312)

(18,615)

239

$101,906

2008 2008

Projected benefit obligation

Less fair value of pension assets

Unrecognized actuarial differences

Prepaid pension cost

Employees’ serverance and retirement benefits

¥20,899

(8,848)

(1,865)

24

¥10,210

2007

¥—

—

—

—

¥—

Thousands of U.S. DollarsMillions of Yen

$10,051

1,916

(1,816)

37,189

$47,340

2008 2008

Service costs-benefits earned during the year

Interest cost on projected benefit obligation

Expected return on plan assets

Others

Serverance and retirement benefit expenses

¥1,007

192

(182)

3,726

¥4,743

2007

¥—

—

—

—

¥—

2006

¥—

—

—

—

¥—

Thousands of U.S. DollarsMillions of Yen

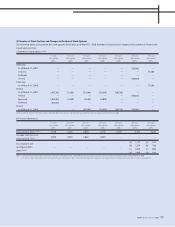

No. 6 EMPLOYEES’ SEVERANCE AND RETIREMENT BENEFITS

The Company and certain of domestic subsidiaries provide contribution benefit plan. And Pentax divisions provide defined benefit plans.

Employees’ severance and retirement benefits included in the liability section of the consolidated balances sheets as of March 31, 2008, 2007.

Included in the consolidated statements of income for the years ended March 31, 2008, 2007 and 2006 are severance and retirement benefit expenses

comprised of the following:

The Group reviewed its long-lived assets for impairment for the years

ended March 31, 2008, 2007 and 2006. As a result, the Group

recognized impairment losses of ¥129 million ($1,288 thousand), ¥88

million and ¥864 million for the years ended March 31, 2008, 2007 and

2006, respectively, as other expense for a decline in value, mainly from

property of certain plants including the Tokyo Studio (in Akishima

Plant) of the Crystal division, due to a continuous operating loss of that

unit. The carrying amount of the relevant machinery was written down

to the recoverable amount, which was measured at its value in use. The

discount rate used for computation of the present value of future cash

flows was 5%.

The Group reviewed its intangible fixed assets for impairment for

the year ended March 31, 2008, and as a result recognized an

impairment loss of ¥212 million ($2,116 thousand) as other expense for

a decline in value of the intangible fixed assets since there was a

possibility for the non-competition provision. The carrying amount of

the relevant intangible assets were written down to the recoverable

amount, which was measured at its value in use. The discount rate used

for computation of the present value of future cash flows was 5%.

The Group reviewed its long-lived assets for impairment for the

years ended March 31, 2008. As a result, the Group recognized

impairment losses of ¥149 million ($1,487 thousand), as other expense

for a decline in value, mainly from buildings and structures due to a

continuous operating loss of that unit. The carrying amount of relevant

buildings and structures was written down to the recoverable amount,

which was measured at its value in use. The discount rate used for

computation of the present value of future cash flows was 5%.

The Group reviewed its long-lived assets for impairment for the

years ended March 31, 2008. As a result, the Group recognized

impairment losses of ¥91 million ($908 thousand), as other expense,

mainly from buildings and structures in Mulleheimm, Germany, and

machineries in Itabashi-ku, Tokyo, since these were currently idle. The

book value of idle assets was reduced to their recoverable amount,

which was measured on the basis of their net sale price.

The Group reviewed its long-lived assets for impairment for the

year ended March 31, 2006, and as a result recognized an impairment

loss of ¥369 million as other expense for a decline in value of the leased

land in Machida-City, due to a fall of market land prices. The carrying

amount of the relevant land was written down to the recoverable

amount, which was measured at its declared value.

HOYA ANNUAL REPORT 2008 63