Pentax 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Hoya Group (the “Group”) consists of Hoya Corporation (the

“Company”), 100 consolidated subsidiaries (seven in Japan and 93

overseas) and 11 affiliates (five in Japan and six overseas). Eight

affiliates (two in Japan and six overseas) are accounted for by the

equity method. Compared with the end of the previous fiscal year, five

consolidated subsidiaries were added through the establishment of

new companies and 36 by acquisitions. Five consolidated subsidiaries

were eliminated through mergers with other subsidiaries as well as one

through a merger with the parent and two through liquidations.

Each of the Group’s major business divisions and subsidiaries carry

out their business strategies as formulated by the global headquarters

at Hoya Corporation, yet with their own management responsibility.

Each region—Asia, North America and Europe—has its own

headquarters, which focuses on enhancing relations within its country

or region of operations, as well as supporting business promotion

activities. Hoya’s branch in the Netherlands is the financial

headquarters for the Group.

On December 21, 2006, Hoya concluded a preliminary agreement to

merge with Pentax Corporation as of October 1, 2007. The merger

would leverage the management resources of both companies to forge

a solid business foundation, create synergies and accelerate growth.

After signing the preliminary agreement, HOYA and Pentax held

several meetings aiming for signing a merger agreement in early April

2007, but for various reasons we deemed our initial plans for business

integration by October 1, 2007, to be unworkable. However, the two

companies continued to recognize that business integration would

contribute to the corporate value of both companies. Subsequent

negotiations and examinations prompted Hoya to make a tender offer

for Pentax’s shares, and the two companies agreed on May 31, 2007, to

carry out the business integration by having Hoya take on Pentax as its

wholly owned subsidiary through stock swaps and other means.

Based on this agreement, Hoya’s tender offer for Pentax’s shares

conducted from July 3 to August 6, 2007, resulted in Hoya holding

90.48% of Pentax’s total outstanding shares, thereby bringing Pentax

and 33 of its consolidated subsidiaries under Hoya’s scope of

consolidation as of August 14, 2007.

Strengthening Pentax’s core businesses will require flexible

management. We realized that the merger that we initially planned

would be the ideal way to enable swift management decisions and

business operations at the Pentax divisions that rivaled the process at

Hoya’s other divisions, and would optimize the allocation of

management resources across the Group instead of just within each

subsidiary.

Consequently, the two companies concluded the merger

agreement at the Board of Directors’ meeting on October 29, 2007,

and Hoya merged with Pentax on March 31, 2008.

Even after the merger, the brand name “Pentax” will continue to be

used in light of its significance and economic value.

The income statements of Pentax and its consolidated subsidiaries

have been consolidated into Hoya’s income statements from the third

quarter of the fiscal year under review (the three-month period from

October 1, 2007, to December 31, 2007). Accordingly, the Group’s

business results only reflect the addition of Pentax’s results after the

consolidation, which is the second half of the fiscal year under review

(the six-month period from October 1, 2007, to March 31, 2008).

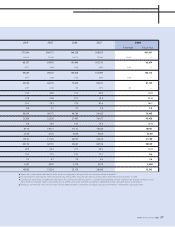

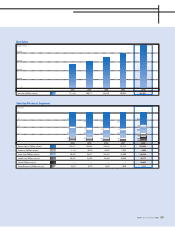

Consolidated net sales for the fiscal year ended March 31, 2008,

amounted to ¥481,631 million, rising 23.5% year on year and reaching a

historic high. By principal business segment, net sales in the

Electro-Optics Division of the Information Technology business

declined 4.3% year on year. Within the Eye Care business, net sales in

the Vision Care Division increased 5.5% year on year, and in the Health

Care Division net sales rose 13.0% year on year. The principal factor

behind these substantial increases in consolidated net sales during the

year was the addition of net sales for Pentax during the term. From

Pentax, only net sales of ¥89,032 million were added during the second

half of the fiscal year (the six-month period from October 1, 2007, to

March 31, 2008).

By customer region, net sales to customers in Japan increased

5.6%, to ¥188,520 million, and net sales to overseas customers surged

38.6%, to ¥293,111 million. As a result, the composition of net sales was

39.1% domestic and 60.9% overseas. Hoya continues to pursue global

business development, with its proportion of overseas net sales rising

accordingly.

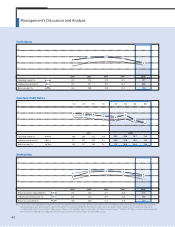

Hoya calculates the effect of exchange rates on operating results

during the fiscal year under review by comparing the foreign currency

denominated financial statements of its overseas subsidiaries when

converted into yen at the average exchange rate during the fiscal year

with the same statements when converted into yen at the average

exchange rates prevailing during the previous year. In currency markets

during the fiscal year, the yen rose 2.7% against the U.S. dollar, to

¥113.80, weakened 7.5% against the euro, to ¥162.26, and fell 12.7%

against the Thai baht, to ¥3.65. Because the yen fell against these two

base currencies, the operating results of Group companies in Europe

and Thailand rose compared with conversion at the rate during the

previous fiscal year. For the Group overall, the effect of exchange rates

added ¥2,835 million to net sales and ¥4,391 million to net income.

Management’s Discussion and Analysis

Business Integration with Pentax

Net Sales

Hoya Group and Scope of Consolidation

38