Pentax 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

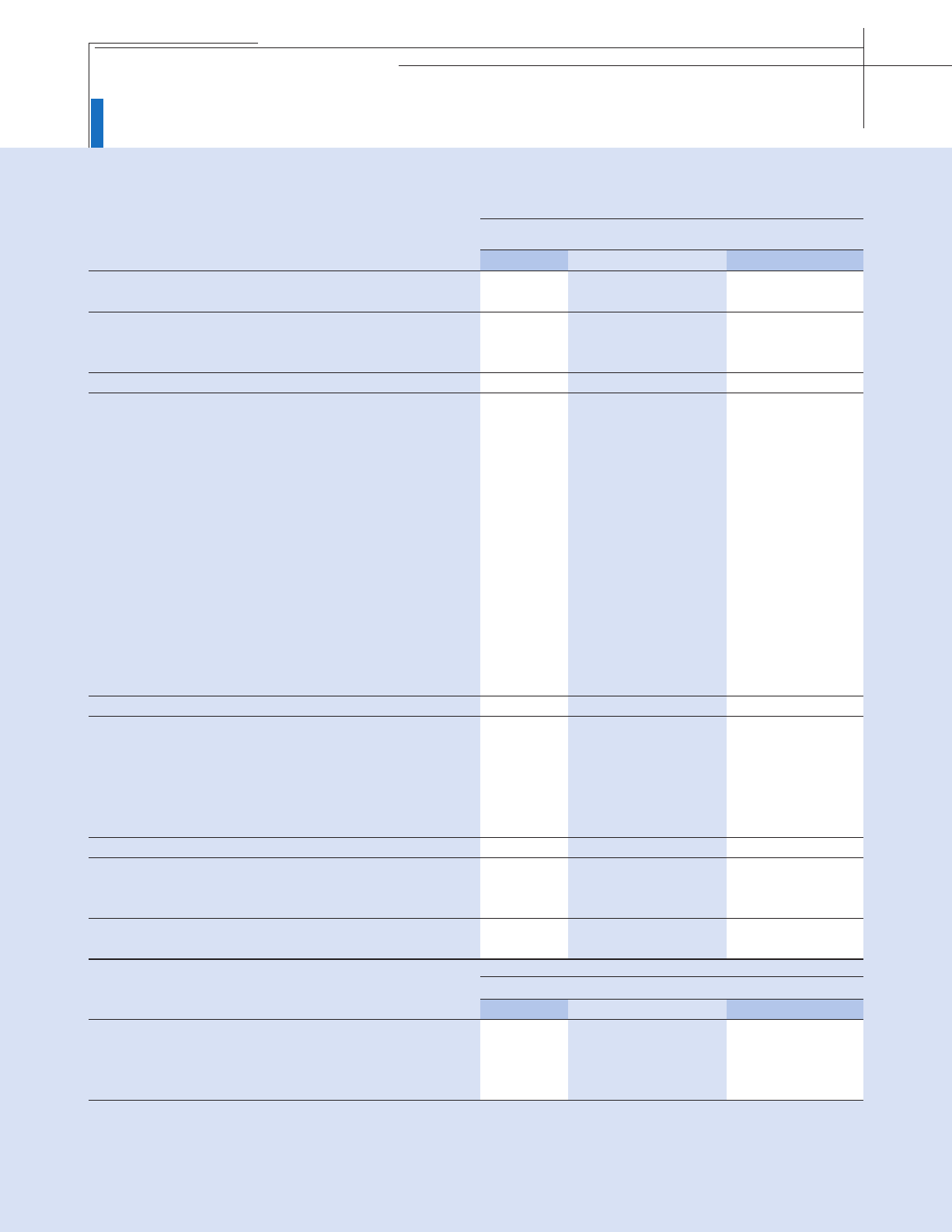

$4,807,176

2,624,453

2,182,723

1,233,786

948,937

45,873

(14,482)

(54,367)

59,148

(16,089)

—

(11,229)

(5,799)

(19,174)

5,190

—

(9,073)

14,802

(5,200)

943,737

(344,845)

200,449

144,396

16,359

$ 815,700

$1.89

1.88

0.65

2008 20062007 2008

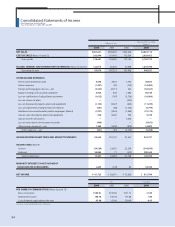

NET SALES

COST OF SALES (Notes 10 and 12)

Gross profit

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES (Notes 10 and 12)

Operating income

OTHER INCOME (EXPENSES):

Interest and dividend income

Interest expense

Foreign exchange gains (losses)—net

Equity in earnigs of associated companies

Loss on clarification of soil pollution and others

Loss on closure of plant

Loss on disposal of property, plant and equipment

Loss on impairment of long-lived assets (Note 5)

Additional retirement benefits paid to employees (Note 6)

Gain on sales of property, plant and equipment

Gain on transfer of business

Loss on write-down of investment securities

Other income (expense)—net

Other expenses—net

INCOME BEFORE INCOME TAXES AND MINORITY INTERESTS

INCOME TAXES (Note 9)

Current

Deferred

Total income taxes

MIINORITY INTERESTS IN NET INCOME OF

CONSOLIDATED SUBSIDIARIES

NET INCOME

PER SHARE OF COMMON STOCK (Notes 2.p and 15)

Basic net income

Diluted net income

Cash dividends applicable to the year

¥481,631

262,944

218,687

123,613

95,074

4,596

(1,451)

(5,447)

5,926

(1,612)

—

(1,125)

(581)

(1,921)

520

—

(909)

1,483

(521)

94,553

(34,550)

20,083

14,467

1,639

¥ 81,725

¥189.01

188.78

65.00

¥344,228

172,034

172,194

71,098

101,096

1,795

(142)

243

1,285

(3,726)

(523)

(625)

(1,233)

(1,689)

109

1,656

—

(879)

(3,729)

97,367

22,250

(512)

21,738

(9)

¥ 75,620

¥171.71

171.08

150.00

¥390,093

197,410

192,683

85,470

107,213

2,922

(87)

(6,711)

642

(767)

—

(3,327)

(88)

(1,055)

9,629

—

—

(1,239)

(81)

107,132

23,492

71

23,563

(178)

¥ 83,391

¥193.50

192.78

65.00

Thousands of U.S. Dollars

(Note 1)

Millions of Yen

2008 20062007 2008

U.S. DollarsYen

See notes to consolidated financial statements.

Consolidated Statements of Income

Hoya Corporation and Subsidiaries

Years Ended March 31, 2008, 2007 and 2006

54