Pentax 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

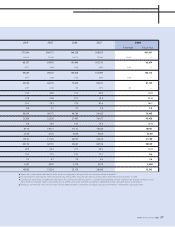

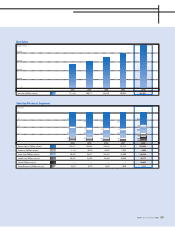

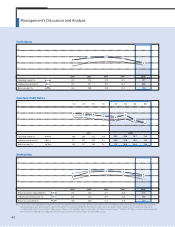

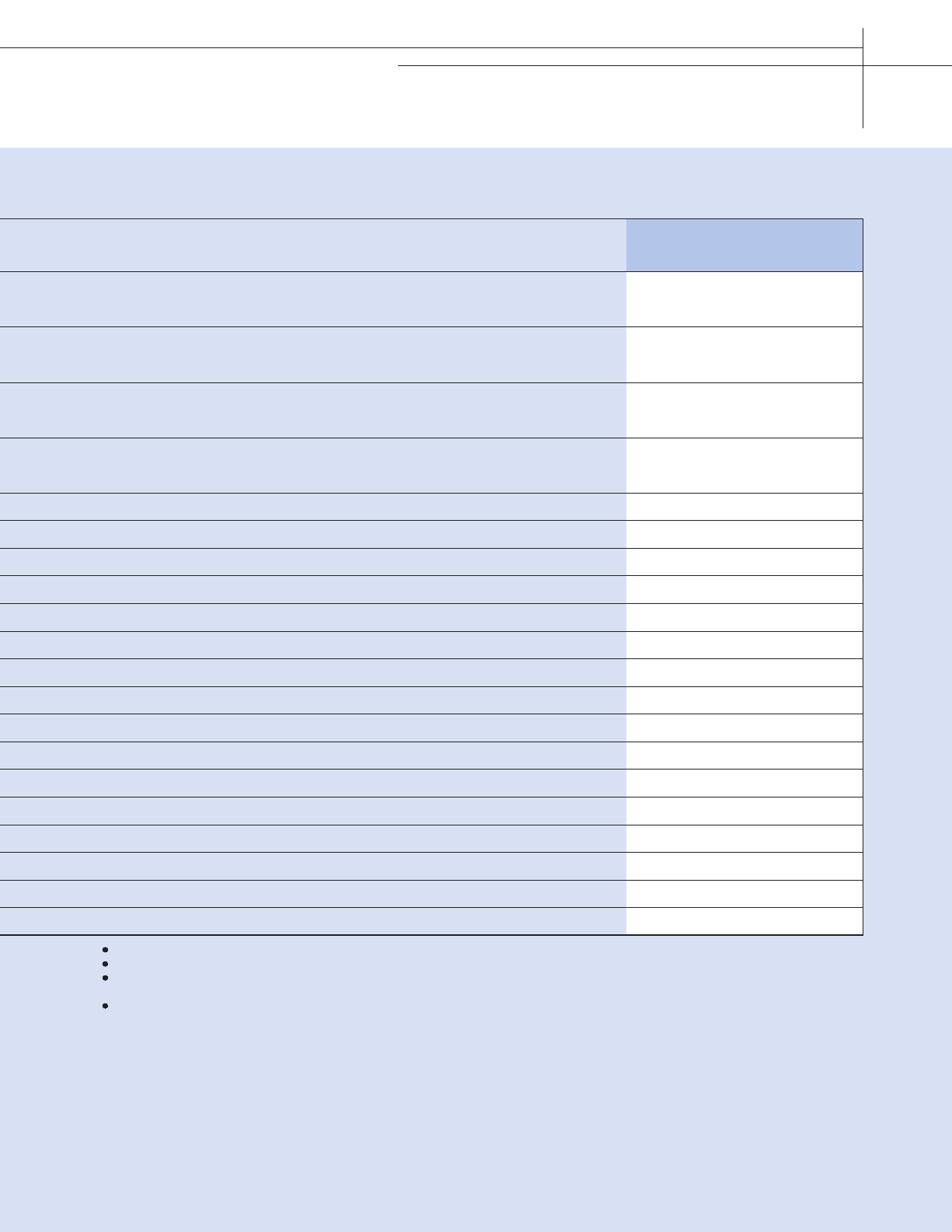

2004 2005 2006 2007 2008

271,444

134,493

68,167

6,937

66,554

5,375

39,549

3,089

14.0

17.8

75.5

2.8

30,659

25,328

9.8

87.74

25.00

174.91

491.90

28.9

14.5

5.2

2,537

18,092

308,172

133,558

84,920

3,586

89,525

3,396

64,135

3,526

20.0

25.8

79.1

2.7

40,175

22,520

10.9

144.71

37.50

171.65

623.59

20.4

17.2

4.7

2,950

21,234

344,228

142,211

101,096

2,985

103,638

3,260

75,620

805

21.2

27.1

77.3

2.7

48,786

27,485

14.1

171.71

60.00

240.57

648.87

27.7

19.7

7.3

4,750

25,176

390,093

157,344

107,213

5,653

102,909

5,067

83,391

3,570

20.6

25.9

81.6

2.8

54,432

36,427

14.9

193.50

65.00

229.23

845.98

20.2

17.1

4.6

3,910

28,450

481,631

—

95,074

—

100,175

—

81,725

—

14.4

21.6

56.7

3.0

39,465

45,458

17.4

189.01

65.00

277.09

903.49

12.4

8.4

2.6

2,340

35,545

85,689

3,337

2,820

586

First Half Fiscal Year

Depreciation, amortization and other: Includes the loss on impairment of long-lived assets and amortization of goodwill.

Per share data: Per share data has been retroactively adjusted to reflect a four-for-one split of common shares implemented on November 15, 2005.

Cash flow per share: From fiscal 2002 and after, figures for cash flow per share are shown as cash flow from operating activities divided by the average number of issued

shares for the fiscal period. Figures prior to 2002 are calculated using simple cash flow calculated by adding depreciation and other factors to net income.

The figures presented for “net assets per share” for fiscal 2006 and earlier correspond to the figures previously presented as “shareholders’ equity per share.”

HOYA ANNUAL REPORT 2008 37