Pentax 2008 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2008 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

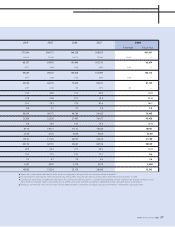

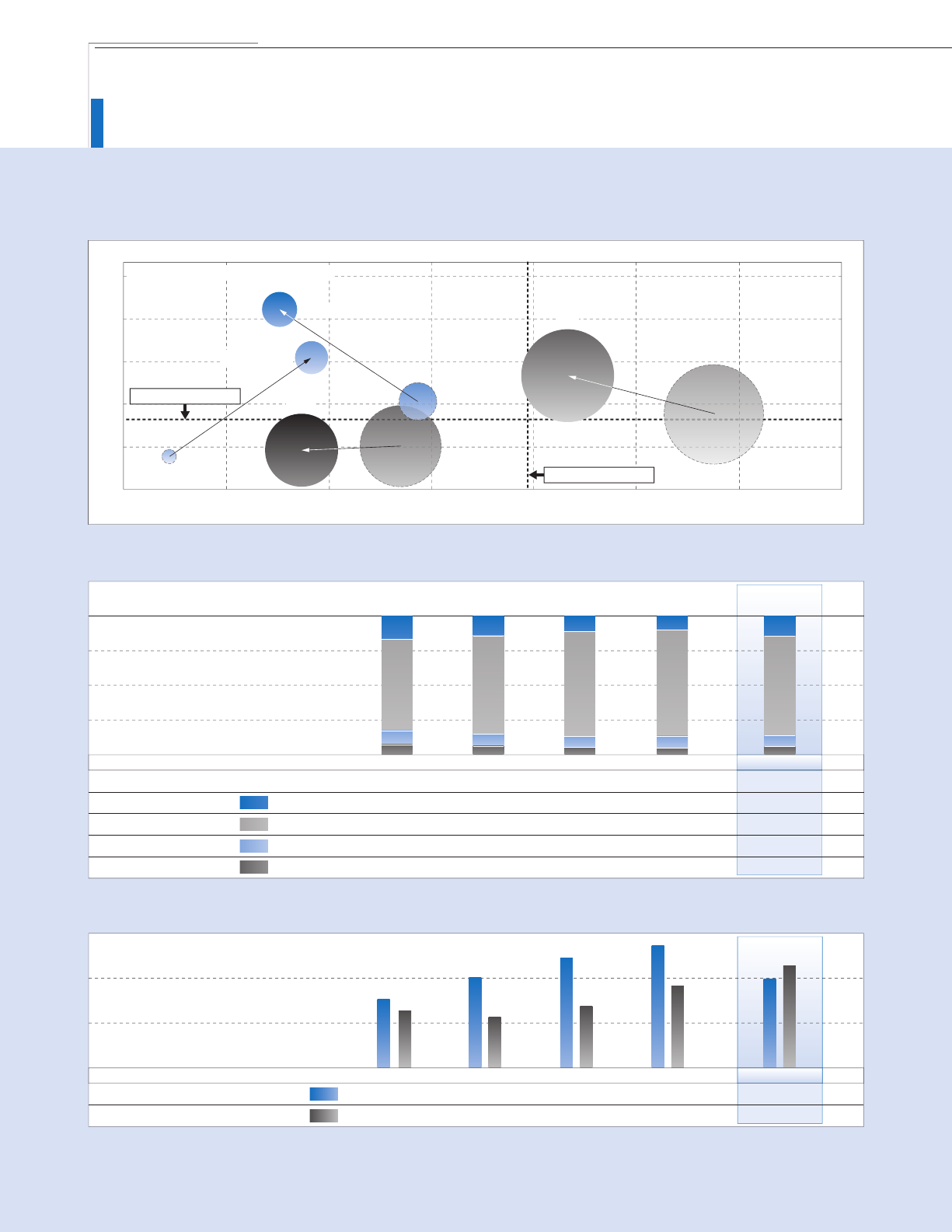

39,465

45,458

54,432

36,427

48,786

27,485

40,175

22,520

30,659

25,328

35,545

5,158

25,515

2,862

2,010

2006 2007 200820052004

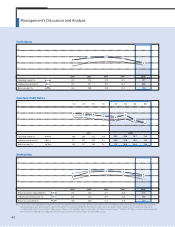

28,450

2,861

21,780

2,429

1,380

25,176

2,800

19,030

2,009

1,337

21,234

3,007

15,102

1,809

1,316

18,092

3,023

11,925

1,821

1,323

7.3

10.1

65.9

16.7 14.2 11.1 10.1 14.5

71.8

8.0

5.7

76.6

8.5

4.8

75.6

8.0

5.3

71.1

8.5

6.2

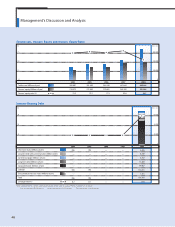

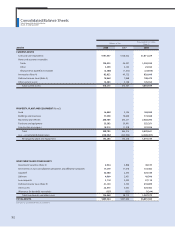

Sales Growth and Profitability by Geographical Segment Fiscal year ended March 31, 2008 (Compared with the previous fiscal year)

501510 20 25 30 35

30

10

-10

50

70

90

Operating margin (%)

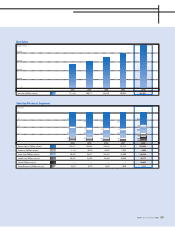

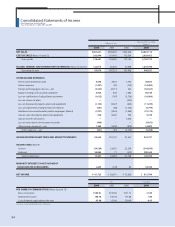

Capital Expenditures/Depreciation, Amortization and other

Group Employees by Region

Consolidated Basis Japan

North America

Europe

Consolidated Basis

Asia

Sales Growth Ratio (%)

(% of total)

100

75

50

25

0

Total

Japan (Persons)

Asia (Persons)

Europe (Persons)

North America (Persons)

Capital expenditures (Millions of yen)

Depreciation, amortization and other (Millions of yen)

(Millions of yen)

2006 2007 2008

2005

2004

* Size of circle shows the volume of operating income.

40,000

20,000

0

Note: Depreciation, amortization and other includes the loss on impairment of long-lived assets and amortization of goodwill.

Management’s Discussion and Analysis

46