Pentax 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

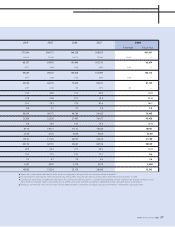

2006 2007 2008

(% of total)

20052004

Japan (Millions of yen)

Asia and Other Areas (Millions of yen)

Europe (Millions of yen)

North America (Millions of yen)

148,325

44,668

40,168

38,283

166,414

61,808

36,430

43,520

173,506

86,848

41,201

42,673

178,547

113,068

53,524

44,954

Japan (Millions of yen)

Asia (Millions of yen)

Europe (Millions of yen)

North America (Millions of yen)

291,566

43,965

89,420

56,680

270,373

30,928

51,336

37,456

244,998

24,527

39,232

35,471

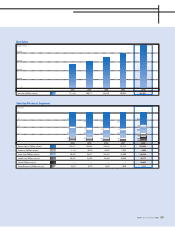

2006 2007 2008

(% of total)

230,946

12,648

33,803

30,775

2005

188,441

12,404

37,486

33,113

2004

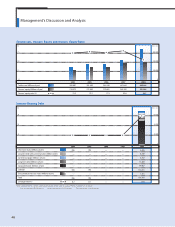

Sales by Region (Based on the location of the Company’s offices)

100

75

50

25

0

100

75

50

25

012.2

13.8

4.6

69.4

10.0 10.3 9.6 11.8

18.6

9.1

60.5

13.2

7.9

69.3

11.4

7.1

71.2

11.0

4.1

74.9

188,520

141,701

92,116

59,294

14.1 14.1 12.4 11.5 12.3

19.1

29.5

39.1

13.7

29.0

45.8

12.0

25.2

50.4

11.8

20.1

54.0

14.8

16.5

54.6

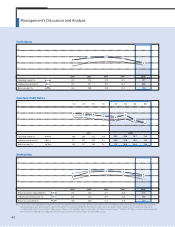

Management’s Discussion and Analysis

Sales to Domestic and Foreign Customers (Based on the location of customers)

In line with the significant increase in net sales, the cost of sales also

grew, rising 33.2%, to ¥262,944 million. Because cost of sales increased

at a rate greater than the 23.5% rise in net sales, the gross profit margin

fell to 45.4%, down 4.0 percentage points from 49.4% in the previous

year. Selling, general and administrative expenses rose 44.6%, to

¥123,613 million, with the ratio of SG&A expenses to net sales up 3.8

percentage points, from 21.9% to 25.7%. As a result, operating income

fell 11.3%, to ¥95,074 million, and the operating margin fell 7.8

percentage points, to 19.7%. Major factors included the inclusion into

the Group’s scope of consolidation from the second half of the fiscal

year of Pentax and its consolidated subsidiaries, as well as increased

production costs in pre-existing Hoya business segments and reduced

production yields for highly complex products. Also, the Group

continued its spending to ensure future growth, including capital

expenditures and marketing activities, as well as research and

development, and personnel increases. By quarter, the operating

margin in the first quarter was 23.2%, 26.6% in the second quarter,

18.7% in the third quarter and 13.3% in the fourth quarter.

Ordinary income during the year under review was ¥100,175

million, down 2.7% from the preceding fiscal year.

Net Income

40