Pentax 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

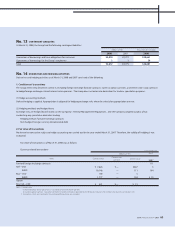

$ 19,982

28,296

5,999

15,890

51,103

45,444

(15,870)

150,844

(25,951)

(17,457)

(43,408)

$107,436

$199,740

201,228

10,151

5,300

1,308

25,641

22,976

(47,949)

418,395

(2,885)

(2,914)

(1,976)

(1,657)

(9,432)

$408,963

2008 2007 2008

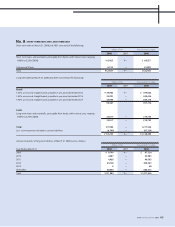

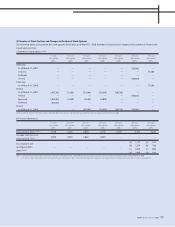

Current:

Deferred tax assets:

Inventories—intercompany unrealized profits

Accrued bonuses to employees

Accrued loss on clarification of soil pollution and others

Accrued enterprise taxes

Inventories—loss on write-down

Other

Less valuation allowance

Total

Deferred tax liabilities:

Undistributed earnings of associated companies

Other

Total

Net deferred tax assets

Non-Current:

Deferred tax assets:

Asset adjuetment account

Net operating loss carried forward

Amortization of goodwill and property, plant and equipment

Loss on impairment of long-lived assets

Allowance for doubtful receivables

Loss on devaluation of investment securities

Other

Less valuation allowance

Total

Deferred tax liabilities:

Reserves for special depreciation and other

Depreciation expense

Reserves for deferred gains on fixed assets

Other

Total

Net deferred tax assets

¥ 2,002

2,835

601

1,592

5,120

4,553

(1,590)

15,113

(2,600)

(1,749)

(4,349)

¥10,764

¥20,012

20,161

1,017

531

131

2,569

2,302

(4,804)

41,919

(289)

(292)

(198)

(166)

(945)

¥40,974

¥2,647

1,656

—

923

78

1,764

—

7,068

—

—

7,068

¥7,068

¥ —

—

1,577

622

111

—

1,119

—

3,429

(540)

—

—

(165)

(705)

¥2,724

Thousands of U.S. DollarsMillions of Yen

Notes to Consolidated Financial Statements

Hoya Corporation and Subsidiaries

No. 9 INCOME TAXES

The company and its domestic subsidiaries are subject to Japanese national and local income taxes which, in the aggregate, resulted in a normal

effective statutory tax rate of approximately 40.4% for the years ended March 31, 2008, 2007 and 2006.

Significant components of deferred tax assets and liabilities as of March 31, 2008 and 2007 were as follows:

66