Pentax 2008 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2008 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

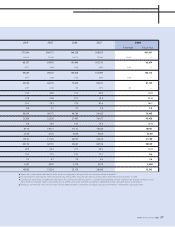

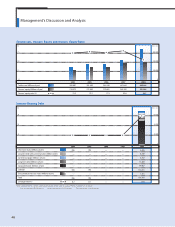

Note: The operating margin above is calculated using net sales plus intersegment sales. Please

refer to details on page 78, Segment Information.

Net sales

(Millions of yen)

Operating income

(Millions of yen)

Operating

margin (%)

Assets

(Millions of yen)

Depreciation

(Millions of yen)

Capital expenditures

(Millions of yen)

209,883

67,464

32.1

210,007

27,653

24,431

219,252

80,085

36.5

258,746

27,449

39,899

190,552

74,862

39.1

204,192

18,716

37,244

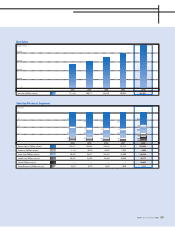

2006 2007 2008

200,000

150,000

100,000

50,000

0

40

30

20

10

0

(%)(Millions of yen)

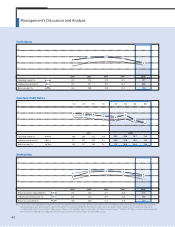

Electro-Optics Division

In the Electo-Optics Division, net sales decreased 4.3% during the year,

to ¥209,883 million. In mask blanks for semiconductor production,

orders for phase-shift mask blanks and other high-precision products

rose in line with the ongoing miniaturization of semiconductors. In

photomasks for semiconductors, although orders for high-precision

and other products for the development of next-generation

semiconductors increased, Japan-centered demand for medium- and

lower-end products was lackluster, resulting in a year-on-year decline

in sales. With regard to large-sized photomasks for LCD production,

panel manufacturers—Hoya’s customers—undertook concentrated

mass production during the year, but sluggish growth in demand for

new masks and falling market prices sapped sales. Sales of glass

memory disks for HDDs declined, affected significantly by delayed

first-quarter introductions of new products that use the perpendicular

magnetic recording method. Sales of optical lenses increased, as

worldwide growth in demand for digital cameras steadily pushed up

demand for aspherical molded lenses for compact digital cameras, as

well as for highly complex lenses.

Segment operating income fell 15.8%, to ¥67,464 million. A poor

first-quarter performance in glass memory disks had a substantial

For more detailed segment information, please refer to pages 12

through 25 of this report.

Information Technology (Photonics Division)

Information Technology (Electo-Optics Division)

impact on income. Other principal reasons for lower income included

an ongoing decline in product prices amid global economic

deceleration throughout the year, coupled with higher production

costs stemming from such factors as rising crude oil and raw materials

prices, as well as yen appreciation.

Capital expenditures in this division came to ¥24,431 million, down

38.8% from the preceding term. These expenditures went toward

up-front production-related investment involving next-generation

semiconductor-related projects, expansion of our HDD glass disk plant

in Vietnam and upgrades to our plant in Thailand that makes polished

lenses for SLR digital cameras.

The Photonics Division mainly produces industrial devices that employ

lasers and specialty light sources, which are used by manufacturers of

semiconductors, LCD panels and optical devices. In a problematic

market environment during the year, Hoya promoted profit-focused

business strategies. Consequently, although divisional net sales

remained flat, at ¥9,090 million, operating income surged 68.1%, to

¥824 million.

Segment Information

HOYA ANNUAL REPORT 2008 43