Oracle 2005 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2005 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2006

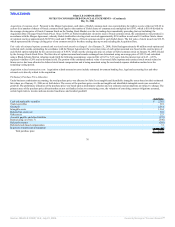

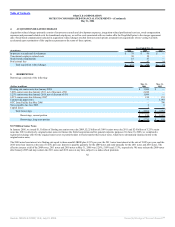

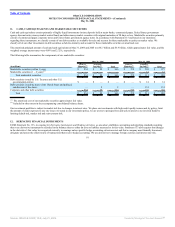

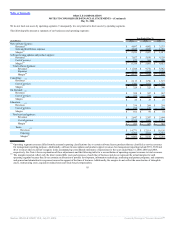

The following tables summarize information about stock options outstanding:

(in millions, except exercise price)

Shares Under

Option

Weighted Average

Exercise Price

Balance, May 31, 2003 455 $ 11.41

Granted 44 $ 12.62

Exercised (38) $ 4.89

Forfeited (21) $ 21.43

Balance, May 31, 2004 440 $ 11.61

Granted(1)

139 $ 11.68

Exercised (71) $ 6.16

Forfeited (39) $ 18.01

Balance, May 31, 2005 469 $ 11.92

Granted(1)

150 $ 15.02

Exercised (87) $ 6.56

Forfeited (59) $ 16.64

Balance, May 31, 2006 473 $ 13.25

(1) Includes options assumed from acquisitions of 82 in fiscal 2006 and 97 in fiscal 2005.

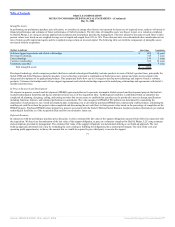

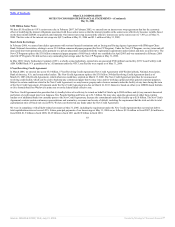

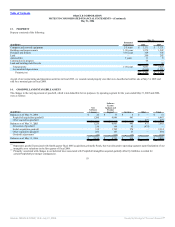

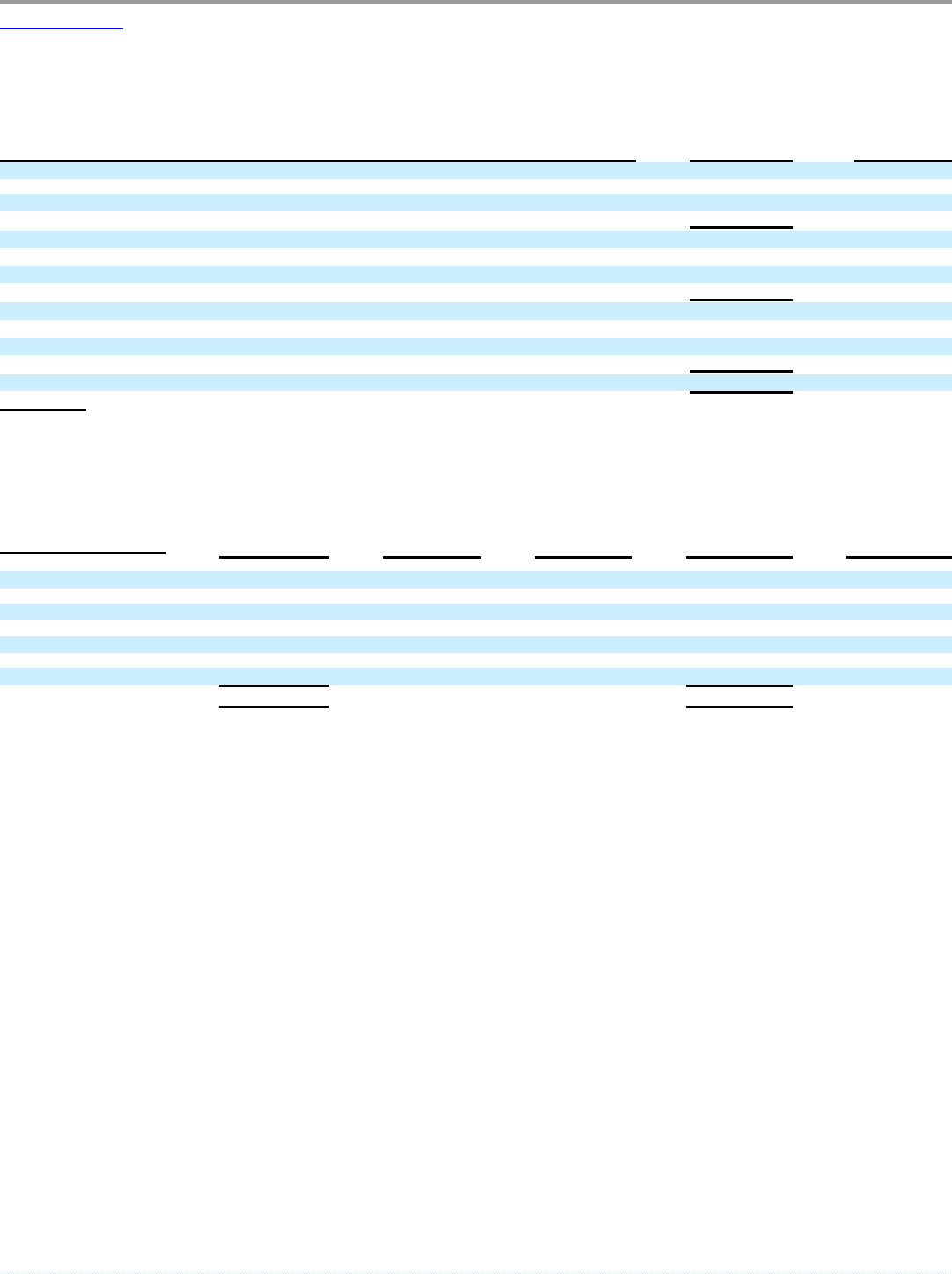

The range of exercise prices for options outstanding at May 31, 2006 was $0.09 to $126.59. The range of exercise prices for options is due to the fluctuating price

of our stock over the period of the grants and from the conversion of options assumed from acquisitions.

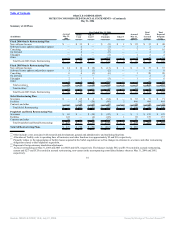

Range of Exercise Price

Options Outstanding

as of May 31, 2006

Weighted Average

Remaining

Contractual Life

Weighted Average

Exercise Price

Options Exercisable

as of May 31, 2006

Weighted Average

Exercise Price of

Exercisable Options

(Shares in millions) (Shares in millions)

$ 0.09 — $ 5.89 61 1.73 $ 4.23 60 $ 4.25

$ 5.94 — $ 6.88 83 3.00 $ 6.87 83 $ 6.87

$ 6.94 — $ 9.90 77 6.64 $ 8.96 43 $ 8.68

$ 9.92 — $ 12.34 90 7.73 $ 11.69 23 $ 11.05

$12.36 — $ 15.86 85 6.30 $ 14.08 57 $ 14.69

$15.90 — $ 42.00 74 4.36 $ 30.77 72 $ 31.06

$42.35 — $126.59 3 4.05 $ 69.98 3 $ 70.00

$ 0.09 — $126.59 473 5.15 $ 13.25 341 $ 13.91

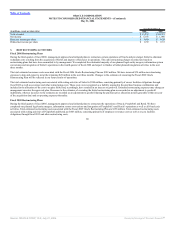

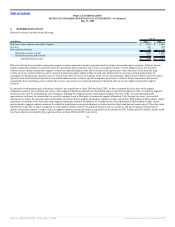

Stock Purchase Plan

We have an Employee Stock Purchase Plan (Purchase Plan). To date, 408.7 million shares of common stock have been reserved for issuance under the Purchase

Plan. Prior to the April 1, 2005 semi-annual option period, under the Purchase Plan employees could purchase shares of common stock at a price per share that is

85% of the lesser of the fair market value of Oracle stock as of the beginning or the end of the semi-annual option period. Starting with the April 1, 2005

semi-annual option period, we amended the Purchase Plan such that employees can purchase shares of common stock at a price per share that is 95% of the fair

value of Oracle stock as of the end of the semi-annual option period. Through May 31, 2006, 321.5 million shares had been issued and 87.2 million shares were

reserved for future issuances under the Purchase Plan. During fiscal 2006, 2005 and 2004, we issued 4.8 million, 16.6 million and 17.5 million shares,

respectively, under the Purchase Plan.

86

Source: ORACLE CORP, 10-K, July 21, 2006 Powered by Morningstar® Document Research℠