Oracle 2005 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2005 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2006

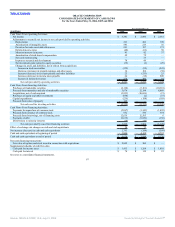

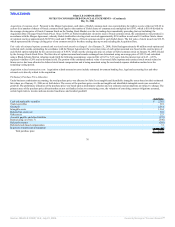

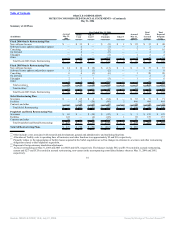

Intangible Assets

In performing our preliminary purchase price allocation, we considered, among other factors, our intention for future use of acquired assets, analyses of historical

financial performance and estimates of future performance of Siebel’s products. The fair value of intangible assets was based, in part, on a valuation completed

by Duff & Phelps, LLC using an income approach and estimates and assumptions provided by management. The rates utilized to discount net cash flows to their

present values were based on our weighted average cost of capital and ranged from 10% to 18%. These discount rates were determined after consideration of our

rate of return on debt capital and equity and the weighted average return on invested capital. The following table sets forth the components of intangible assets

associated with the acquisition:

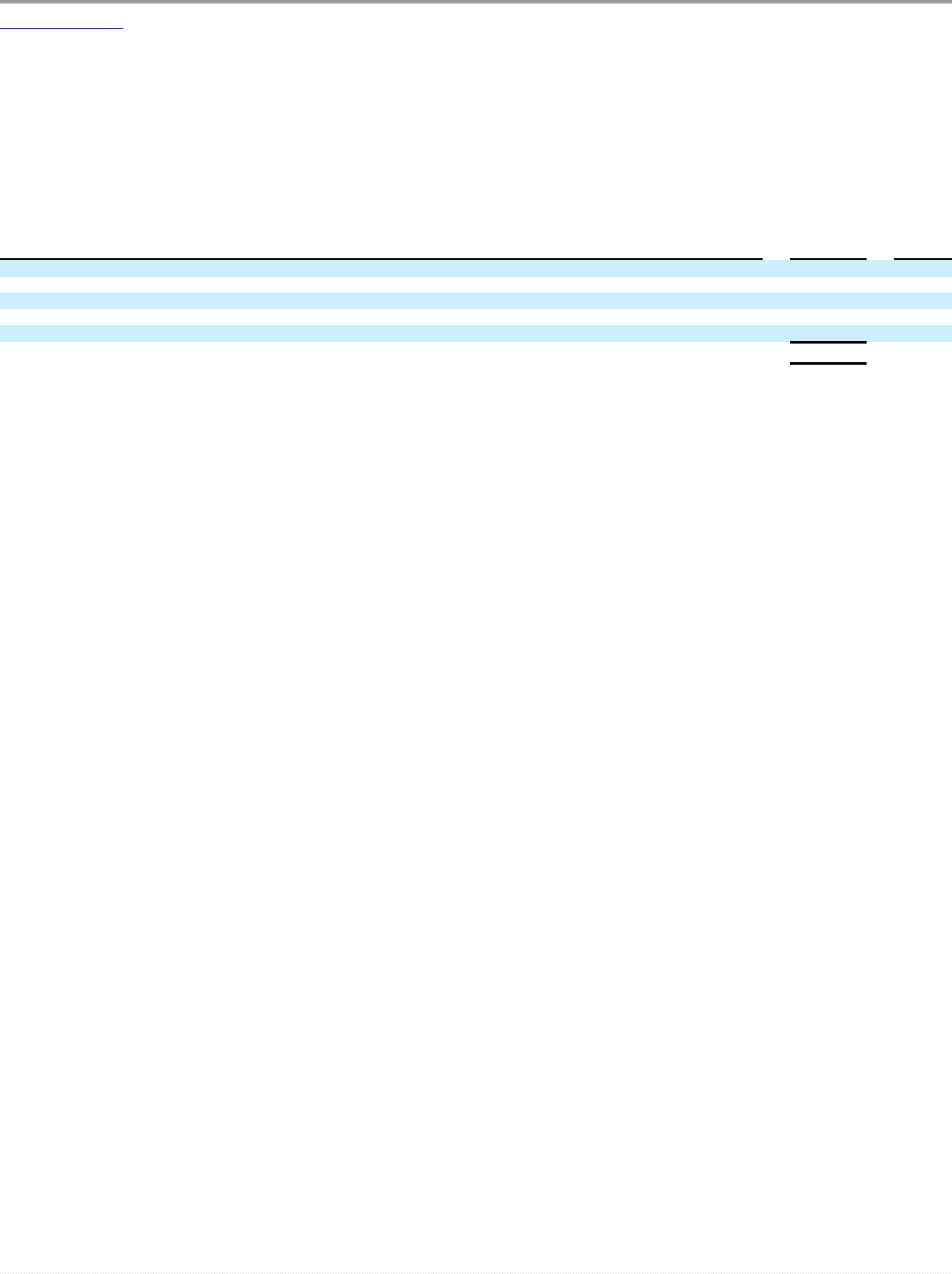

(Dollars in millions) Fair Value Useful Life

Software support agreements and related relationships $ 808 10 years

Developed technology 418 5 years

Core technology 199 5 years

Customer relationships 108 10 years

Trademarks and other 31 5 years

Total intangible assets $ 1,564

Developed technology, which comprises products that have reached technological feasibility, includes products in most of Siebel’s product lines, principally the

Siebel CRM and Siebel Business Analytics products. Core technology represents a combination of Siebel processes, patents and trade secrets related to the

design and development of its applications products. This proprietary know-how can be leveraged to develop new technology and improve Oracle’s software

products. Customer relationships and software support agreements and related relationships represent the underlying relationships and agreements with Siebel’s

installed customer base.

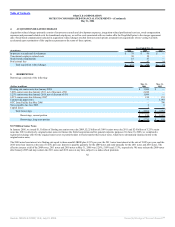

In-Process Research and Development

We expense in-process research and development (IPR&D) upon acquisition as it represents incomplete Siebel research and development projects that had not

reached technological feasibility and had no alternative future use as of the Acquisition Date. Technological feasibility is established when an enterprise has

completed all planning, designing, coding, and testing activities that are necessary to establish that a product can be produced to meet its design specifications

including functions, features, and technical performance requirements. The value assigned to IPR&D of $64 million was determined by considering the

importance of each project to our overall development plan, estimating costs to develop the purchased IPR&D into commercially viable products, estimating the

resulting net cash flows from the projects when completed and discounting the net cash flows to their present value based on the percentage of completion of the

IPR&D projects. Purchased IPR&D relates primarily to projects associated with the Siebel CRM and Siebel Business Analytics products that had not yet reached

technological feasibility as of the Acquisition Date and have no alternative future use.

Deferred Revenues

In connection with the preliminary purchase price allocation, we have estimated the fair value of the support obligations assumed from Siebel in connection with

the acquisition. We based our determination of the fair value of the support obligation, in part, on a valuation completed by Duff & Phelps, LLC using estimates

and assumptions provided by management. The estimated fair value of the support obligations was determined utilizing a cost build-up approach. The cost

build-up approach determines fair value by estimating the costs relating to fulfilling the obligations plus a normal profit margin. The sum of the costs and

operating profit approximates, in theory, the amount that we would be required to pay a third party to assume the support

77

Source: ORACLE CORP, 10-K, July 21, 2006 Powered by Morningstar® Document Research℠