Oracle 2005 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2005 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2006

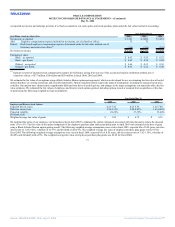

Acquisition of common stock: Pursuant to the Merger Agreement, each share of Siebel common stock was converted into the right to receive either (a) $10.66 in

cash or (b) a number of shares of Oracle common stock equal to the number of Siebel shares of common stock multiplied by 0.8593, which is $10.66 divided by

the average closing price of Oracle Common Stock on the Nasdaq Stock Market over the ten trading days immediately preceding (but not including) the

Acquisition Date (Average Oracle Stock Price). Since 32.68% of Siebel stockholders elected to receive Oracle common stock, the consideration was prorated, in

accordance with the Merger Agreement, whereby Siebel stockholders electing stock received approximately $156 million in cash and 141 million Oracle shares

of common stock (or approximately $0.8752 in cash and 0.7888 shares of Oracle common stock for each Siebel share). The fair value of stock issued was $12.53,

which represented the average closing price of our common stock for the three trading days up to and including the Acquisition Date.

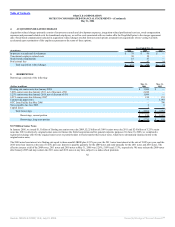

Fair value of estimated options assumed and restricted stock awards exchanged: As of January 31, 2006, Siebel had approximately 80 million stock options and

restricted stock awards outstanding. In accordance with the Merger Agreement, the conversion value of each option assumed was based on the exercise price of

each Siebel option multiplied by the conversion ratio of 0.8576, which was the closing sale price of a share of Siebel common stock on January 30, 2006 divided

by the Average Oracle Stock Price. The fair value of options assumed and awards exchanged was determined using an average price of $12.53 and calculated

using a Black-Scholes-Merton valuation model with the following assumptions: expected life of 0.25 to 7.23 years, risk-free interest rate of 4.45 – 4.59%,

expected volatility of 24% and no dividend yield. The portion of the estimated intrinsic value of unvested Siebel options and restricted stock awards related to

future service has been allocated to deferred stock-based compensation and is being amortized using the accelerated expense attribution method over the

remaining vesting period.

Acquisition related transaction costs: Acquisition related transaction costs include estimated investment banking fees, legal and accounting fees and other

external costs directly related to the acquisition.

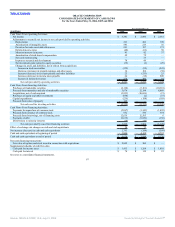

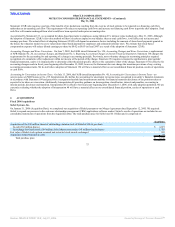

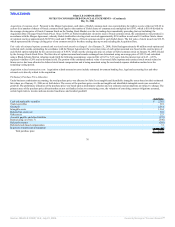

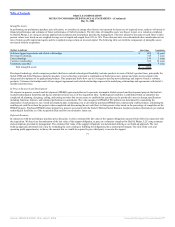

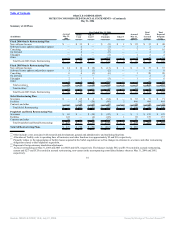

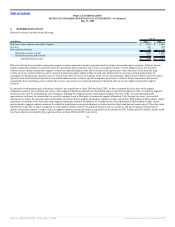

Preliminary Purchase Price Allocation

Under business combination accounting, the total purchase price was allocated to Siebel’s net tangible and identifiable intangible assets based on their estimated

fair values as of January 31, 2006 as set forth below. The excess of the purchase price over the net tangible and identifiable intangible assets was recorded as

goodwill. The preliminary allocation of the purchase price was based upon a preliminary valuation and our estimates and assumptions are subject to change. The

primary areas of the purchase price allocation that are not yet finalized relate to restructuring costs, the valuation of consulting contract obligations assumed,

certain legal matters, income and non-income based taxes and residual goodwill.

(in millions)

Cash and marketable securities $ 2,362

Trade receivables 318

Goodwill 2,514

Intangible assets 1,564

Deferred tax assets, net 318

Other assets 123

Accounts payable and other liabilities (372)

Restructuring (see Note 3) (590)

Deferred revenues (202)

Deferred stock-based compensation 31

In-process research and development 64

Total purchase price $ 6,130

76

Source: ORACLE CORP, 10-K, July 21, 2006 Powered by Morningstar® Document Research℠