Oracle 2005 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2005 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

in the fourth quarter of fiscal 2006 for approximately $1.7 billion. At May 31, 2006, 17,968,130 shares were available for repurchase pursuant to our Siebel

Program.

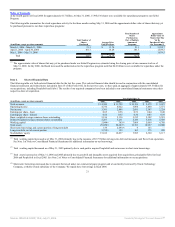

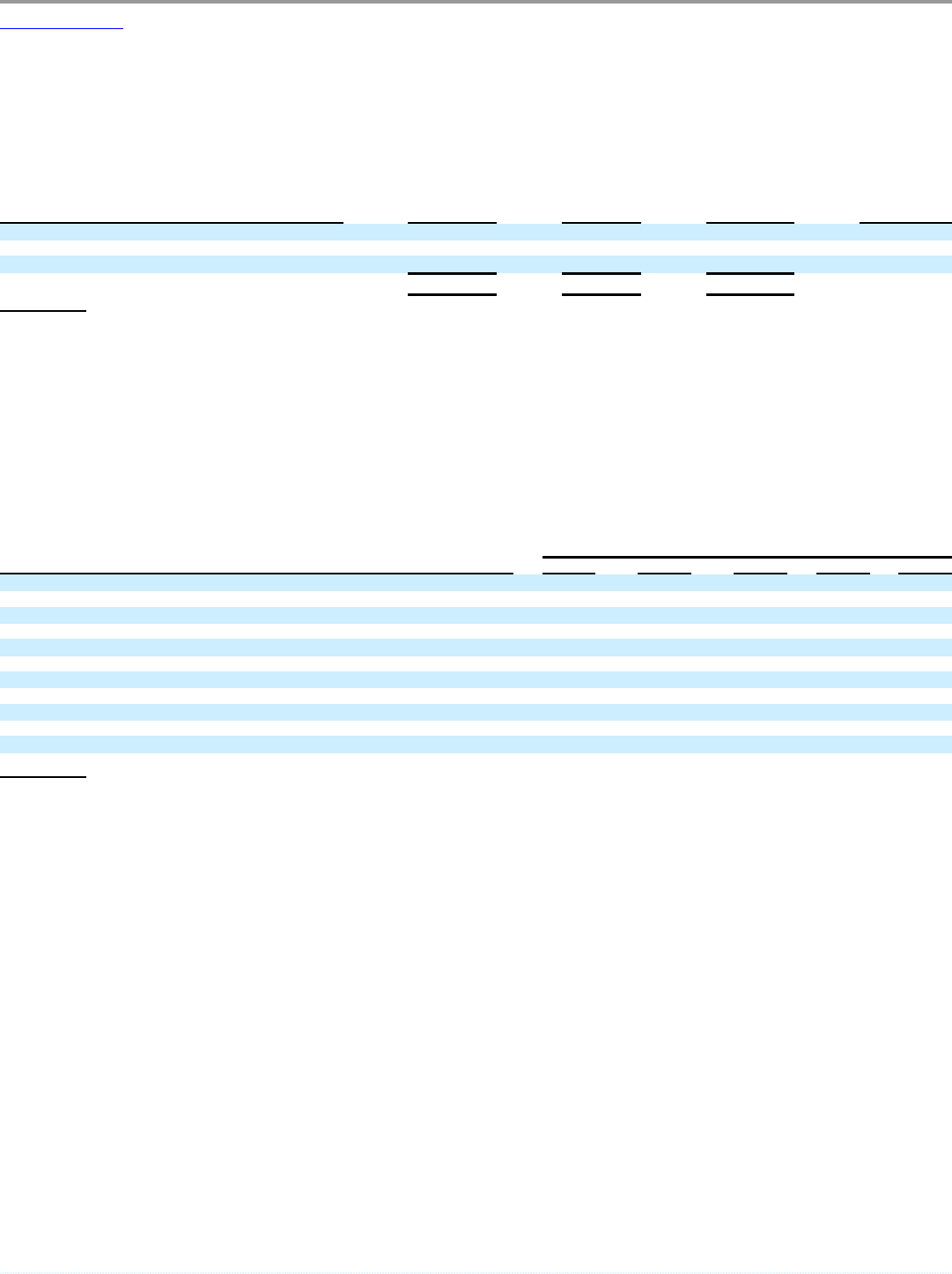

The following table summarizes the stock repurchase activity for the three months ending May 31, 2006 and the approximate dollar value of shares that may yet

be purchased pursuant to our share repurchase programs:

(in millions, except per share amounts)

Total Number of

Shares

Purchased

Average Price

Paid Per Share

Total Number of

Shares

Purchased as

Part of Publicly

Announced

Programs

Approximate

Dollar Value of

Shares that May

Yet Be

Purchased Under

the Programs(1)

March 1, 2006 - March 31, 2006 21.1 $ 13.74 21.1 $ 3,292.7

April 1, 2006 - April 30, 2006 101.7 14.29 101.7 1,839.5

May 1, 2006 - May 31, 2006 — — — 1,839.5

Total 122.8 $ 14.19 122.8

(1) The approximate value of shares that may yet be purchased under our Siebel Program was estimated using the closing price of our common stock as of

May 31, 2006. In July 2006, the Board increased the authorization for the repurchase program such that $4.0 billion is now available for repurchase under the

program.

Item 6. Selected Financial Data

The following table sets forth selected financial data for the last five years. This selected financial data should be read in conjunction with the consolidated

financial statements and related notes included in Item 15 of this Form 10-K. In the last two years, we have paid an aggregate of approximately $19.5 billion for

our acquisitions, including PeopleSoft and Siebel. The results of our acquired companies have been included in our consolidated financial statements since their

respective dates of acquisition.

Year Ended May 31,

(in millions, except per share amounts) 2006 2005 2004 2003 2002

Total revenues $ 14,380 $ 11,799 $ 10,156 $ 9,475 $ 9,673

Operating income 4,736 4,022 3,864 3,440 3,571

Net income 3,381 2,886 2,681 2,307 2,224

Earnings per share - basic 0.65 0.56 0.51 0.44 0.40

Earnings per share - diluted 0.64 0.55 0.50 0.43 0.39

Basic weighted average common shares outstanding 5,196 5,136 5,215 5,302 5,518

Diluted weighted average common shares outstanding 5,287 5,231 5,326 5,418 5,689

Working capital 5,044(1) 385(2) 7,064 5,069 4,768

Total assets 29,029(3) 20,687(3) 12,763 10,967 10,800

Short-term borrowings and current portion of long-term debt 159 2,693(4) 9 153 —

Long-term debt, net of current portion 5,735(1) 159 163 175 298

Stockholders’ equity 15,012 10,837 7,995 6,320 6,117

(1) Total working capital increased as of May 31, 2006 primarily due to the issuance of $5.75 billion in long-term debt and increased cash flows from operations.

See Note 5 of Notes to Consolidated Financial Statements for additional information on our borrowings.

(2) Total working capital decreased as of May 31, 2005 primarily due to cash paid to acquire PeopleSoft and an increase in short-term borrowings.

(3) Total assets increased as of May 31, 2006 and 2005 primarily due to goodwill and intangible assets acquired from acquisitions, principally Siebel in fiscal

2006 and PeopleSoft in fiscal 2005. See Note 2 of Notes to Consolidated Financial Statements for additional information on our acquisitions.

(4) Short-term borrowings increased due to amounts borrowed under our commercial paper program and a loan facility borrowed by Oracle Technology

Company, a wholly-owned subsidiary of the Company. We repaid these borrowings in fiscal 2006.

21

Source: ORACLE CORP, 10-K, July 21, 2006 Powered by Morningstar® Document Research℠