Oracle 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

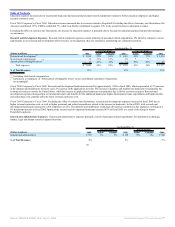

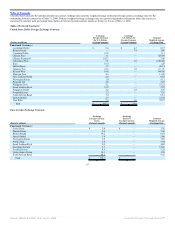

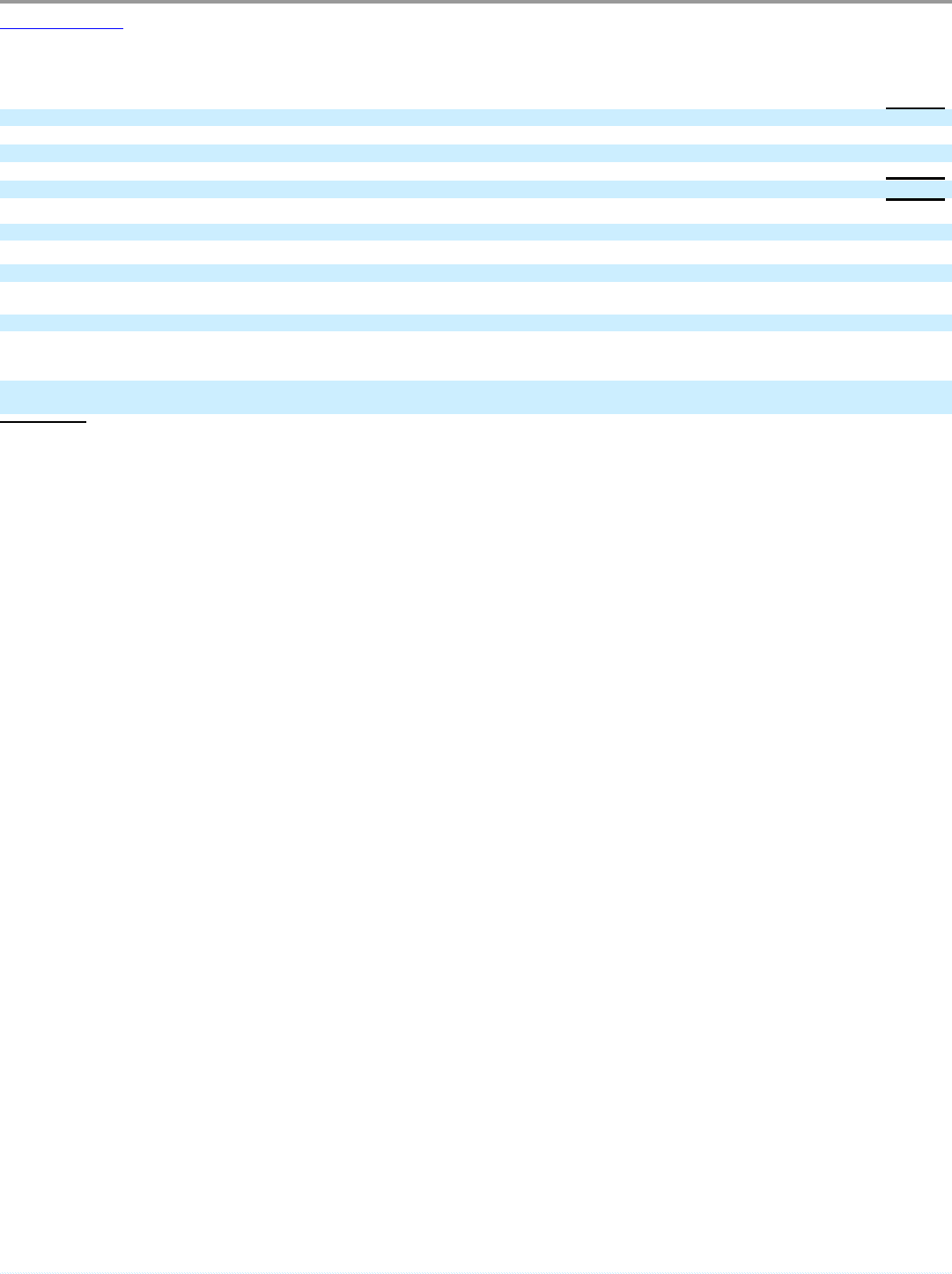

Options granted from June 1, 2003 through May 31, 2006 are summarized as follows:

(Shares

in millions)

Options outstanding at May 31, 2003 455

Options granted(1)

333

Options exercised (196)

Forfeitures (119)

Options outstanding at May 31, 2006 473

Average annualized options granted, net of forfeitures 71

Average annualized stock repurchases 126

Shares outstanding at May 31, 2006 5,232

Weighted-average shares outstanding from June 1, 2003 through May 31, 2006 5,182

Options outstanding as a percent of shares outstanding at May 31, 2006 9.0%

In the money options outstanding (based on our May 31, 2006 stock price) as a percent of shares outstanding at May 31, 2006 6.8%

Average annualized options granted, net of forfeitures and before stock repurchases, as a percent of weighted average shares outstanding from

June 1, 2003 through May 31, 2006 1.4%

Average annualized options granted, net of forfeitures and after stock repurchases, as a percent of average shares outstanding from June 1,

2003 through May 31, 2006 -1.1%

(1) Includes 179 million options assumed in connection with acquisitions.

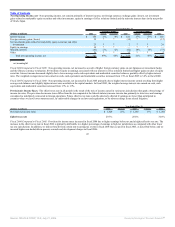

Generally, we grant stock options to key employees on an annual basis. During fiscal 2006, we made our annual grant of options and other grants to purchase

approximately 67.6 million shares, which were partially offset by forfeitures of options to purchase 58.1 million shares.

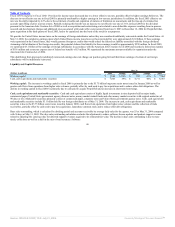

New Accounting Pronouncements

Share-Based Payment: On December 16, 2004, the FASB issued Statement No. 123 (revised 2004), Share-Based Payment, which is a revision of FASB

Statement No. 123, Accounting for Stock-Based Compensation. Statement 123(R) supersedes APB Opinion No. 25, Accounting for Stock Issued to Employees,

and amends FASB Statement No. 95, Statement of Cash Flows. Generally, the approach in Statement 123(R) is similar to the approach described in Statement

123. However, Statement 123(R) generally requires share-based payments to employees, including grants of employee stock options and purchases under

employee stock purchase plans, to be recognized in the statement of operations based on their fair values. Pro forma disclosure of fair value recognition is no

longer an alternative.

On April 14, 2005, the Securities and Exchange Commission announced that the Statement 123(R) effective transition date would be extended to annual periods

beginning after June 15, 2005. We adopted the provisions of Statement 123(R) under the modified prospective method in our first quarter of fiscal 2007. Under

the modified prospective method, compensation cost is recognized beginning with the effective date of adoption (a) based on the requirements of Statement

123(R) for all share-based payments granted after the effective date of adoption and (b) based on the requirements of Statement 123 for all awards granted to

employees prior to the effective date of adoption that remain unvested on the date of adoption.

Statement 123(R) also requires a portion of the benefits of tax deductions resulting from the exercise of stock options to be reported as a financing cash flow,

rather than as an operating cash flow. This requirement will reduce net operating cash flows and increase net financing cash flows in periods after adoption. Total

cash flow will remain unchanged from what would have been reported under prior accounting rules.

52

Source: ORACLE CORP, 10-K, July 21, 2006 Powered by Morningstar® Document Research℠