Oracle 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in

financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

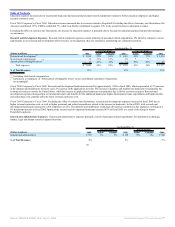

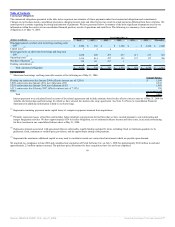

Recent Financing Activities

In January 2006, we issued $1.5 billion of floating rate senior notes due 2009, $2.25 billion of 5.00% senior notes due 2011 and $2.0 billion of 5.25% senior

notes due 2016 (collectively, original senior notes) to finance the Siebel acquisition and for general corporate purposes. On June 16, 2006, we completed a

registered exchange offer for the original senior notes to permit holders to freely transfer their senior notes, which have substantially identical terms to the

original senior notes.

The 2009 notes bear interest at a floating rate equal to three-month LIBOR plus 0.23% per year, the 2011 notes bear interest at the rate of 5.00% per year, and the

2016 notes bear interest at the rate of 5.25% per year. Interest is payable quarterly for the 2009 notes and semi-annually for the 2011 notes and 2016 notes. The

effective interest yield of the 2009 notes, 2011 notes and 2016 notes at May 31, 2006 was 5.28%, 5.09% and 5.33%, respectively. We may redeem the 2009 notes

after January 2007 and may redeem the 2011 notes and 2016 notes at any time, subject to a make-whole premium.

In February 2006, we entered into dealer agreements with various financial institutions and an Issuing and Paying Agency Agreement with JPMorgan Chase

Bank, National Association, relating to a new $3.0 billion commercial paper program (the New CP Program). We did not have any outstanding borrowings under

the New CP Program at May 31, 2006. In March 2006, we entered into a new $3.0 billion, 5-Year Revolving Credit Agreement (New Credit Agreement) with

Wachovia Bank, National Association, Bank of America, N.A. and certain other lenders. The New Credit Agreement provides for an unsecured revolving credit

facility which can be used to backstop any commercial paper that we may issue and for working capital and other general corporate purposes.

We believe that our current cash and cash equivalents, marketable securities and cash generated from operations will be sufficient to meet our working capital,

capital expenditures, contractual obligations and investment needs. In addition, we believe we could fund other acquisitions and repurchase common stock with

our internally available cash and investments, cash generated from operations, amounts available under our credit facilities, additional borrowings or from the

issuance of additional securities.

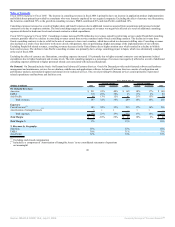

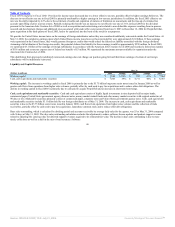

Quarterly Results of Operations

Quarterly revenues and expenses have historically been affected by a variety of seasonal factors, including sales compensation plans. These seasonal factors are

common in the software industry. These factors have caused a decrease in our first quarter revenues as compared to revenues in the immediately preceding fourth

quarter, which historically, has been the highest quarter. We expect this trend to continue in the first quarter of fiscal 2007. In addition, our European operations

generally provide lower revenues in our first fiscal quarter because of the reduced economic activity in Europe during the summer.

50

Source: ORACLE CORP, 10-K, July 21, 2006 Powered by Morningstar® Document Research℠