Oracle 2005 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2005 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2006

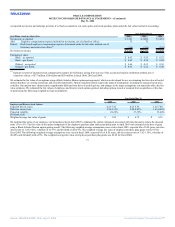

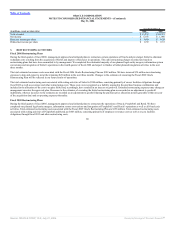

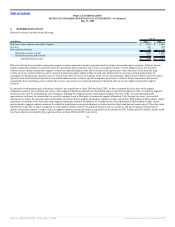

4. ACQUISITION RELATED CHARGES

Acquisition related charges primarily consist of in-process research and development expenses, integration-related professional services, stock-compensation

expenses and personnel related costs for transitional employees, as well as costs associated with our tender offer for PeopleSoft prior to the merger agreement

date. Stock-based compensation included in acquisition related charges resulted from unvested options assumed from acquisitions whose vesting was fully

accelerated upon termination of the employees pursuant to the terms of these options.

Year Ended May 31,

(in millions) 2006 2005 2004

In-process research and development $ 78 $ 46 $ —

Transitional employee related costs 30 52 —

Stock-based compensation 18 47 —

Professional fees 11 63 54

Total acquisition related charges $ 137 $ 208 $ 54

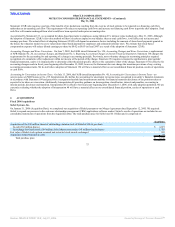

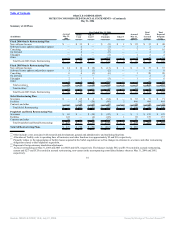

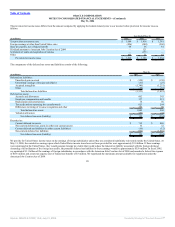

5. BORROWINGS

Borrowings consisted of the following:

(Dollars in millions)

May 31,

2006

May 31,

2005

Floating rate senior notes due January 2009 $ 1,500 $ —

5.00% senior notes due January 2011, net of discount of $8 2,242 —

5.25% senior notes due January 2016, net of discount of $11 1,989 —

6.91% senior notes due February 2007 150 153

Commercial paper notes — 1,993

OTC Loan Facility due May 2006 — 700

Notes payable due June 2006 6 6

Capital leases 7 —

Total borrowings $ 5,894 $ 2,852

Borrowings, current portion $ 159 $ 2,693

Borrowings, long-term portion $ 5,735 $ 159

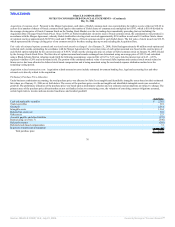

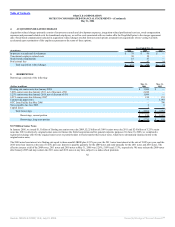

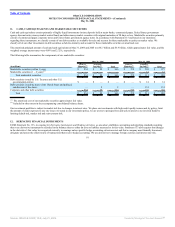

$5.75 Billion Senior Notes

In January 2006, we issued $1.5 billion of floating rate senior notes due 2009, $2.25 billion of 5.00% senior notes due 2011 and $2.0 billion of 5.25% senior

notes due 2016 (collectively, original senior notes) to finance the Siebel acquisition and for general corporate purposes. On June 16, 2006, we completed a

registered exchange offer for the original senior notes to permit holders to freely transfer their senior notes, which have substantially identical terms to the

original senior notes.

The 2009 notes bear interest at a floating rate equal to three-month LIBOR plus 0.23% per year, the 2011 notes bear interest at the rate of 5.00% per year, and the

2016 notes bear interest at the rate of 5.25% per year. Interest is payable quarterly for the 2009 notes and semi-annually for the 2011 notes and 2016 notes. The

effective interest yield of the 2009 notes, 2011 notes and 2016 notes at May 31, 2006 was 5.28%, 5.09% and 5.33%, respectively. We may redeem the 2009 notes

after January 2007 and may redeem the 2011 notes and 2016 notes at any time, subject to a make-whole premium.

82

Source: ORACLE CORP, 10-K, July 21, 2006 Powered by Morningstar® Document Research℠