Oracle 2005 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2005 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

May 31, 2006

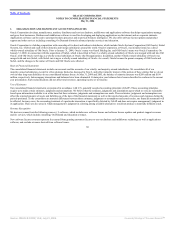

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Oracle Corporation develops, manufactures, markets, distributes and services database, middleware and applications software that helps organizations manage

and grow their businesses. Database and middleware software is used for developing and deploying applications on the internet and on corporate intranets.

Applications software can be used to automate business processes and to provide business intelligence. We also offer software license updates and product

support and other services including consulting, On Demand (formerly advanced product services) and education.

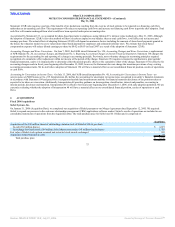

Oracle Corporation is a holding corporation with ownership of its direct and indirect subsidiaries, which include Oracle Systems Corporation (Old Oracle), Siebel

Systems, Inc. (Siebel) and each of their domestic and foreign subsidiaries around the world. Oracle Corporation, or Oracle, was initially formed as a direct

wholly-owned subsidiary of Old Oracle. Prior to January 31, 2006, Oracle’s name was Ozark Holding Inc. and Old Oracle’s name was Oracle Corporation. On

January 31, 2006, in connection with the acquisition of Siebel, which is described in Note 2, a wholly-owned subsidiary of Oracle was merged with and into Old

Oracle, with Old Oracle surviving as a wholly-owned subsidiary of Oracle (the Reorganization). In addition, another wholly-owned subsidiary of Oracle was

merged with and into Siebel, with Siebel surviving as a wholly-owned subsidiary of Oracle. As a result, Oracle became the parent company of Old Oracle and

Siebel, and the changes to the names of Oracle and Old Oracle were effected.

Basis of Financial Statements

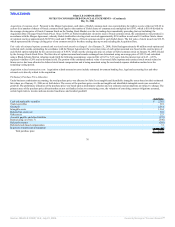

The consolidated financial statements include our accounts and the accounts of our wholly- and majority-owned subsidiaries. We consolidate all of our

majority-owned subsidiaries, except for i-flex solutions limited as discussed in Note 2, and reflect minority interest of the portion of these entities that we do not

own in other long-term liabilities on our consolidated balance sheets. At May 31, 2006 and 2005, the balance of minority interests was $209 million and $199

million, respectively. Intercompany transactions and balances have been eliminated. Certain prior year balances have been reclassified to conform to the current

year presentation. Such reclassifications did not affect total revenues, operating income or net income.

Use of Estimates

Our consolidated financial statements are prepared in accordance with U.S. generally accepted accounting principles (GAAP). These accounting principles

require us to make certain estimates, judgments and assumptions. We believe that the estimates, judgments and assumptions upon which we rely are reasonable

based upon information available to us at the time that these estimates, judgments and assumptions are made. These estimates, judgments and assumptions can

affect the reported amounts of assets and liabilities as of the date of the financial statements as well as the reported amounts of revenues and expenses during the

periods presented. To the extent there are material differences between these estimates, judgments or assumptions and actual results, our financial statements will

be affected. In many cases, the accounting treatment of a particular transaction is specifically dictated by GAAP and does not require management’s judgment in

its application. There are also areas in which management’s judgment in selecting among available alternatives would not produce a materially different result.

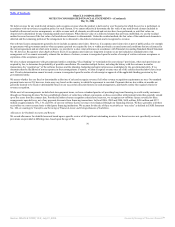

Revenue Recognition

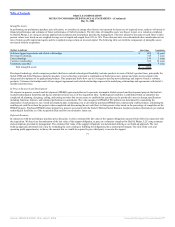

We derive revenues from the following sources: (1) software, which includes new software license and software license updates and product support revenues

and (2) services, which include consulting, On Demand and education revenues.

New software license revenues represent fees earned from granting customers licenses to use our database and middleware technology as well as applications

software, and exclude revenues derived from software license

68

Source: ORACLE CORP, 10-K, July 21, 2006 Powered by Morningstar® Document Research℠