Oracle 2005 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2005 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

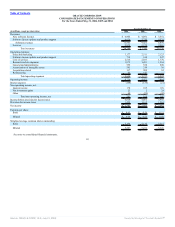

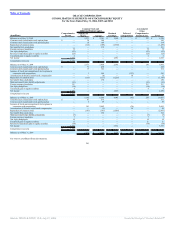

ORACLE CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Years Ended May 31, 2006, 2005 and 2004

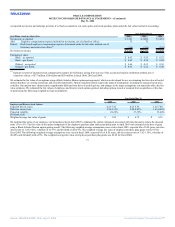

Year Ended May 31,

(in millions) 2006 2005 2004

Cash Flows From Operating Activities:

Net income $ 3,381 $ 2,886 $ 2,681

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation 223 206 198

Amortization of intangible assets 583 219 36

Provision for trade receivable allowances 241 197 173

Deferred income taxes (40) (66) 58

Minority interests in income 41 42 37

Amortization of stock-based compensation 49 72 —

Non-cash restructuring — 33 —

In-process research and development 78 46 —

Net investment gains related to equity securities (39) (2) (29)

Changes in assets and liabilities, net of effects from acquisitions:

Increase in trade receivables (355) (88) (245)

Decrease (increase) in prepaid expenses and other assets 14 164 (30)

Increase (decrease) in accounts payable and other liabilities 23 (533) 25

Increase (decrease) in income taxes payable 64 (18) 200

Increase in deferred revenues 278 394 91

Net cash provided by operating activities 4,541 3,552 3,195

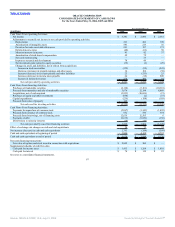

Cash Flows From Investing Activities:

Purchases of marketable securities (2,128) (7,101) (10,310)

Proceeds from maturities and sale of marketable securities 3,676 12,194 8,009

Acquisitions, net of cash acquired (3,953) (10,656) (21)

Purchases of equity and other investments (858) (2) (37)

Capital expenditures (236) (188) (189)

Proceeds from sales of property 140 — —

Net cash used for investing activities (3,359) (5,753) (2,548)

Cash Flows From Financing Activities:

Payments for repurchase of common stock (2,067) (1,343) (1,499)

Proceeds from issuance of common stock 632 596 354

Proceeds from borrowings, net of financing costs 12,636 12,505 6

Payments of debt (9,635) (9,830) (150)

Distributions to minority interests (39) (44) (31)

Net cash provided by (used for) financing activities 1,527 1,884 (1,320)

Effect of exchange rate changes on cash and cash equivalents 56 73 74

Net increase (decrease) in cash and cash equivalents 2,765 (244) (599)

Cash and cash equivalents at beginning of period 3,894 4,138 4,737

Cash and cash equivalents at end of period $ 6,659 $ 3,894 $ 4,138

Non-cash financing transactions:

Fair value of options and stock issued in connection with acquisitions $ 2,042 $ 504 $ —

Supplemental schedule of cash flow data:

Cash paid for income taxes $ 1,413 $ 1,268 $ 1,010

Cash paid for interest $ 74 $ 119 $ 23

See notes to consolidated financial statements.

67

Source: ORACLE CORP, 10-K, July 21, 2006 Powered by Morningstar® Document Research℠