Oracle 2005 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2005 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

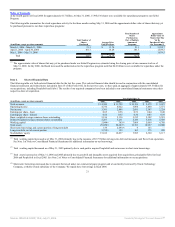

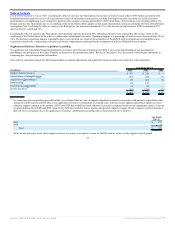

Stock-Based Compensation

Up until May 31, 2006, we measured compensation expense for our stock-based incentive programs using the intrinsic value method prescribed by Accounting

Principles Board Opinion No. 25, Accounting for Stock Issued to Employees. Under this method, we did not record compensation expense when stock options

were granted to eligible participants as long as the exercise price was not less than the fair market value of the stock when the option was granted. In accordance

with FASB Statement No. 123, Accounting for Stock-Based Compensation, and FASB Statement No. 148, Accounting for Stock-Based

Compensation—Transition and Disclosure, we disclosed our pro forma net income or loss and net income or loss per share as if the fair value-based method had

been applied in measuring compensation expense for our stock-based incentive programs.

We were required to adopt the provisions of FASB Statement 123(R), Share-Based Payment, in the first quarter of fiscal 2007. Although the adoption of

Statement 123(R)’s fair value method has no adverse impact on our balance sheet or total cash flows, it affects our operating expenses, net income and earnings

per share. The actual effects of adopting Statement 123(R) will depend on numerous factors including the amounts of share-based payments granted in the future,

the valuation model we use to value future share-based payments to employees and estimated forfeiture rates. We estimate that stock-based compensation

expense will reduce diluted earnings per share by $0.02 to $0.03 in fiscal 2007.

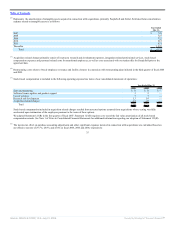

Allowances for Doubtful Accounts and Returns

We make judgments as to our ability to collect outstanding receivables and provide allowances for the portion of receivables when collection becomes doubtful.

Provisions are made based upon a specific review of all significant outstanding invoices. For those invoices not specifically reviewed, provisions are recorded at

differing rates, based upon the age of the receivable. In determining these percentages, we analyze our historical collection experience and current economic

trends. If the historical data we use to calculate the allowance for doubtful accounts does not reflect the future ability to collect outstanding receivables,

additional provisions for doubtful accounts may be needed and the future results of operations could be materially affected.

We also record a provision for estimated sales returns and allowances on product and service related sales in the same period the related revenues are recorded.

These estimates are based on historical sales returns, analysis of credit memo data and other known factors. If the historical data we use to calculate these

estimates do not properly reflect future returns, then a change in the allowances would be made in the period in which such a determination is made and revenues

in that period could be materially affected.

31

Source: ORACLE CORP, 10-K, July 21, 2006 Powered by Morningstar® Document Research℠