Oracle 2005 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2005 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

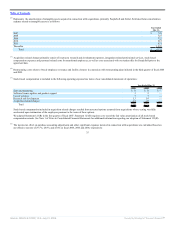

Table of Contents

Other significant estimates associated with the accounting for acquisitions include restructuring costs. Restructuring costs are primarily comprised of severance

costs, costs of consolidating duplicate facilities and contract termination costs. Restructuring expenses are based upon plans that have been committed to by

management but which are subject to refinement. To estimate restructuring expenses, management utilizes assumptions of the number of employees that would

be involuntarily terminated and of future costs to operate and eventually vacate duplicate facilities. Estimated restructuring expenses may change as management

executes the approved plan. Decreases to the cost estimates of executing the currently approved plans associated with pre-merger activities of the companies we

acquire are recorded as an adjustment to goodwill indefinitely, whereas increases to the estimates are recorded as an adjustment to goodwill during the purchase

price allocation period (generally within one year of the acquisition date) and as operating expenses thereafter. Changes in cost estimates of executing the

currently approved plans associated with our pre-merger activities are recorded in restructuring expenses.

For a given acquisition, we may identify certain pre-acquisition contingencies. If, during the purchase price allocation period, we are able to determine the fair

value of a pre-acquisition contingency, we will include that amount in the purchase price allocation. If, as of the end of the purchase price allocation period, we

are unable to determine the fair value of a pre-acquisition contingency, we will evaluate whether to include an amount in the purchase price allocation based on

whether it is probable a liability had been incurred and whether an amount can be reasonably estimated. After the end of the purchase price allocation period, any

adjustment that results from a pre-acquisition contingency will be included in our operating results in the period in which the adjustment is determined.

PeopleSoft Customer Assurance Program

As discussed in Note 16 of Notes to Consolidated Financial Statements, in June 2003, in response to our tender offer, PeopleSoft implemented what it referred to

as the “customer assurance program” or “CAP.” The CAP incorporated a provision in PeopleSoft’s standard licensing arrangement that purports contractually to

burden Oracle, as a result of our acquisition of PeopleSoft, with a contingent obligation to make payments to PeopleSoft customers should we fail to take certain

business actions for a fixed period, which typically expires four years from the date of the contract. We have concluded that, as of the date of the acquisition, the

penalty provisions under the CAP represent a contingent liability of Oracle. We have not recorded a liability related to the CAP, as we do not believe it is

probable that our post-acquisition activities related to the PeopleSoft and JD Edwards product lines will trigger an obligation to make any payment pursuant to

the CAP. The maximum potential penalty under the CAP as of May 31, 2006 was $3.5 billion. Unless the CAP provisions are removed from these licensing

arrangements, we do not expect the aggregate potential CAP obligation to decline substantially until fiscal year 2008 when these provisions begin to expire.

While no assurance can be given as to the ultimate outcome of potential litigation, we believe we would also have substantial defenses with respect to the legality

and enforceability of the CAP contract provisions in response to any claims seeking payment from Oracle under the CAP terms. If we determine in the future that

a payment pursuant to the CAP is probable, the estimated liability would be recorded in our operating results in the period in which such liability is determined.

Goodwill

We review goodwill for impairment annually and whenever events or changes in circumstances indicate its carrying value may not be recoverable in accordance

with FASB Statement No. 142, Goodwill and Other Intangible Assets. The provisions of Statement 142 require that a two-step impairment test be performed on

goodwill. In the first step, we compare the fair value of each reporting unit to its carrying value. Our reporting units are consistent with the reportable segments

identified in Note 15 of the Notes to Consolidated Financial Statements. If the fair value of the reporting unit exceeds the carrying value of the net assets assigned

to that unit, goodwill is considered not impaired and we are not required to perform further testing. If the carrying value of the net assets assigned to the reporting

unit exceeds the fair value of the reporting unit, then we must perform the second step of the impairment test in order to determine the implied fair value of the

reporting unit’s goodwill. If the carrying value of a reporting unit’s goodwill exceeds its implied fair value, then we would record an impairment loss equal to the

difference.

26

Source: ORACLE CORP, 10-K, July 21, 2006 Powered by Morningstar® Document Research℠