Oracle 2005 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2005 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

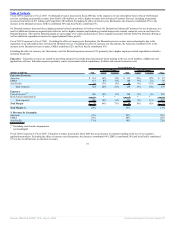

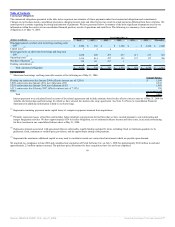

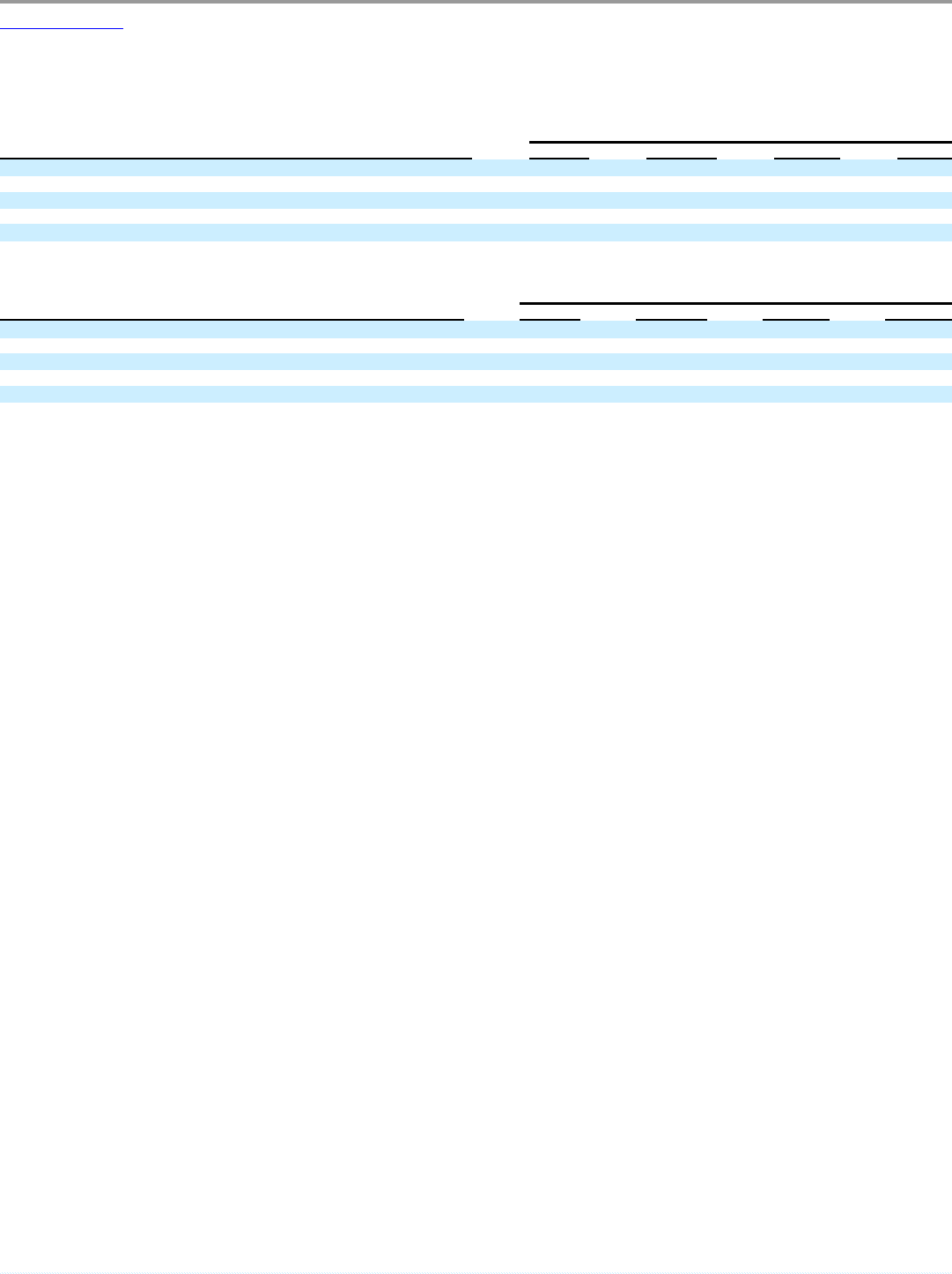

The following table sets forth selected unaudited quarterly information for our last eight fiscal quarters. We believe that all necessary adjustments, which

consisted only of normal recurring adjustments, have been included in the amounts stated below to present fairly the results of such periods when read in

conjunction with the consolidated financial statements and related notes included elsewhere in this Annual Report on Form 10-K. The sum of the quarterly

financial information may vary from the annual data due to rounding.

Fiscal 2006 Quarter Ended (Unaudited)

(in millions, except per share amounts) August 31 November 30 February 28 May 31

Revenues $ 2,768 $ 3,292 $ 3,470 $ 4,851

Gross profit $ 1,311 $ 1,705 $ 1,779 $ 2,606

Operating income $ 712 $ 1,116 $ 1,052 $ 1,857

Net income $ 519 $ 798 $ 765 $ 1,300

Earnings per share—basic $ 0.10 $ 0.15 $ 0.15 $ 0.25

Earnings per share—diluted $ 0.10 $ 0.15 $ 0.14 $ 0.24

Fiscal 2005 Quarter Ended (Unaudited)

(in millions, except per share amounts) August 31 November 30 February 28 May 31

Revenues $ 2,215 $ 2,756 $ 2,950 $ 3,878

Gross profit $ 1,180 $ 1,611 $ 1,493 $ 2,165

Operating income $ 715 $ 1,131 $ 770 $ 1,407

Net income $ 509 $ 815 $ 540 $ 1,022

Earnings per share—basic $ 0.10 $ 0.16 $ 0.11 $ 0.20

Earnings per share—diluted $ 0.10 $ 0.16 $ 0.10 $ 0.20

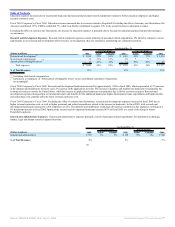

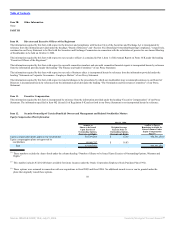

Stock Options

Our stock option program is a key component of the compensation package we provide to attract and retain talented employees and align their interests with the

interests of existing stockholders. We recognize that options dilute existing stockholders and have sought to control the number of options granted while

providing competitive compensation packages. Consistent with these dual goals, our cumulative potential dilution for each of the last three full fiscal years has

been less than 2.0% and has averaged 1.4% per year. The potential dilution percentage is calculated as the new option grants for the year, net of options forfeited

by employees leaving the company, divided by the total outstanding shares at the beginning of the year. This maximum potential dilution will only result if all

options are exercised. Many of these options, which have 10-year exercise periods, have exercise prices substantially higher than the current market price. At

May 31, 2006, 25% of our outstanding stock options had exercise prices in excess of the current market price. Consistent with our historic practices, we do not

expect that dilution from future grants before the effect of our stock repurchase program will exceed 1.5% per year for our ongoing business. Over the last 10

years, our stock repurchase program has more than offset the dilutive effect of our stock option program; however, we may reduce the level of our stock

repurchases in the future as we may use our available cash for acquisitions or to repay indebtedness. At May 31, 2006, the maximum potential dilution from all

outstanding and unexercised option awards, regardless of when granted and regardless of whether vested or unvested and including options where the strike price

is higher than the current market price, was 9.1%.

The Compensation Committee of the Board of Directors reviews and approves the organization-wide stock option grants to selected employees, all stock option

grants to executive officers and any individual stock option grants in excess of 25,000 shares. A separate Plan Committee, which is an executive officer

committee, approves individual stock option grants up to 25,000 shares to non-executive officers and employees.

51

Source: ORACLE CORP, 10-K, July 21, 2006 Powered by Morningstar® Document Research℠