Oracle 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

license updates and product support revenues are generally billed one year in advance, while the revenues are recognized ratably over the annual contract period.

Software license updates and product support revenues as a percent of total revenues increased, resulting in higher cash collections and lower days sales

outstanding.

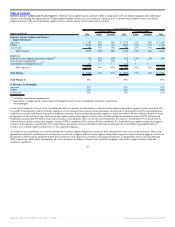

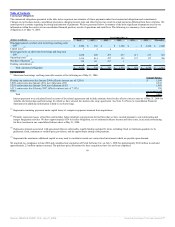

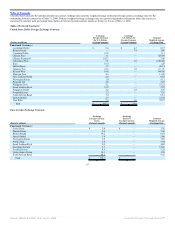

Year Ended May 31,

(Dollars in millions) 2006 Change 2005 Change 2004

Cash provided by operating activities $ 4,541 28% $ 3,552 11% $ 3,195

Cash used for investing activities $ (3,359) -42% $ (5,753) 126% $ (2,548)

Cash provided by (used for) financing activities $ 1,527 -19% $ 1,884 243% $ (1,320)

Cash flows from operating activities: Our largest source of operating cash flows is cash collections from our customers following the purchase and renewal of

their software license updates and product support agreements. Payments from customers for software license updates and product support are generally received

by the beginning of the contract term, which is generally one year in length. We also generate significant cash from new software license sales and, to a lesser

extent, services. Our primary uses of cash from operating activities are for personnel related expenditures, payment of taxes, facilities and technology costs.

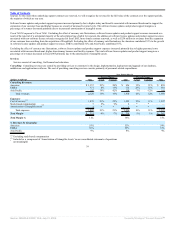

Fiscal 2006 Compared to Fiscal 2005: Cash flows provided by operating activities increased in fiscal 2006 primarily due to higher sales volumes and higher net

income, excluding non-cash charges, partially offset by increased accounts receivables due to fourth quarter fiscal 2006 revenue growth.

Fiscal 2005 Compared to Fiscal 2004: Cash flows from operating activities increased in fiscal 2005 primarily due to higher net income, excluding non-cash

charges, and increases in non-acquisition related deferred revenues, partially offset by the payment of liabilities assumed in connection with the PeopleSoft

acquisition.

Cash flows from investing activities: The changes in cash flows from investing activities primarily relate to acquisitions and the timing of purchases and

maturities of marketable securities. We also use cash to invest in capital and other assets to support our growth.

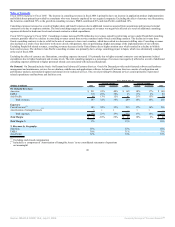

Fiscal 2006 Compared to Fiscal 2005: Cash used for investing activities decreased in fiscal 2006 primarily due to lower cash payments for acquisitions, net of

cash acquired as well as proceeds from property sales. Investing cash outflows in fiscal 2005 include cash paid for our acquisition of PeopleSoft, whereas

investing cash outflows in fiscal 2006 primarily relates to our acquisition of Siebel Systems and our equity investment purchases in i-flex.

Fiscal 2005 Compared to Fiscal 2004: Cash used for investing activities increased in fiscal 2005 primarily due to cash paid to acquire PeopleSoft. The increase

was partially offset by higher proceeds from maturities of marketable securities, net of purchases.

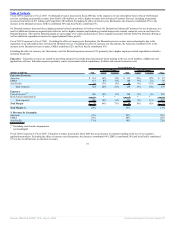

Cash flows from financing activities: The changes in cash flows from financing activities primarily relate to borrowings and payments under debt obligations as

well as stock repurchase activity.

Fiscal 2006 Compared to Fiscal 2005: Cash provided by financing activities decreased in fiscal 2006 primarily due to higher stock repurchases, partially offset

by higher net borrowings. We increased our share repurchases in fiscal 2006 due to the issuance of approximately 141 million shares of common stock in

connection with our Siebel acquisition. We intend to continue to repurchase shares under our stock repurchase programs.

47

Source: ORACLE CORP, 10-K, July 21, 2006 Powered by Morningstar® Document Research℠