Oracle 2005 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2005 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2006

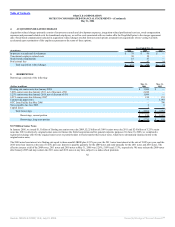

obligations. The estimated costs to fulfill the support obligations were based on the historical direct costs related to providing the support services and to correct

any errors in Siebel software products. We did not include any costs associated with selling efforts or research and development or the related fulfillment margins

on these costs. Profit associated with selling effort is excluded because Siebel had concluded the selling effort on the support contracts prior to the Acquisition

Date. The estimated research and development costs have not been included in the fair value determination, as these costs were not deemed to represent a legal

obligation at the time of acquisition. We estimated the normal profit margin to be 30%. As a result, in allocating the purchase price, we recorded an adjustment to

reduce the carrying value of Siebel’s January 31, 2006 deferred support revenue by $193 million to $129 million, which represents our estimate of the fair value

of the support obligation assumed.

Pre-Acquisition Contingencies

We have currently not identified any material pre-acquisition contingencies. If we identify a material pre-acquisition contingency during the remainder of the

purchase price allocation period, we will attempt to determine its fair value and include it in the purchase price allocation. If, as of the end of the purchase price

allocation period, we are unable to determine its fair value, we will apply FASB Statement No. 5, Accounting for Contingencies, and the amount determined by

applying Statement 5 to such item will be included in the purchase price allocation.

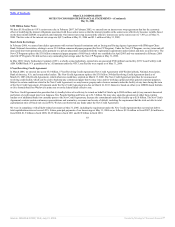

Investment in i-flex solutions limited

On August 2, 2005, we entered into a Share Purchase Agreement with OrbiTech Limited, a subsidiary of Citigroup Inc., for the purchase of 32,236,000 shares of

i-flex solutions limited, a provider of software solutions and services to the financial services industry (Bombay Stock Exchange: IFLX.BO and National Stock

Exchange of India: IFLX.NS). Under the terms of the Share Purchase Agreement and related agreements, we purchased the i-flex shares from OrbiTech on

November 18, 2005 for $593 million, or 800 Indian rupees per share. We have made additional purchases of i-flex common stock pursuant to an open offer in

October 2005 and through ordinary brokerage transactions in the fourth quarter of fiscal 2006 for approximately $234 million, or a weighted average price of

1,334 Indian rupees per share.

We own approximately 52.5% of i-flex common stock as of May 31, 2006. We currently account for our investment in i-flex under the equity method of

accounting two months in arrears as our reporting periods differ and the access to more current information is not available. Under the equity method of

accounting, we record our percentage interest of the earnings of i-flex in non-operating income, net in our consolidated statements of operations. Equity in

earnings of i-flex was $14 million in fiscal 2006. Our investment in i-flex reflects the price paid for the common stock as well as equity in earnings, and it

exceeds our share of the underlying interest in the net assets of i-flex, as determined under U.S. GAAP. As we are unable to relate this difference to specific

accounts of i-flex, the difference has been recognized in a similar manner as goodwill and will not be subject to amortization. The market value of our

investment, which was $987 million at May 31, 2006, was in excess of the carrying value of our investment of $841 million, which is recorded in other assets,

net in the consolidated balance sheets.

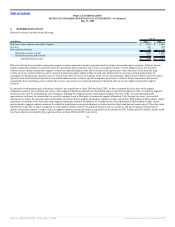

Other Acquisitions

During fiscal 2006, we acquired several software companies and purchased certain technology and development organizations for approximately $682 million,

which includes cash paid of $648 million and the fair value of options assumed of $34 million.

We recorded approximately $484 million of goodwill, $173 million of identifiable intangible assets, $11 million of net tangible assets and $14 million of IPR&D

in connection with these other acquisitions during fiscal 2006. We have included the effects of these transactions in our results of operations prospectively from

the respective dates of the acquisitions.

78

Source: ORACLE CORP, 10-K, July 21, 2006 Powered by Morningstar® Document Research℠