Oracle 2005 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2005 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2006

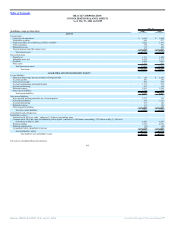

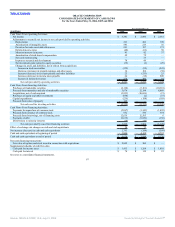

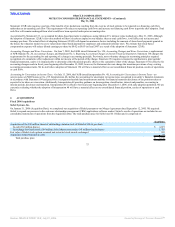

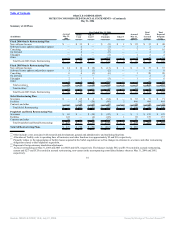

on reported net income and earnings per share if we had accounted for our stock option and stock purchase plans under the fair value method of accounting:

Year Ended May 31,

(in millions, except per share data) 2006 2005 2004

Net income, as reported $ 3,381 $ 2,886 $ 2,681

Add: Employee compensation expense included in net income, net of related tax effects 39 70 —

Deduct: Stock-based employee compensation expense determined under the fair value method, net of

forfeitures and related tax effects(1) (158) (205) (203)

Pro forma net income $ 3,262 $ 2,751 $ 2,478

Earnings per share:

Basic—as reported $ 0.65 $ 0.56 $ 0.51

Basic—pro forma $ 0.63 $ 0.54 $ 0.48

Diluted—as reported $ 0.64 $ 0.55 $ 0.50

Diluted—pro forma $ 0.62 $ 0.52 $ 0.46

(1) Includes reversal of unearned stock compensation expense for forfeitures arising from our use of the accelerated expense attribution method, net of

related tax effects, of $37 million, $28 million and $59 million in fiscal 2006, 2005 and 2004.

We estimate the fair value of our options using a Black-Scholes-Merton option-pricing model, which was developed for use in estimating the fair value of traded

options that have no vesting restrictions and are fully transferable. Option valuation models require the input of assumptions, including the expected stock price

volatility. Our options have characteristics significantly different from those of traded options, and changes in the input assumptions can materially affect the fair

value estimates. We estimated the fair values of employee and director stock options granted, including options issued or assumed from acquisitions, at the date

of grant using the following weighted-average assumptions:

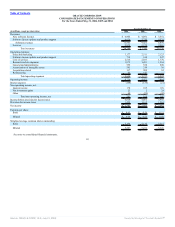

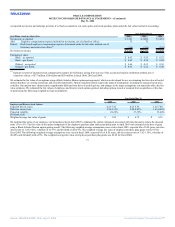

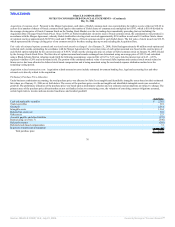

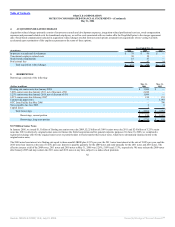

Year Ended May 31,

2006 2005 2004

Employee and Director Stock Options

Expected life (in years) 0.25-7.50 0.25-6.56 1.26-7.00

Risk-free interest rate 3.38-5.11% 2.40-4.05% 1.65-4.09%

Expected volatility 24-28% 27-36% 35-44%

Dividend yield — — —

Weighted average fair value of grants $ 3.89 $ 4.72 $ 4.76

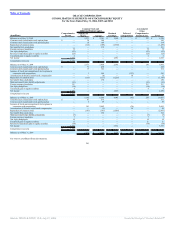

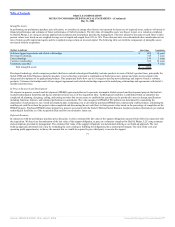

We modified the terms of our employee stock purchase plan in April 2005 to eliminate the option component associated with the plan and to reduce the discount

from 15% to 5%. The fair value of the option component of the employee purchase plan shares purchased prior to April 2005 was estimated at the date of grant

using a Black-Scholes-Merton option-pricing model. The following weighted-average assumptions were used in fiscal 2005: expected life of 0.50 years, risk-free

interest rate of 1.69-2.92%, volatility of 32-37% and dividend yield of 0%. The weighted average fair value of employee purchase plan grants was $2.93 for

fiscal 2005. The following weighted-average assumptions were used in fiscal 2004: expected life of 0.50 years, risk-free interest rate of 1.02-1.10%, volatility of

40-48% and dividend yield of 0%. The weighted average fair value of employee purchase plan grants was $3.04 for fiscal 2004.

73

Source: ORACLE CORP, 10-K, July 21, 2006 Powered by Morningstar® Document Research℠