Oracle 2005 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2005 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

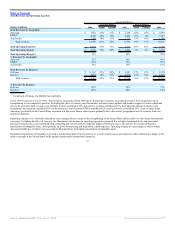

Operating Margins

We continually focus on improving our operating margins by providing our customers with superior products and services as well as improving our cost structure

by hiring personnel in countries where advanced technical expertise is available at lower costs. As part of this effort, we continually evaluate our workforce and

make adjustments where we deem appropriate. When we make adjustments to our workforce, we may incur expenses associated with workforce reductions that

delay the benefit of a more efficient workforce structure, but we believe that the fundamental shift towards globalization is crucial to maintaining a long-term

competitive cost structure.

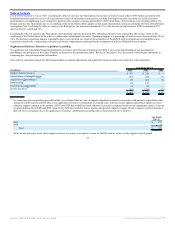

Acquisitions

An active acquisition program is an important element of our corporate strategy. In the last two years, we have paid an aggregate of $19.5 billion for our

acquisitions, which included the following:

• In January 2006, we acquired Siebel, a provider of customer relationship management software for approximately $6.1 billion. We completed the

substantial majority of our planned legal-entity mergers, information system conversions and integration of Siebel’s operations and expect to finalize all

other planned integration activities in the next three months;

• In January 2005, we acquired PeopleSoft, a provider of enterprise application software products for approximately $11.1 billion. We completed our

planned legal-entity mergers, information system conversions and integration of PeopleSoft’s operations in the first half of fiscal 2006.

We believe our recent acquisitions support our long-term strategic direction, strengthen our competitive position, particularly in the applications market, expand

our customer base and provide greater scale to increase our investment in research and development to accelerate innovation, increase stockholder value and

grow our earnings. We expect to continue to acquire companies, products, services and technologies. See Note 2 of Notes to Consolidated Financial Statements

for additional information related to our recent acquisitions.

We believe we can fund additional acquisitions with our internally available cash and marketable securities, cash generated from operations, amounts available

under our commercial paper program, additional borrowings or from the issuance of additional securities. We estimate the financial impact of any potential

acquisition with regard to earnings, operating margin, cash flow and return on invested capital targets before deciding to move forward with an acquisition.

Critical Accounting Policies and Estimates

Our consolidated financial statements are prepared in accordance with U.S. generally accepted accounting principles (GAAP). These accounting principles

require us to make certain estimates, judgments and assumptions. We believe that the estimates, judgments and assumptions upon which we rely are reasonable

based upon information available to us at the time that these estimates, judgments and assumptions are made. These estimates, judgments and assumptions can

affect the reported amounts of assets and liabilities as of the date of the financial statements as well as the reported amounts of revenues and expenses during the

periods presented. To the extent there are material differences between these estimates, judgments or assumptions and actual results, our financial statements will

be affected. The accounting policies that reflect our more significant estimates, judgments and assumptions and which we believe are the most critical to aid in

fully understanding and evaluating our reported financial results include the following:

• Business Combinations

• PeopleSoft Customer Assurance Program

• Goodwill

• Revenue Recognition

24

Source: ORACLE CORP, 10-K, July 21, 2006 Powered by Morningstar® Document Research℠