Oracle 2005 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2005 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2006

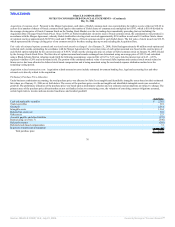

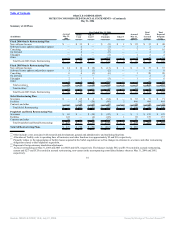

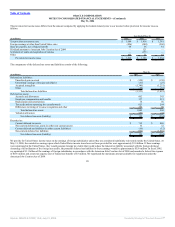

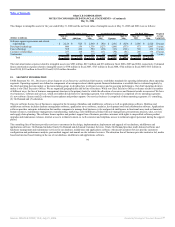

6. DEFERRED REVENUES

Deferred revenues consisted of the following:

May 31,

(in millions) 2006 2005

Software license updates and product support $ 2,501 $ 1,985

Services 246 225

New software licenses 83 79

Deferred revenues, current 2,830 2,289

Deferred revenues, non-current 114 126

Total deferred revenues $ 2,944 $ 2,415

Deferred software license updates and product support revenues represent customer payments made in advance for annual support contracts. Software license

updates and product support are typically billed on a per annum basis in advance and revenue is recognized ratably over the support period. The deferred

software license updates and product support revenues are typically highest at the end of our first fiscal quarter due to the collection of cash from the large

volume of service contracts that are sold or renewed in the fiscal quarter ending in May of each year. Deferred service revenues include prepayments for

consulting, On Demand and education services. Revenue for these services is recognized as the services are performed. Deferred new software license revenues

typically result from undelivered products or specified enhancements, customer specific acceptance provisions or software license transactions that are not

segmentable from consulting services. Deferred revenues, non-current are comprised primarily of deferred software license updates and product support

revenues.

In connection with purchase price allocations related to our acquisitions in fiscal 2006 and fiscal 2005, we have estimated the fair values of the support

obligations assumed. The estimated fair values of the support obligations assumed were determined using a cost-build up approach. The cost-build up approach

determines fair value by estimating the costs relating to fulfilling the obligations plus a normal profit margin. The sum of the costs and operating profit

approximates, in theory, the amount that we would be required to pay a third party to assume the support obligations. Over the past two years, we recorded

adjustments to reduce the carrying values of the deferred software license updates and product support revenues assumed by $640 million to $426 million, which

represents our estimate of the fair value of the support obligations assumed. In addition, we recorded a fair value adjustment of $208 million in other current

assets related to support contracts assumed for which the underlying service period had not yet started and for which cash had not been received. These fair value

adjustments reduce the revenues recognized over the support contract term of our acquired contracts and, as a result, we did not recognize software license

updates and product support revenues related to support contracts assumed in business acquisitions in the amount of $391 million and $320 million, which would

have been otherwise recorded by the acquired entities, in fiscal 2006 and 2005 respectively.

84

Source: ORACLE CORP, 10-K, July 21, 2006 Powered by Morningstar® Document Research℠