Oracle 2005 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2005 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2006

Advertising

All advertising costs are expensed as incurred. Advertising expenses, which are included within sales and marketing expenses, were $106 million, $67 million

and $68 million in fiscal 2006, 2005 and 2004, respectively.

Research and Development

All research and development costs are expensed as incurred. Costs eligible for capitalization under FASB Statement No. 86, Accounting for the Costs of

Computer Software to Be Sold, Leased, or Otherwise Marketed, were not material to our consolidated financial statements.

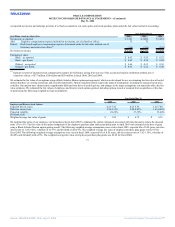

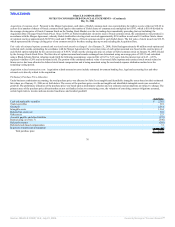

Non-Operating Income, net

Non-operating income, net consists primarily of interest income, net foreign currency exchange gains (losses), net investment gains related to marketable equity

securities and other investments, equity in earnings of i-flex and the minority interest share in the net profits of Oracle Japan.

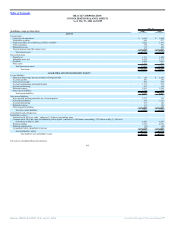

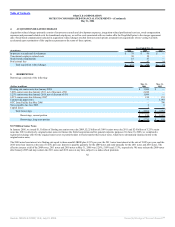

Year Ended May 31,

(in millions) 2006 2005 2004

Interest income $ 170 $ 185 $ 118

Foreign currency gains (losses) 39 (14) (13)

Net investment gains related to marketable equity securities and other investments 25 2 29

Equity in earnings 14 — —

Minority interest (41) (42) (37)

Other 36 33 5

Total non-operating income, net $ 243 $ 164 $ 102

Income Taxes

We account for income taxes in accordance with FASB Statement No. 109, Accounting for Income Taxes. Deferred income taxes are recorded for the expected

tax consequences of temporary differences between the tax bases of assets and liabilities for financial reporting purposes and amounts recognized for income tax

purposes. We record a valuation allowance to reduce our deferred tax assets to the amount of future tax benefit that is more likely than not to be realized.

New Accounting Pronouncements

Share-Based Payment: On December 16, 2004, the FASB issued Statement No. 123 (revised 2004), Share-Based Payment, which is a revision of Statement 123.

Statement 123(R) supersedes Opinion 25, and amends FASB Statement No. 95, Statement of Cash Flows. Generally, the approach in Statement 123(R) is similar

to the approach described in Statement 123. However, Statement 123(R) generally requires share-based payments to employees, including grants of employee

stock options and purchases under employee stock purchase plans, to be recognized in the statement of operations based on their fair values. Pro forma disclosure

of fair value recognition is no longer an alternative.

On April 14, 2005, the Securities and Exchange Commission announced that the Statement 123(R) effective transition date would be extended to annual periods

beginning after June 15, 2005. We adopted the provisions of Statement 123(R) under the modified prospective method in our first quarter of fiscal 2007. Under

the modified prospective method, compensation cost is recognized beginning with the effective date of adoption (a) based on the requirements of Statement

123(R) for all share-based payments granted after the effective date of adoption and (b) based on the requirements of Statement 123 for all awards granted to

employees prior to the effective date of adoption that remain unvested on the date of adoption.

74

Source: ORACLE CORP, 10-K, July 21, 2006 Powered by Morningstar® Document Research℠