Oracle 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Fiscal 2005 Compared to Fiscal 2004: We generated cash flow from financing activities in fiscal 2005 as a result of net borrowings of $2.7 billion primarily

used to pay for the acquisition of PeopleSoft. In the third quarter of fiscal 2005, we borrowed $9.2 billion under a bridge loan to fund the acquisition of

PeopleSoft and repaid the entire balance as of May 31, 2005 with cash flows from operations, proceeds from maturities and sale of marketable securities, the

repatriation of foreign earnings and new borrowings. We borrowed $2.0 billion under a $3.0 billion commercial paper program and $700 million under a 364-day

loan facility through a wholly-owned subsidiary in the fourth quarter of fiscal 2005.

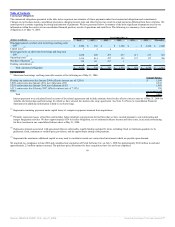

Free cash flow: To supplement our statements of cash flows presented on a GAAP basis, we use non-GAAP measures of cash flows on a trailing 4-quarter basis

to analyze cash flow generated from operations. We believe free cash flow is also useful as one of the bases for comparing our performance with our competitors.

The presentation of non-GAAP free cash flow is not meant to be considered in isolation or as an alternative to net income as an indicator of our performance, or

as an alternative to cash flows from operating activities as a measure of liquidity. We calculate free cash flows as follows:

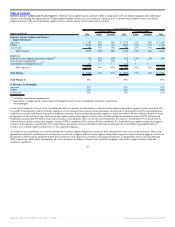

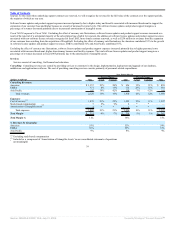

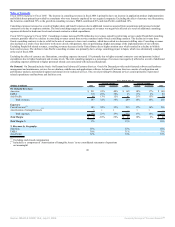

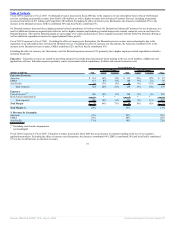

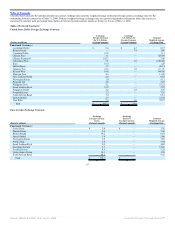

Year Ended May 31,

(Dollars in millions) 2006 Change 2005 Change 2004

Cash provided by operating activities $ 4,541 28% $ 3,552 11% $ 3,195

Capital expenditures(1)

$ (236) 26% $ (188) -1% $ (189)

Free cash flow $ 4,305 28% $ 3,364 12% $ 3,006

Net income $ 3,381 17% $ 2,886 8% $ 2,681

Free cash flow as a percent of net income 127% 117% 112%

(1) Represents capital expenditures as reported in cash flows from investing activities in our consolidated statements of cash flows presented in accordance with

U.S. generally accepted accounting principles.

Long-Term Customer Financing

We offer our customers the option to acquire our software and services through separate long-term payment contracts. We generally sell such contracts on a

non-recourse basis to financial institutions. We record the transfers of amounts due from customers to financial institutions as sales of financial assets because we

are considered to have surrendered control of these financial assets. In fiscal 2006, 2005 and 2004, $618 million, $456 million and $357 million or approximately

13%, 11% and 10%, respectively, of our new software license revenues were financed through our financing division.

48

Source: ORACLE CORP, 10-K, July 21, 2006 Powered by Morningstar® Document Research℠