Oracle 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

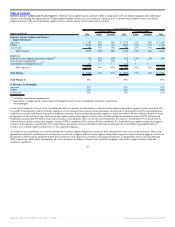

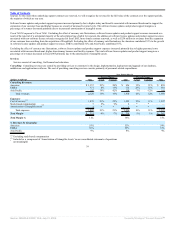

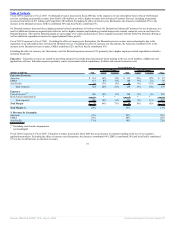

Fiscal 2005 Compared to Fiscal 2004: Provision for income taxes decreased due to a lower effective tax rate, partially offset by higher earnings before tax. The

decrease in our effective tax rate in fiscal 2005 is primarily attributable to higher earnings in low tax rate jurisdictions. In addition, the fiscal 2005 effective tax

rate was favorably impacted by 4.2% due to the settlement of audits and expiration of statutes of limitation on assessments and the true-up of estimated tax

accruals upon filing of prior year tax returns. Partially reducing this benefit was an increase to our effective tax rate of 3.6% in fiscal 2005 for the dividend

pursuant to the American Jobs Creation Act of 2004 as well as acquisition and restructuring costs related to non-deductible expenses resulting from in-process

research and development charges and additional taxes associated with tender offer costs incurred from June 9, 2003 to December 12, 2004 for PeopleSoft that,

upon acquisition in the third quarter of fiscal 2005, had to be capitalized into the basis of the stock for tax purposes.

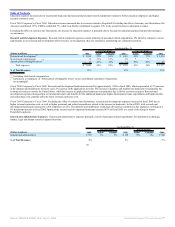

We provide for United States income taxes on the earnings of foreign subsidiaries unless they are considered indefinitely reinvested outside the United States. At

May 31, 2006, the cumulative earnings upon which United States income taxes have not been provided for were approximately $3.0 billion. If these earnings

were repatriated in the United States, they would generate foreign tax credits that would reduce the federal tax liability associated with the foreign dividend.

Assuming a full utilization of the foreign tax credits, the potential deferred tax liability for these earnings would be approximately $550 million. In fiscal 2005,

we repatriated $3.1 billion of the earnings of foreign subsidiaries in accordance with the American Jobs Creation Act of 2004 and recorded a federal tax expense

of $118 million and a state tax expense (net of federal tax benefit) of $3 million. We repatriated the maximum amount available for repatriation under the

American Jobs Creation Act of 2004.

This distribution from previously indefinitely reinvested earnings does not change our position going forward that future earnings of certain of our foreign

subsidiaries will be indefinitely reinvested.

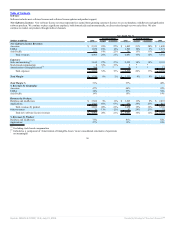

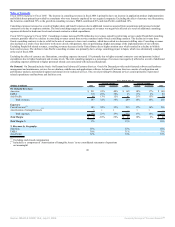

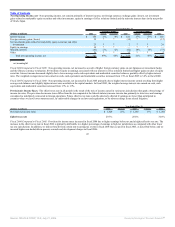

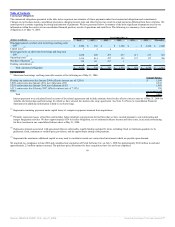

Liquidity and Capital Resources

May 31,

(Dollars in millions) 2006 Change 2005 Change 2004

Working capital $ 5,044 1,210% $ 385 -95% $ 7,064

Cash, cash equivalents and marketable securities $ 7,605 59% $ 4,771 -44% $ 8,587

Working capital: The increase in working capital in fiscal 2006 is primarily due to the $5.75 billion long-term senior notes issued in January 2006 as well as

greater cash flows from operations from higher sales volumes, partially offset by cash used to pay for acquisitions and to reduce other debt obligations. The

decline in working capital in fiscal 2005 is primarily due to cash paid to acquire PeopleSoft and an increase in short-term borrowings.

Cash, cash equivalents and marketable securities: Cash and cash equivalents consist of highly liquid investments in time deposits held at major banks,

commercial paper, United States government agency discount notes, money market mutual funds and other money market securities with original maturities of

90 days or less. Marketable securities primarily consist of commercial paper, corporate notes and Unites States government agency notes. Cash, cash equivalents

and marketable securities include $3.1 billion held by our foreign subsidiaries as of May 31, 2006. The increase in cash, cash equivalents and marketable

securities is due to the $5.75 billion senior notes issued in January 2006, cash flows from operations from higher sales volumes and the collection of trade

receivables, partially offset by cash used to pay for acquisitions, repurchase common stock and to reduce other debt obligations.

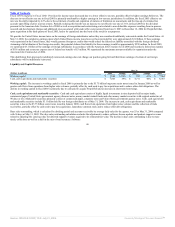

Days sales outstanding, which is calculated by dividing period end accounts receivable by average daily sales for the quarter, was 55 at May 31, 2006 compared

with 56 days at May 31, 2005. The days sales outstanding calculation excludes the adjustment to reduce software license updates and product support revenue

related to adjusting the carrying value for deferred support revenues acquired to its estimated fair value. The decline in days sales outstanding is due to more

timely collections as well as a shift in the mix of total revenues. Software

46

Source: ORACLE CORP, 10-K, July 21, 2006 Powered by Morningstar® Document Research℠