Oracle 2005 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2005 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2006

Fiscal 2005 Acquisitions

PeopleSoft, Inc.

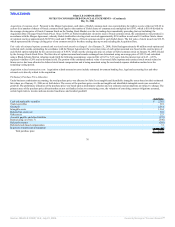

We acquired approximately 75% and 97% of the outstanding common stock of PeopleSoft, Inc. for $26.50 per share in cash as of December 29, 2004 and

January 6, 2005, respectively. On January 7, 2005, we completed the merger of our wholly-owned subsidiary with and into PeopleSoft and converted each

remaining outstanding share of PeopleSoft common stock not tendered, into a right to receive $26.50 per share in cash, without interest.

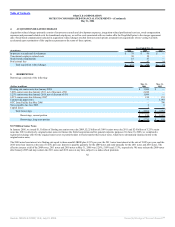

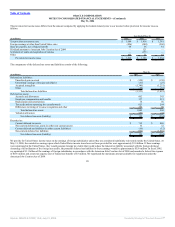

The total purchase price was $11.1 billion, which consisted of $10,576 million in cash paid to acquire the outstanding common stock of PeopleSoft, $492 million

for the fair value of options assumed and $12 million in cash for transaction costs. In allocating the purchase price based on estimated fair values, we recorded

approximately $6,318 million of goodwill, $3,384 million of identifiable intangible assets, $1,345 million of net tangible assets and $33 million of in-process

research and development. The allocation of goodwill decreased by $169 million in fiscal 2006 as a result of changes in our deferred taxes associated with

intangibles acquired, partially offset by liabilities recorded for certain pre-merger contingencies which were deemed to be probable and could be reasonably

estimated.

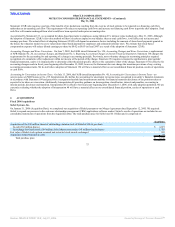

Retek Inc.

We purchased 5.5 million shares of common stock of Retek Inc., a Delaware Corporation, on March 7 and 8, 2005, through ordinary brokerage transactions at

prevailing market prices for a weighted-average price of $8.82 per share. In April and May 2005, we acquired the remaining outstanding common stock of Retek

for $11.25 per share, or $584 million.

The total purchase price was $701 million, comprised of $633 million of cash paid to acquire the outstanding common stock of Retek, $32 million of cash paid

for outstanding stock options and $36 million of acquisition related transaction costs. In allocating the purchase price based on estimated fair values, we recorded

approximately $416 million of goodwill, $133 million of identifiable intangible assets, $145 million of net tangible assets and $7 million of in-process research

and development.

Unaudited Pro Forma Financial Information

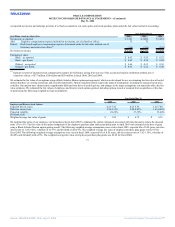

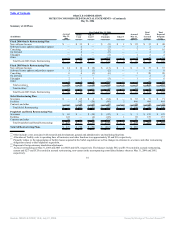

The unaudited financial information in the table below summarizes the combined results of operations of Oracle, PeopleSoft and Siebel, on a pro forma basis, as

though the companies had been combined as of the beginning of each of the periods presented. Pro forma financial information for our other acquisitions have

not been presented, as the effects were not material to our historical consolidated financial statements either individually or in aggregate. The pro forma financial

information is presented for informational purposes only and is not indicative of the results of operations that would have been achieved if the acquisitions and

$5.75 billion senior notes issued (see Note 5) had taken place at the beginning of each of the periods presented. The pro forma financial information for all

periods presented also includes the business combination accounting effect on historical PeopleSoft and Siebel support revenues, the charge for IPR&D,

amortization charges from acquired intangible assets, stock-based compensation charges for unvested options assumed, Oracle restructuring costs, adjustments to

interest expense and related tax effects.

The unaudited pro forma financial information for the year ended May 31, 2006 combines the historical results of Oracle for year ended May 31, 2006 and, due

to differences in our reporting periods, the historical results of Siebel for the eight months ended December 31, 2005. The unaudited pro forma financial

information for the year ended May 31, 2005 combines the historical results for Oracle, with the historical results of Siebel for the year ended December 31, 2004

and the historical results of PeopleSoft for the seven months ended December 28, 2004.

79

Source: ORACLE CORP, 10-K, July 21, 2006 Powered by Morningstar® Document Research℠