Oracle 2005 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2005 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

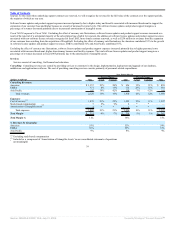

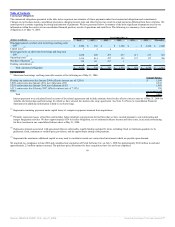

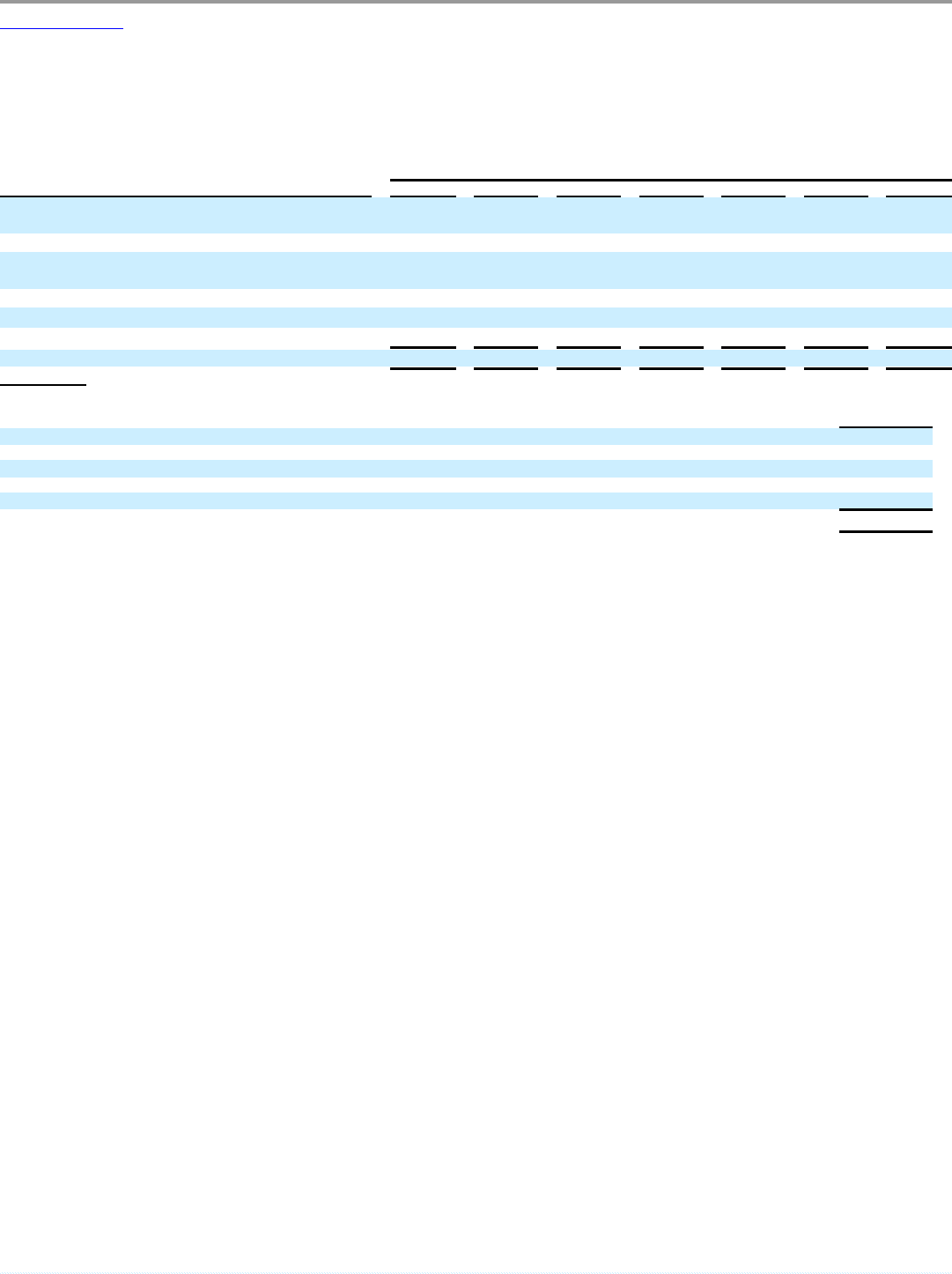

Contractual Obligations

The contractual obligations presented in the table below represent our estimates of future payments under fixed contractual obligations and commitments.

Changes in our business needs, cancellation provisions, changing interest rates and other factors may result in actual payments differing from these estimates. We

cannot provide certainty regarding the timing and amounts of payments. We have presented below a summary of the most significant assumptions used in our

information within the context of our consolidated financial position, results of operations and cash flows. The following is a summary of our contractual

obligations as of May 31, 2006:

Year Ending May 31,

(Dollars in millions) Total 2007 2008 2009 2010 2011 Thereafter

Principal payments on short-term borrowings and long-term

debt(1)

$ 5,906 $ 156 $ — $ 1,500 $ — $ 2,250 $ 2,000

Capital leases(2)

7 3 4 — — — —

Interest payments on short-term borrowings and long-term

debt(1)

1,838 305 297 277 217 217 525

Operating leases(3)

1,416 414 227 195 157 117 306

Purchase obligations(4)

329 111 217 1

Funding commitments(5)

6 6 — — — — —

Total contractual obligations $ 9,502 $ 995 $ 745 $ 1,973 $ 374 $ 2,584 $ 2,831

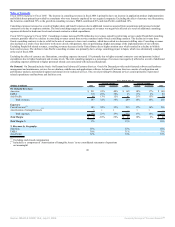

(1) Short-term borrowings and long-term debt consists of the following as of May 31, 2006:

Principal Balance

Floating rate senior notes due January 2009 (effective interest rate of 5.28%) $ 1,500

5.00% senior notes due January 2011, net of discount of $8 2,242

5.25% senior notes due January 2016, net of discount of $11 1,989

6.91% senior notes due February 2007 (effective interest rate of 7.30%) 150

Other 6

Total $ 5,887

Interest payments were calculated based on terms of the related agreements and include estimates based on the effective interest rates as of May 31, 2006 for

variable rate borrowings and borrowings for which we have entered into interest-rate swap agreements. See Note 5 of Notes to Consolidated Financial

Statements for additional information related to our borrowings.

(2) Represents remaining payments under capital leases of computer equipment assumed from acquisitions.

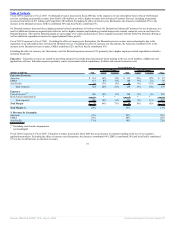

(3) Primarily represents leases of facilities and includes future minimum rent payments for facilities that we have vacated pursuant to our restructuring and

merger integration activities. We have approximately $559 in facility obligations, net of estimated sublease income and other costs, in accrued restructuring

for these locations in our consolidated balance sheet at May 31, 2006.

(4) Represents amounts associated with agreements that are enforceable, legally binding and specify terms, including: fixed or minimum quantities to be

purchased; fixed, minimum or variable price provisions; and the approximate timing of the payment.

(5) Represents the maximum additional capital we may need to contribute toward our venture fund investments which are payable upon demand.

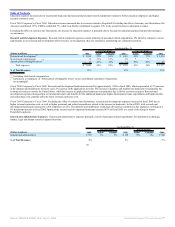

We acquired two companies in June 2006 and completed our acquisition of Portal Software, Inc. on July 3, 2006 for approximately $340 million in cash and

approximately 2.5 million options assumed. The purchase price allocations for these acquisitions have not yet been completed.

49

Source: ORACLE CORP, 10-K, July 21, 2006 Powered by Morningstar® Document Research℠