Oracle 2005 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2005 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2006

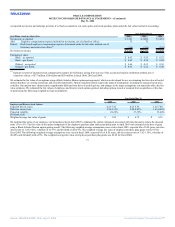

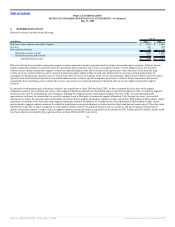

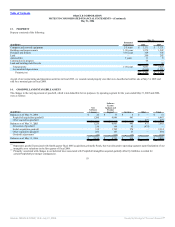

$150 Million Senior Notes

We have $150 million in 6.91% senior notes due in February 2007. In February 2002, we entered into an interest-rate swap agreement that has the economic

effect of modifying the interest obligations associated with these senior notes so that the interest payable on the senior notes effectively becomes variable based

on the three-month LIBOR set quarterly until maturity. Our interest rate swap increased the effective interest rate on the senior notes to 7.30% as of May 31,

2006. The fair value of the interest rate swap was $(0.7) million at May 31, 2006 and $3.1 million at May 31, 2005.

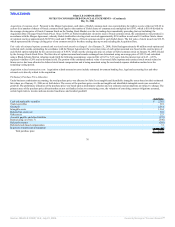

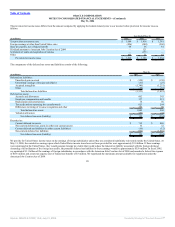

Short-Term Borrowings

In February 2006, we entered into dealer agreements with various financial institutions and an Issuing and Paying Agency Agreement with JPMorgan Chase

Bank, National Association, relating to a new $3.0 billion commercial paper program (the New CP Program). Under the New CP Program, we may issue and sell

unsecured short-term promissory notes pursuant to a private placement exemption from the registration requirements under federal and state securities laws. The

New CP Program replaces the $3.0 billion commercial paper program of Old Oracle which was established in April 2005 and was terminated in February 2006

(the Old CP Program). We did not have any outstanding borrowings under the New CP Program at May 31, 2006.

In May 2005, Oracle Technology Company (OTC), a wholly-owned subsidiary, entered into an unsecured $700 million loan facility (OTC Loan Facility) with

ABN AMRO Bank N.V. guaranteed by us. All amounts under the OTC Loan Facility were repaid as of May 31, 2006.

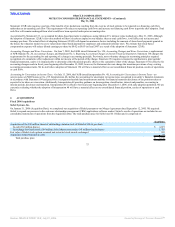

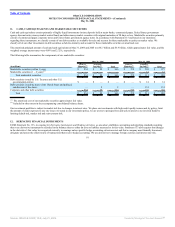

5-Year Revolving Credit Agreement

In March 2006, we entered into a new $3.0 billion, 5-Year Revolving Credit Agreement (New Credit Agreement) with Wachovia Bank, National Association,

Bank of America, N.A. and certain other lenders. The New Credit Agreement replaces the $3.0 billion 364-day Revolving Credit Agreement dated as of

March 18, 2005 (Old Credit Agreement), which otherwise would have expired on March 17, 2006. The New Credit Agreement provides for an unsecured

revolving credit facility which can be used to backstop any commercial paper that we may issue and for working capital and other general corporate purposes.

Subject to certain conditions stated in the New Credit Agreement, we may borrow, prepay and re-borrow amounts under the facility at any time during the term

of the New Credit Agreement. All amounts under the New Credit Agreement are due on March 14, 2011. Interest is based on either (a) a LIBOR-based formula

or (b) a formula based on Wachovia’s prime rate or on the federal funds effective rate.

The New Credit Agreement also provides that (i) standby letters of credit may be issued on behalf of Oracle up to $500 million; and (ii) any amounts borrowed

and letters of credit issued may be in Japanese Yen, Pounds Sterling and Euros up to $1.5 billion. We may also, upon the agreement of either then existing

lenders or of additional banks not currently party to the New Credit Agreement, increase the commitments under this facility up to $5.0 billion. The New Credit

Agreement contains certain customary representations and warranties, covenants and events of default, including the requirement that the total net debt to total

capitalization ratio of Oracle not exceed 45%. We have not borrowed any funds under the New Credit Agreement.

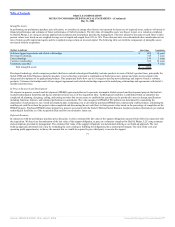

We were in compliance with all debt-related covenants at May 31, 2006, including the requirement under the New Credit Agreement that our total net debt to

total capitalization ratio not exceed 45%. Future principal payments of our borrowings at May 31, 2006 are as follows: $159 million in fiscal 2007, $4 million in

fiscal 2008, $1.5 billion in fiscal 2009, $2.25 billion in fiscal 2011 and $2.0 billion in fiscal 2016.

83

Source: ORACLE CORP, 10-K, July 21, 2006 Powered by Morningstar® Document Research℠