Oracle 2005 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2005 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2006

Statement 123(R) also requires a portion of the benefits of tax deductions resulting from the exercise of stock options to be reported as a financing cash flow,

rather than as an operating cash flow. This requirement will reduce net operating cash flows and increase net financing cash flows in periods after adoption. Total

cash flow will remain unchanged from what would have been reported under prior accounting rules.

As permitted by Statement 123, we accounted for share-based payments to employees using Opinion 25’s intrinsic value method up to May 31, 2006. Although

the adoption of Statement 123(R)’s fair value method will have no adverse impact on our balance sheet or total cash flows, it will affect our net income and

earnings per share. The actual effects of adopting Statement 123(R) will depend on numerous factors including the amounts of share-based payments granted in

the future, the valuation model we use to value future share-based payments to employees and estimated forfeiture rates. We estimate that stock-based

compensation expense will reduce diluted earnings per share by $0.02 to $0.03 in fiscal 2007 as a result of the adoption of Statement 123(R).

Accounting Changes and Error Corrections: On June 7, 2005, the FASB issued Statement No. 154, Accounting Changes and Error Corrections, a replacement

of APB Opinion No. 20, Accounting Changes, and Statement No. 3, Reporting Accounting Changes in Interim Financial Statements. Statement 154 changes the

requirements for the accounting for and reporting of a change in accounting principle. Previously, most voluntary changes in accounting principles required

recognition of a cumulative effect adjustment within net income of the period of the change. Statement 154 requires retrospective application to prior periods’

financial statements, unless it is impracticable to determine either the period-specific effects or the cumulative effect of the change. Statement 154 is effective for

accounting changes made in fiscal years beginning after December 15, 2005; however, the Statement does not change the transition provisions of any existing

accounting pronouncements. We do not believe adoption of Statement 154 will have a material effect on our consolidated financial position, results of operations

or cash flows.

Accounting for Uncertainty in Income Taxes: On July 13, 2006, the FASB issued Interpretation No. 48, Accounting for Uncertainty in Income Taxes—an

interpretation of FASB Statement No. 109. Interpretation 48 clarifies the accounting for uncertainty in income taxes recognized in an entity’s financial statements

in accordance with Statement 109 and prescribes a recognition threshold and measurement attribute for financial statement disclosure of tax positions taken or

expected to be taken on a tax return. Additionally, Interpretation 48 provides guidance on derecognition, classification, interest and penalties, accounting in

interim periods, disclosure and transition. Interpretation 48 is effective for fiscal years beginning after December 15, 2006, with early adoption permitted. We are

currently evaluating whether the adoption of Interpretation 48 will have a material effect on our consolidated financial position, results of operations or cash

flows.

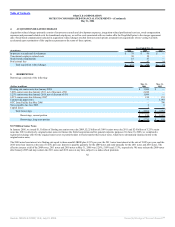

2. ACQUISITIONS

Fiscal 2006 Acquisitions

Siebel Systems, Inc.

On January 31, 2006 (Acquisition Date), we completed our acquisition of Siebel pursuant to our Merger Agreement dated September 12, 2005. We acquired

Siebel to expand our presence in the customer relationship management (CRM) applications software market. Siebel’s results of operations are included in our

consolidated statements of operations from the Acquisition Date. The total purchase price for Siebel was $6.1 billion and is comprised of:

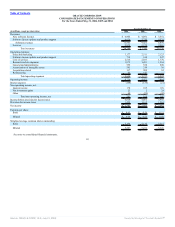

(in millions)

Acquisition of the 546 million shares of outstanding common stock of Siebel at $10.66 per share:

In cash (382 million shares) $ 4,073

In exchange for Oracle stock (164 million Siebel shares converted to 141 million Oracle shares) 1,763

Fair value of Siebel stock options assumed and restricted stock awards exchanged 245

Acquisition related transaction costs 49

Total purchase price $ 6,130

75

Source: ORACLE CORP, 10-K, July 21, 2006 Powered by Morningstar® Document Research℠