Oracle 2005 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2005 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is traded on the NASDAQ Global Select Market under the symbol “ORCL” and has been traded on NASDAQ since our initial public offering

in 1986. According to the records of our transfer agent, we had 23,121 stockholders of record as of May 31, 2006. The majority of our shares are held in

approximately 1.3 million customer accounts held by brokers and other institutions on behalf of stockholders. However, we believe that the number of total

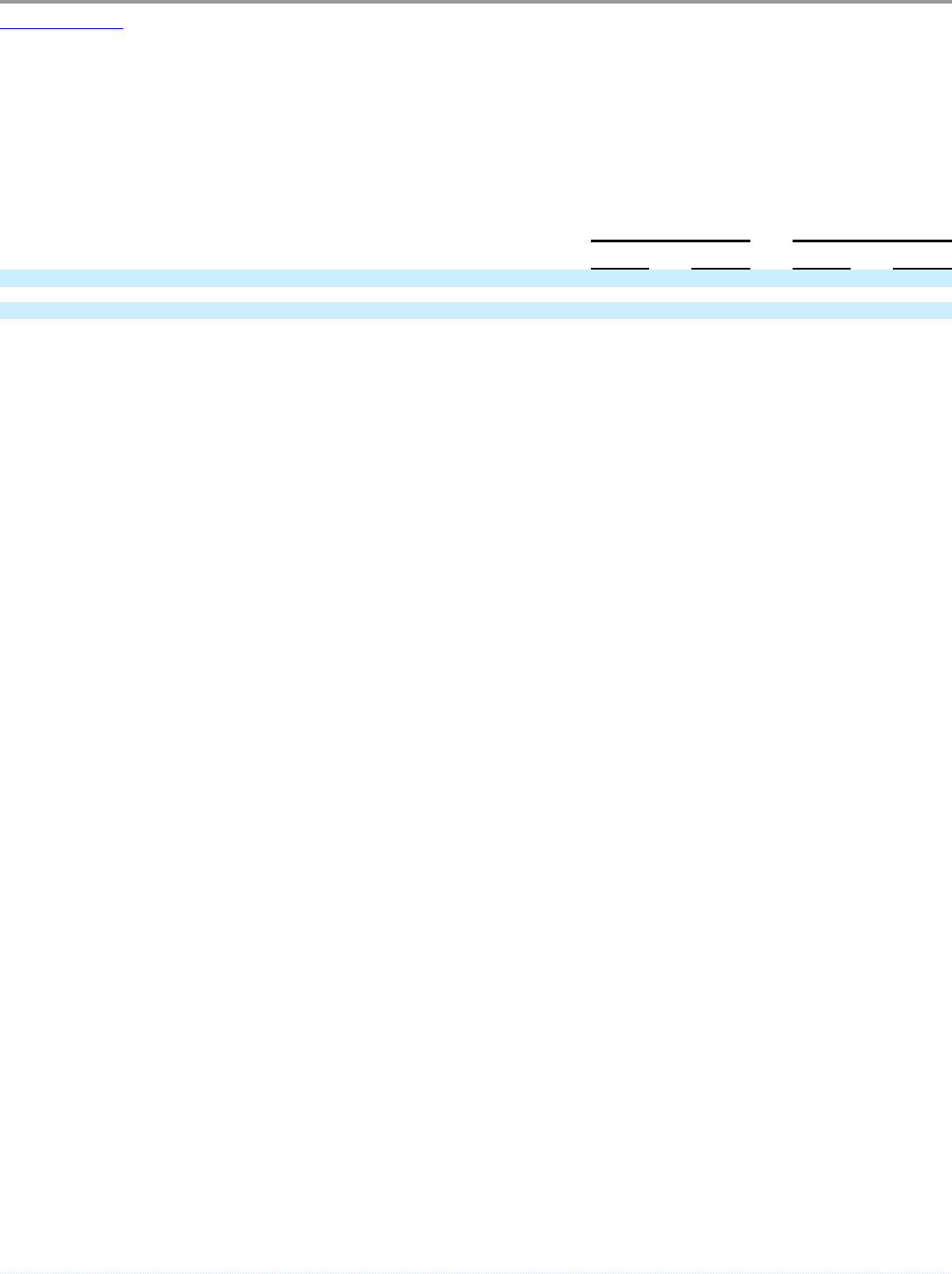

stockholders is less than 1.3 million due to stockholders with accounts at more than one brokerage. The following table sets forth the low and high sale price of

our common stock, based on the last daily sale, in each of our last eight fiscal quarters.

Fiscal 2006 Fiscal 2005

Low Sale

Price

High Sale

Price

Low Sale

Price

High Sale

Price

Fourth Quarter $ 12.42 $ 14.93 $ 11.52 $ 13.62

Third Quarter 12.18 13.12 12.66 14.63

Second Quarter 11.98 13.64 9.86 13.39

First Quarter 12.34 14.05 9.90 11.93

Our policy has been to reinvest earnings to fund future growth, acquisitions and to repurchase our common stock pursuant to a program approved by our Board

of Directors. Accordingly, we have not paid cash dividends and do not anticipate declaring cash dividends on our common stock in the foreseeable future,

although our Board of Directors regularly reviews this matter.

In the fourth quarter of fiscal 2006, we sold an aggregate of 11,716 shares of our common stock to eligible employees of Oracle EMEA Limited, an indirect

subsidiary of the Company, who are participants in the Oracle Ireland Approved Profit Sharing Scheme (the Ireland APSS) at an aggregate purchase price of

approximately $175,000. We purchased the shares in the open market at the same price the shares were sold to the Ireland APSS participants and paid customary

brokerage commissions of approximately $1,300 in connection with the purchase. There were no underwriting discounts or commissions in connection with the

sale. The Ireland APSS permits an eligible employee to receive shares of common stock in a tax efficient manner as a portion of such employee’s bonus, as well

as to contribute a portion of their base salary allowance towards the purchase of additional shares in certain circumstances. The securities are held in trust for the

employees for a minimum of two years. The shares of common stock were offered and sold in reliance upon Section 4(2) of the Securities Act of 1933, as

amended, and the safe harbor provided by Rule 903 of Regulation S under the Securities Act, to employees of Oracle EMEA Limited who are not “U.S. Persons”

as that term is defined in Regulation S.

Stock Repurchase Programs

In 1992, our Board of Directors approved a program to repurchase shares of our common stock to reduce the dilutive effect of our stock option and stock

purchase plans. The Board has expanded the repurchase program several times by either increasing the authorized number of shares to be repurchased or by

authorizing a fixed dollar amount expansion. From the inception of the stock repurchase program to May 31, 2006, a total of 1.8 billion shares have been

repurchased for approximately $20.7 billion. We did not repurchase any shares under this program in our fourth quarter of fiscal 2006. At May 31, 2006,

approximately $1.6 billion was available to repurchase shares of our common stock pursuant to the stock repurchase program. On June 22, 2006, we announced

that we intend to repurchase $1.0 billion of our common stock a quarter in fiscal 2007 and such repurchases may occur through the use of Rule 10b5-1 trading

plans. In July 2006, the Board expanded the program such that $4.0 billion is available for repurchase under the program.

On January 31, 2006, we announced our plan to repurchase common stock equivalent to the amount of common stock issued in connection with the Siebel

acquisition. Our Board of Directors approved a separate program (Siebel Program) to repurchase 140,720,666 shares of our common stock, which is equivalent

to the amount of common stock issued to former Siebel stockholders as of January 31, 2006. We repurchased 122,752,536 shares

20

Source: ORACLE CORP, 10-K, July 21, 2006 Powered by Morningstar® Document Research℠