Neiman Marcus 2010 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

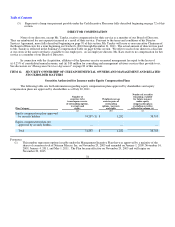

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

Our Board of Directors has adopted a written related-person transactions policy that sets forth our policies and procedures

regarding the identification, review, consideration and approval or ratification of "related-person transactions." For purposes of our

policy only, a "related-person transaction " is any transaction, including any financial transaction, arrangement or relationship (or any

series of similar transactions, arrangements or relationships), in which we and any "related person" are, were or will be participants

involving an amount that exceeds $120,000. Certain transactions, including transactions involving compensation for services

provided to us as an employee, director or consultant by a related person and transactions in which rates or charges are determined by

competitive bid, are not covered by this policy. A related person is any executive officer, director or nominee for director, or more

than 5% stockholder of our company, including any of their immediate family members, and any entity owned or controlled by such

persons.

The Board of Directors has determined that the Company's Audit Committee is best suited to review and approve any related-

person transaction and any material amendments thereto, although the Board of Directors may instead determine that a particular

transaction (or amendment thereto) should be reviewed and approved by a majority of directors disinterested from the transaction. In

the event a member of the Audit Committee has an interest in the proposed transaction, the relevant member must recuse himself or

herself from the deliberations and approval. The policy requires that, in determining whether to approve, ratify or reject a related-

person transaction, the Audit Committee satisfy itself that it has been fully informed as to the related person's relationship and interest

in the transaction (or amendment thereto) and the material facts thereof, and must determine, in light of known circumstances, whether

the transaction is, or is not, consistent with the best interests of our company and our Sponsors, as the Audit Committee determines in

the good faith exercise of its discretion.

Typically, in considering related-person transactions, the Audit Committee takes into account the relevant available facts and

circumstances including, but not limited to (a) the risks, costs and benefits to us, (b) the terms of the transaction, (c) the availability of

other sources for comparable services or products and (d) the terms available to or from, as the case may be, unrelated third parties or

to or from employees generally.

Related Person Transactions

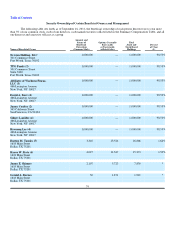

Newton Holding, LLC Limited Liability Company Operating Agreement

The investment funds associated with or designated by a Sponsor (Sponsor Funds) and certain investors who agreed to co-

invest with the Sponsor Funds or through a vehicle jointly controlled by the Sponsors to provide equity financing for the Acquisition

(Co-Investors), entered into a limited liability company operating agreement in respect of our parent company, Newton Holding, LLC

(the "LLC Agreement"). The LLC Agreement contains agreements among the parties with respect to the election of our directors and

the directors of our parent companies, restrictions on the issuance or transfer of interests in us, including tag-along rights and drag-

along rights, and other corporate governance provisions (including the right to approve various corporate actions).

Pursuant to the LLC Agreement, each of the Sponsors has the right, which is freely assignable to other members or indirect

members, to nominate four directors, and the Sponsors are entitled to jointly nominate additional directors. The rights of the Sponsors

to nominate directors are subject to their ownership percentages in Newton Holding, LLC remaining above a specified percentage of

their initial ownership percentage. Each of the Sponsors has the right to have at least one of its directors sit on each committee of the

Board of Directors, to the extent permitted by applicable laws and regulations.

The Sponsors have assigned the right to appoint one of our directors to investment funds that are affiliates of Credit Suisse

Securities (USA) LLC and the right to appoint one of our directors to investment funds associated with Leonard Green Partners.

For purposes of any action of the board of directors, each director nominated by a Sponsor has three votes and each of the

other directors (including any jointly nominated directors and the directors nominated by investment funds that are affiliates of Credit

Suisse Securities (USA) LLC and Leonard Green Partners) has one vote. Certain major decisions of the board of directors of Newton

Holding, LLC require the approval of each of the Sponsors and certain other decisions of the board of directors of Newton Holding,

LLC require the approval of a specified number of directors designated by each of the Sponsors, in each case subject to the

requirement that their respective ownership percentage in Newton Holding, LLC remains above a specified percentage of their initial

ownership percentage.

82