Neiman Marcus 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

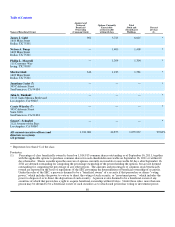

the Company and its business. The non-competition agreement generally prohibits Ms. Katz during employment and for a period of

one year after termination from becoming a director, officer, employee or consultant for any competing business that owns or operates

a luxury specialty retail store located in the geographic areas of the Company's operations. The agreement also requires that she

disclose and assign to the Company any trademarks or inventions developed by her which relate to her employment by the Company

or to the Company's business.

Effective December 31, 2010, Ms. Katz's employment agreement was amended with respect to reimbursement for hotel or

other lodging expenses while on business trips to New York. Under the amendment, Ms. Katz will receive a lump sum cash payment

during each year of the employment term in the amount of $15,000 in lieu of any reimbursement of hotel or other lodging expenses

incurred in connection with business trips to New York, plus an amount necessary to gross-up such payment for income tax purposes.

The amendment also provides for reimbursement of liability for any New York state and city taxes, on an after-tax basis.

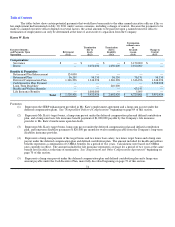

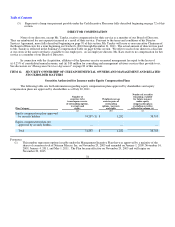

Employment Agreements with Mr. Skinner and Mr. Gold

On July 22, 2010, the Company entered into new employment agreements with James E. Skinner, Executive Vice President

and Chief Financial Officer, and James J. Gold, President and Chief Executive Officer of Bergdorf Goodman, Inc., the terms of which

became effective on October 6, 2010. Each of the employment agreements is for a four-year term with automatic extensions of one

year unless either party provides three months' written notice of non-renewal. The agreement with Mr. Skinner provides that he will

act as Executive Vice President, Chief Operating Officer and Chief Financial Officer of The Neiman Marcus Group, Inc. for a

beginning annual base salary of $700,000 and participation in an annual incentive program with a target bonus opportunity of 75% of

annual base salary and a maximum bonus of 150% of annual base salary. In addition, as part of the agreement, effective

September 30, 2010, he received a non-qualified stock option grant under the Management Equity Incentive Plan with respect to 2,200

shares of common stock of the Company with an exercise price equal to the fair market value of the common stock at the time of

grant. The stock option will expire no later than the seventh anniversary of the grant date.

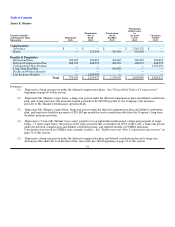

The agreement with Mr. Gold provides that he will act as President, Specialty Retail of The Neiman Marcus Group, Inc. for a

beginning annual base salary of $750,000 and participation in an annual incentive program with a target bonus opportunity of 75% of

annual base salary and a maximum bonus of 150% of annual base salary. In addition, as part of the agreement, effective

September 30, 2010, he received a non-qualified stock option grant under the Management Equity Incentive Plan with respect to 2,200

shares of common stock of the Company with an exercise price equal to the fair market value of the common stock on the date of

grant. The stock option will expire no later than the seventh anniversary of the grant date.

The employment agreements may be terminated by either party. In certain termination circumstances, Mr. Skinner and

Mr. Gold each will receive, subject to their execution of a waiver and release agreement, severance pay consisting of no more than a

prorated portion of the target bonus for the year of termination, an amount representing the monthly premium cost of certain continued

medical benefits for eighteen months, 1.5 times annual base salary, and 1.5 times annual target bonus. The agreements contain an

eighteen-month noncompetition agreement along with related confidentiality, nondisparagement, and intellectual property provisions

and conditions receipt of the severance pay just described on compliance with those provisions.

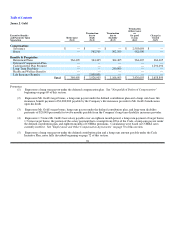

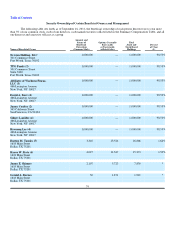

Confidentiality, Non-Competition and Termination Benefits Agreements

Messrs. Bangs, Maxwell and Barnes are each a party to a confidentiality, non-competition and termination benefits

agreement that will provide for severance benefits if the employment of the affected individual is terminated by the Company other

than in the event of death, "disability" or termination for "cause." These agreements provide for a severance payment equal to one and

one-half annual base salary payable over an eighteen-month period, and reimbursement for COBRA premiums for the same period.

Each confidentiality, non-competition and termination benefits agreement contains restrictive covenants as a condition to receipt of

any payments payable thereunder.

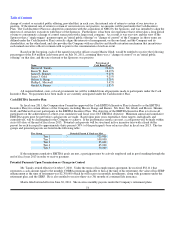

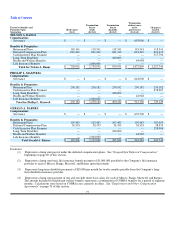

Cash Incentive Plan

Following the consummation of the Acquisition, the Neiman Marcus, Inc. Cash Incentive Plan (referred to as the Cash

Incentive Plan) was adopted to aid in the retention of certain key executives, including the named executive officers. The Cash

Incentive Plan provides for the creation of a $14 million cash bonus pool to be shared by the participants based on the number of stock

options that were granted to each such participant pursuant to the Management Equity Incentive Plan in October 2005. Each

participant in the Cash Incentive Plan will be entitled to a cash bonus upon the earlier to occur of a

72