Neiman Marcus 2010 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

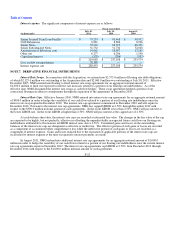

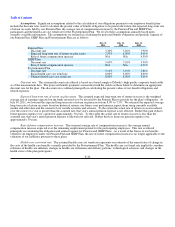

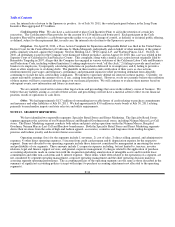

At July 30, 2011 the gross amount of unrecognized tax benefits was $4.1 million, all of which would impact our effective tax

rate, if recognized. We classify interest and penalties as a component of income tax expense (benefit) and our liability for accrued

interest and penalties was $6.2 million at July 30, 2011 and $6.3 million at July 30, 2010. A reconciliation of the beginning and

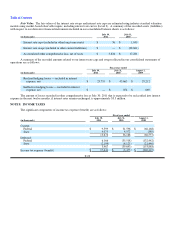

ending amounts of unrecognized tax benefits is as follows:

(in thousands)

July 30,

2011

July 31,

2010

Balance at beginning of fiscal year $ 6,401 $ 6,605

Gross amount of decreases for prior year tax position (373) —

Gross amount of increases for current year tax positions 306 654

Gross amount of decreases for settlements with tax authorities (2,209) (406)

Gross amount of decreases for expiration of statutes of limitation — (452)

Balance at ending of fiscal year $ 4,125 $ 6,401

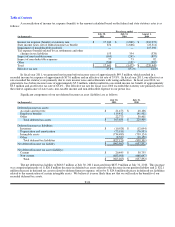

We file income tax returns in the U.S. federal jurisdiction and various state and local jurisdictions. During fiscal year 2011,

the Internal Revenue Service (IRS) began examination of our fiscal years 2008 and 2009 federal income tax returns. With respect to

state and local jurisdictions, with limited exceptions, the Company and its subsidiaries are no longer subject to income tax audits for

fiscal years before 2006. We believe our recorded tax liabilities as of July 30, 2011 are sufficient to cover any potential assessments

to be made by the IRS or other taxing authorities upon the completion of their examinations and we will continue to review our

recorded tax liabilities for potential audit assessments based upon subsequent events, new information and future circumstances. We

believe it is reasonably possible that additional adjustments in the amounts of our unrecognized tax benefits could occur within the

next twelve months as a result of settlements with tax authorities or expiration of statutes of limitation. At this time, we do not believe

such adjustments will have a material impact on our consolidated financial statements.

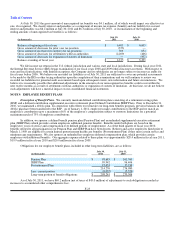

NOTE 9. EMPLOYEE BENEFIT PLANS

Description of Benefit Plans. We currently maintain defined contribution plans consisting of a retirement savings plan

(RSP) and a defined contribution supplemental executive retirement plan (Defined Contribution SERP Plan). Prior to December 31,

2010, we maintained a 401(k) plan. In connection with efforts to restructure our long-term benefits program, previous balances in the

401(k) plan have been transferred to the RSP. As of January 1, 2011, employees make contributions to the RSP and we match an

employee's contribution up to a maximum of 6% of the employee's compensation subject to statutory limitations for a potential

maximum match of 75% of employee contributions.

In addition, we sponsor a defined benefit pension plan (Pension Plan) and an unfunded supplemental executive retirement

plan (SERP Plan) which provides certain employees additional pension benefits. Benefits under both plans are based on the

employees' years of service and compensation over defined periods of employment. As of the third quarter of fiscal year 2010,

benefits offered to all participants in our Pension Plan and SERP Plan have been frozen. Retirees and active employees hired prior to

March 1, 1989 are eligible for certain limited postretirement health care benefits (Postretirement Plan) if they meet certain service and

minimum age requirements. We also sponsor an unfunded key employee deferred compensation plan, which provides certain

employees with additional benefits. Our aggregate expense related to these plans was approximately $28.4 million in fiscal year 2011,

$19.9 million in fiscal year 2010 and $20.0 million in fiscal year 2009.

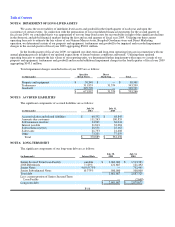

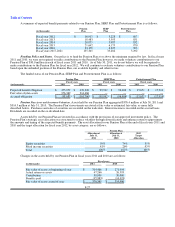

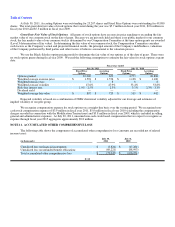

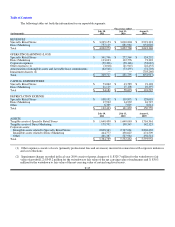

Obligations for our employee benefit plans, included in other long-term liabilities, are as follows:

(in thousands)

July 30,

2011

July 31,

2010

Pension Plan $ 98,683 $ 161,760

SERP Plan 99,942 96,406

Postretirement Plan 15,651 17,914

214,276 276,080

Less: current portion (6,035)(5,574)

Long-term portion of benefit obligations $ 208,241 $ 270,506

As of July 30, 2011, we have $69.2 million (net of taxes of $45.0 million) of adjustments to such obligations recorded as

increases to accumulated other comprehensive loss.

F-25