Neiman Marcus 2010 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

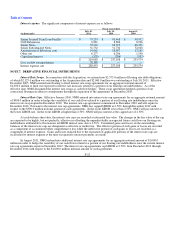

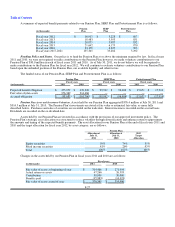

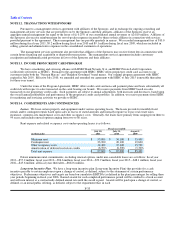

A reconciliation of income tax expense (benefit) to the amount calculated based on the federal and state statutory rates is as

follows:

Fiscal year ended

(in thousands)

July 30,

2011

July 31,

2010

August 1,

2009

Income tax expense (benefit) at statutory rate $ 17,242 $ (1,860) $ (310,972)

State income taxes, net of federal income tax benefit 874 (1,666) (23,311)

Impairment of nondeductible goodwill — — 115,398

Tax expense (benefit) related to tax settlements and other

changes in tax liabilities 153 354 (378)

Impact of non-taxable income (169) (245) (897)

Impact of non-deductible expenses 77 73 82

Other (536)(131)(367)

Total $ 17,641 $ (3,475) $ (220,445)

Effective tax rate 35.8% 65.4% 24.8%

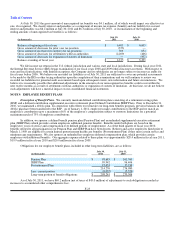

In fiscal year 2011, we generated net income before income taxes of approximately $49.3 million, which resulted in a

recorded income tax expense of approximately $17.6 million and an effective tax rate of 35.8%. In fiscal year 2011, our effective tax

rate exceeded the statutory rate primarily due to state income taxes and settlements with taxing authorities. In fiscal year 2010, we

generated a loss before income taxes of approximately $5.3 million, which resulted in a recorded income tax benefit of approximately

$3.5 million and an effective tax rate of 65.4%. The effective tax rate for fiscal year 2010 exceeded the statutory rate primarily due to

the relative significance of state taxes, non-taxable income and non-deductible expense to our pretax loss.

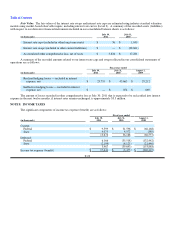

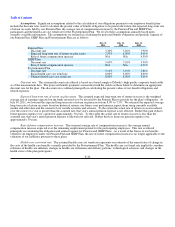

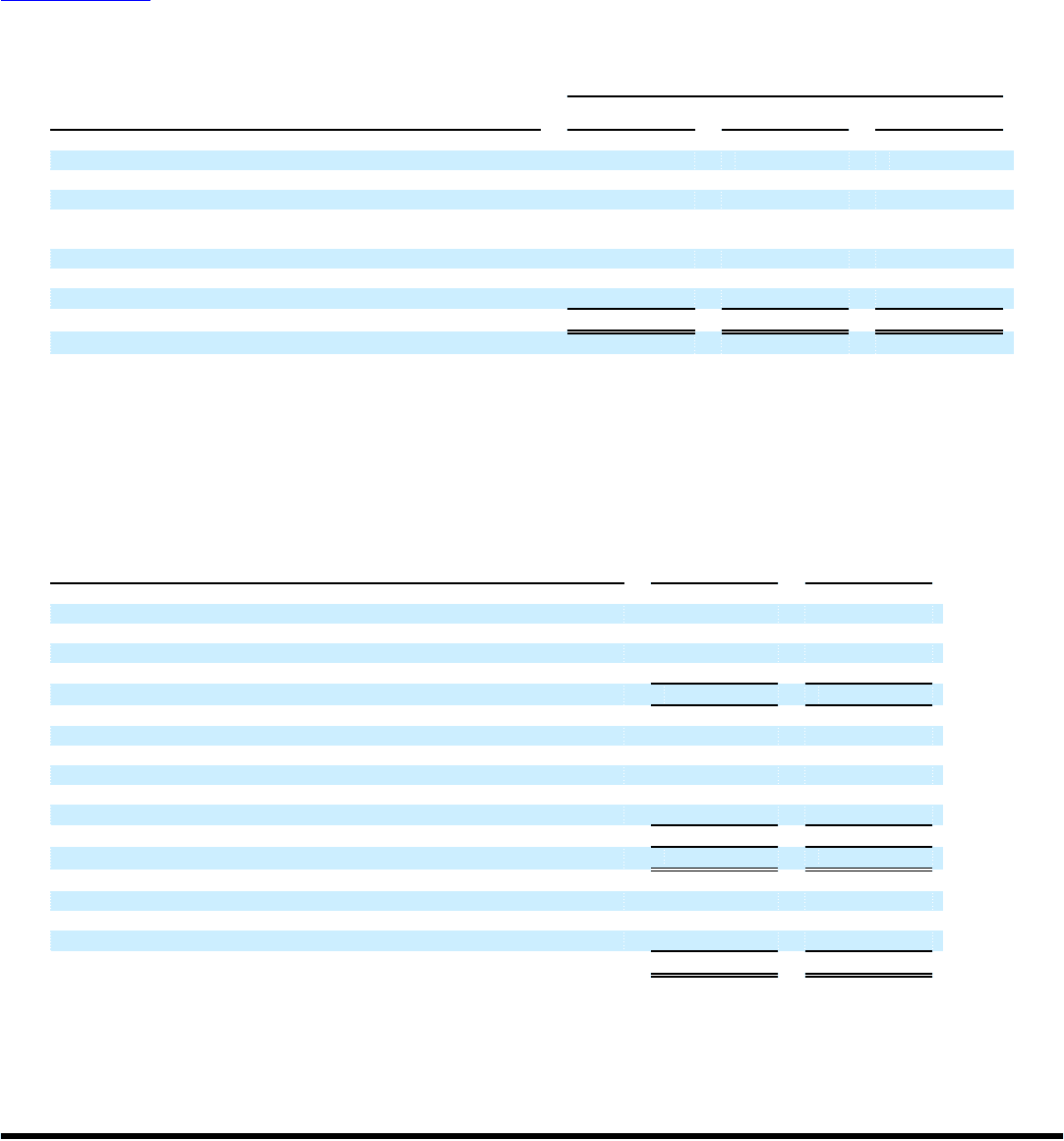

Significant components of our net deferred income tax asset (liability) are as follows:

(in thousands)

July 30,

2011

July 31,

2010

Deferred income tax assets:

Accruals and reserves $ 21,473 $ 48,106

Employee benefits 119,412 141,902

Other 22,773 30,401

Total deferred tax assets $ 163,658 $ 220,409

Deferred income tax liabilities:

Inventory $ (10,928) $ (12,094)

Depreciation and amortization (73,181) (76,933)

Intangible assets (734,485) (759,124)

Other (8,527)(10,150)

Total deferred tax liabilities (827,121)(858,301)

Net deferred income tax liability $ (663,463) $ (637,892)

Net deferred income tax asset (liability):

Current $ 20,445 $ 30,755

Non-current (683,908)(668,647)

Total $ (663,463)$ (637,892)

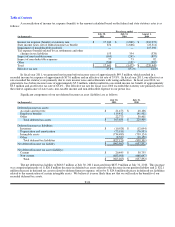

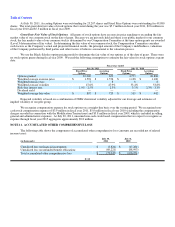

The net deferred tax liability of $663.5 million at July 30, 2011 increased from $637.9 million at July 31, 2010. This increase

was comprised primarily of 1) $26.8 million decrease in deferred tax assets related to the decrease in our pension liability and 2) $22.1

million decrease in deferred tax assets related to deferred interest expense, offset by 3) $24.6 million decrease in deferred tax liabilities

related to the amortization of certain intangible assets. We believe it is more likely than not that we will realize the benefits of our

recorded deferred tax assets.

F-24