Neiman Marcus 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

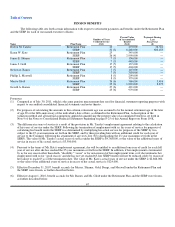

have received under the RSP if the tax law limitations did not apply and if certain other components of compensation could be

included in calculation of benefits under our tax-qualified plans. Prior to 2008, executive, administrative and professional employees

(other than those employed as salespersons) with an annual base salary at least equal to a minimum established by the Company were

eligible to participate in the SERP. Similar to the Retirement Plan, effective December 31, 2007, eligibility and benefit accruals under

the SERP were frozen for all participants not meeting the "Rule of 65" and such participants were moved into The Neiman Marcus

Group, Inc. Defined Contribution Supplemental Executive Retirement Plan (DC SERP). Effective August 1, 2010, all benefits and

accruals under the SERP for "Rule of 65" employees were frozen and such participants will be moved into the DC SERP. SERP

related benefits are more fully described under "Pension Benefits" beginning on page 67.

Participation in the KEDC Plan is limited to employees whose base salary is in excess of $300,000 and meet other stated

criteria. Amounts in excess of those benefits provided under the 401(K) plans are credited to the account balances of each KEDC Plan

participant. KEDC Plan benefits are more fully described under "Nonqualified Deferred Compensation" beginning on page 69 of this

section.

Matching Gift Program. All employees, including the named executive officers except Mr. Tansky and Ms. Glodt, may

participate in our matching gift program. Under the program, we will match charitable contributions by employees up to a maximum

of $2,000 per qualifying organization on a two-for-one basis in each calendar year. For any contribution made to a qualifying

organization in which the employee has an active involvement (as evidenced by service on the organization's governing body or in one

of its working committees), the basis of our matching contribution may, upon application by the employee, be increased to a level

greater than two-for-one.

Perquisites. We provide perquisites and other personal benefits that we believe are reasonable and consistent with the nature

of individual responsibilities in order to provide a competitive level of total compensation to our executives. We believe the level of

perquisites is within an acceptable range of what is offered by a group of industry related companies. The Compensation Committee

believes that these benefits are aligned with the Company's desire to attract and retain highly skilled management talent for the benefit

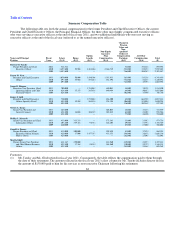

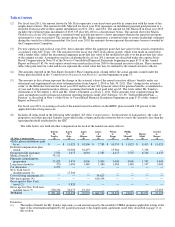

of all stockholders. The value of these benefits to the named executive officers is set forth in the Summary Compensation Table under

the column "All Other Compensation" and details about each benefit are set forth in a table following the Summary Compensation

Table.

Compensation Following Employment Termination or Change of Control

Employment Agreements

Mr. Tansky, our former President and Chief Executive Officer, retired effective as of October 5, 2010. Effective October 6,

2010, Ms. Katz was promoted to President and Chief Executive Officer, Mr. Skinner was promoted to the additional position of Chief

Operating Officer, and Mr. Gold was promoted to President, Specialty Retail. In order to support the continuity of senior leadership,

the Compensation Committee approved the entry into the employment agreements with Ms. Katz and Messrs. Skinner and Gold in

connection with their promotions. The employment agreements provide, among other things, for payments to the executive following

a termination of employment by the executive for "good reason" or a termination of the executive's employment by the Company

without "cause." The triggering events constituting "good reason" and "cause" were negotiated to provide protection to the Company

for unwarranted termination of employment that could cause harm to the Company as well as to provide protection to the executive.

The employment agreements also provide for certain payments to the executives upon death or "disability." For a detailed description

of the terms of the employment agreements, see "Employment and Other Compensation Agreements" beginning on page 70.

Confidentiality, Non-Competition and Termination Benefits Agreements

Each of Messrs. Bangs, Maxwell, and Barnes is a party to a confidentiality, non-competition and termination benefits

agreement with the Company. The confidentiality, non-competition and termination benefits agreements provide for severance

benefits if the employment of the affected individual is terminated other than for death, "disability", or for "cause." These agreements

provide for a severance payment equal to one and one-half annual base salary of the named executive officer, payable over an eighteen

month period, and reimbursement for COBRA premiums for the same period. The employment agreements of Ms. Katz and

Messrs. Skinner and Gold contain similar provisions as described beginning on page 71.

60