Neiman Marcus 2010 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

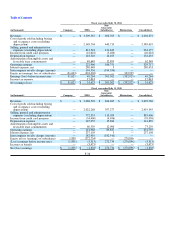

Table of Contents

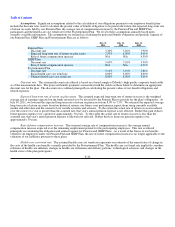

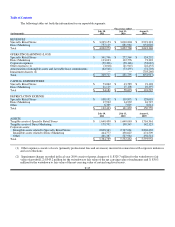

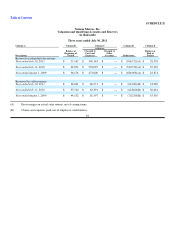

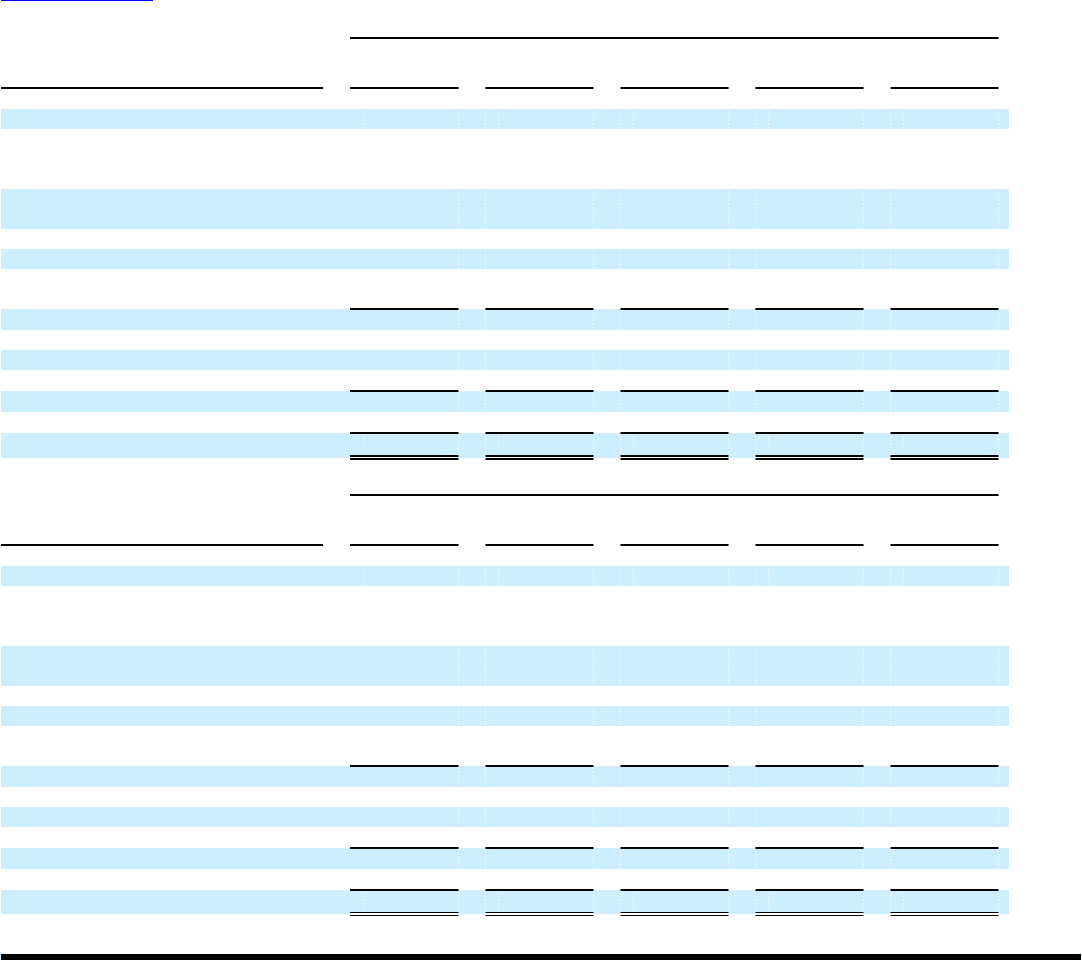

Fiscal year ended July 30, 2011

(in thousands) Company NMG

Non-

Guarantor

Subsidiaries Eliminations Consolidated

Revenues $ — $ 3,309,567 $ 692,705 $ — $ 4,002,272

Cost of goods sold including buying

and occupancy costs (excluding

depreciation) — 2,148,704 440,715 — 2,589,419

Selling, general and administrative

expenses (excluding depreciation) — 812,542 121,635 — 934,177

Income from credit card program — (42,622) (3,400) — (46,022)

Depreciation expense — 118,328 14,105 — 132,433

Amortization of intangible assets and

favorable lease commitments — 49,649 12,899 — 62,548

Operating earnings — 222,966 106,751 — 329,717

Interest expense, net — 280,448 5 — 280,453

Intercompany royalty charges (income) — 194,556 (194,556) — —

Equity in (earnings) loss of subsidiaries (31,623)(301,302)— 332,925 —

Earnings (loss) before income taxes 31,623 49,264 301,302 (332,925) 49,264

Income tax expense — 17,641 — — 17,641

Net earnings (loss) $ 31,623 $ 31,623 $ 301,302 $ (332,925)$ 31,623

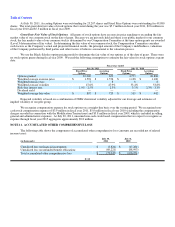

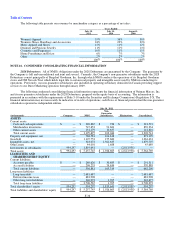

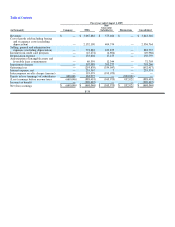

Fiscal year ended July 31, 2010

(in thousands) Company NMG

Non-

Guarantor

Subsidiaries Eliminations Consolidated

Revenues $ — $ 3,068,503 $ 624,265 $ — $ 3,692,768

Cost of goods sold including buying

and occupancy costs (excluding

depreciation) — 2,022,268 397,277 — 2,419,545

Selling, general and administrative

expenses (excluding depreciation) — 772,353 113,053 — 885,406

Income from credit card program — (54,400) (4,676) — (59,076)

Depreciation expense — 125,955 15,884 — 141,839

Amortization of intangible assets and

favorable lease commitments — 60,359 12,900 — 73,259

Operating earnings — 141,968 89,827 — 231,795

Interest expense, net — 237,105 3 — 237,108

Intercompany royalty charges (income) — 182,910 (182,910) — —

Equity in loss (earnings) of subsidiaries 1,838 (272,734)— 270,896 —

(Loss) earnings before income taxes (1,838) (5,313) 272,734 (270,896) (5,313)

Income tax benefit — (3,475)— — (3,475)

Net (loss) earnings $ (1,838)$ (1,838)$ 272,734 $ (270,896)$ (1,838)

F-38