Neiman Marcus 2010 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

• do not reflect any cash requirements for assets being depreciated and amortized that may have to be replaced in the

future.

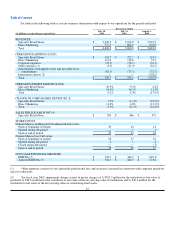

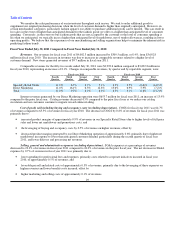

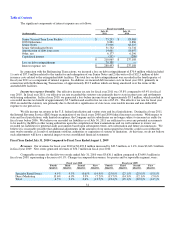

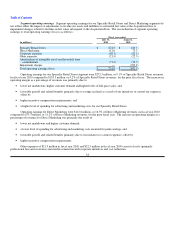

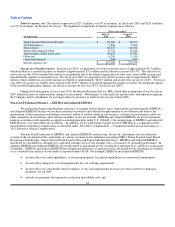

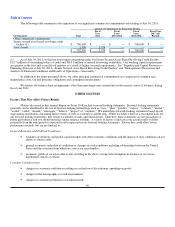

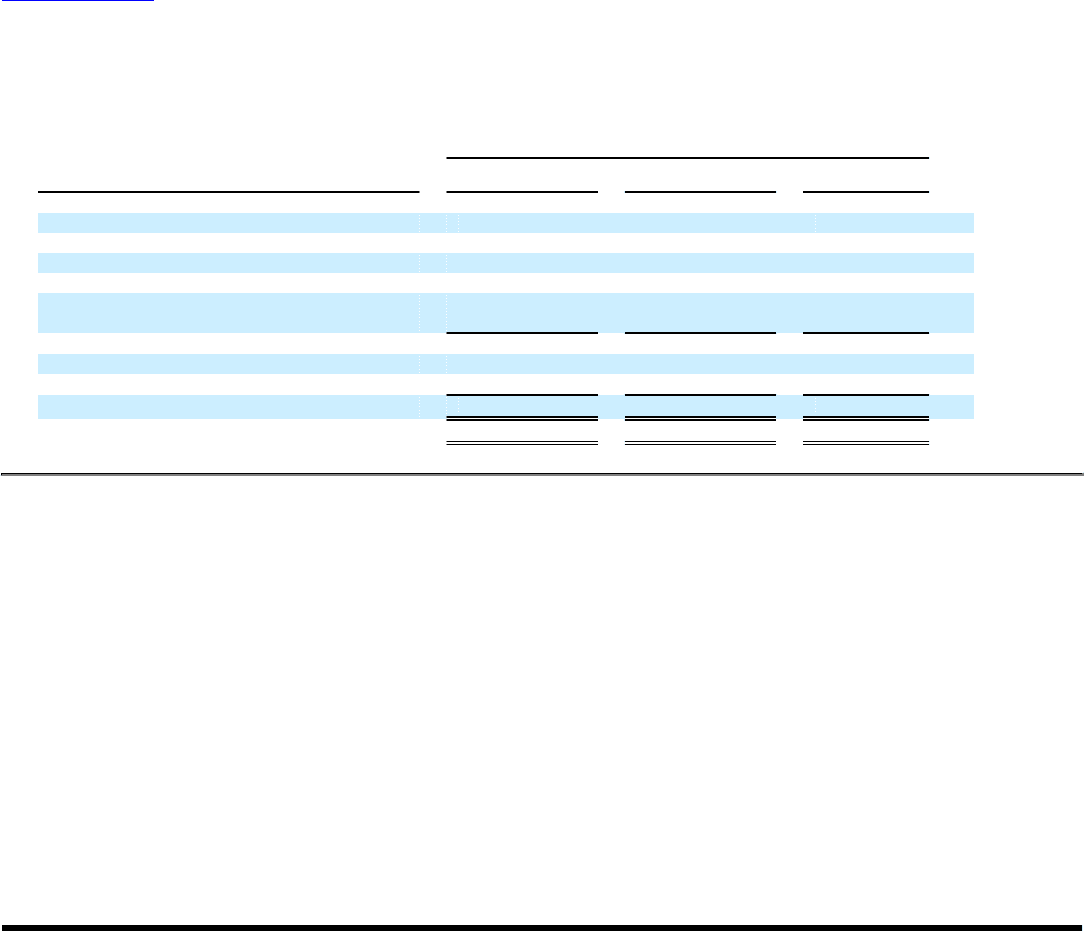

The following table reconciles net earnings (loss) as reflected in our consolidated statements of operations prepared in

accordance with GAAP to EBITDA and Adjusted EBITDA:

Fiscal year ended

(dollars in millions)

July 30,

2011

July 31,

2010

August 1,

2009

Net earnings (loss) $ 31.6 $ (1.8) $ (668.0)(1)

Income tax expense (benefit) 17.7 (3.5) (220.5)

Interest expense, net 280.5 237.1 235.6

Depreciation expense 132.4 141.8 150.8

Amortization of intangible assets and

favorable lease commitments 62.5 73.3 72.7

EBITDA 524.7 446.9 (429.4)(1)

EBITDA as a percentage of revenues 13.1% 12.1% (11.8)%

Non-cash impairment of long-lived assets — — 703.2

Adjusted EBITDA $ 524.7 $ 446.9 $ 273.8

Adjusted EBITDA as a percentage of revenues 13.1%12.1%7.5%

(1) For fiscal year 2009, operating loss and EBITDA include pretax impairment charges related to 1) $329.7 million for the

writedown to fair value of goodwill, 2) $343.2 million for the writedown to fair value of the net carrying value of tradenames

and 3) $30.3 million for the writedown to fair value of the net carrying value of certain long-lived assets.

Inflation and Deflation

We believe changes in revenues and net earnings that have resulted from inflation or deflation have not been material during

the past three fiscal years. In recent years, we have experienced certain inflationary conditions in our cost base due primarily

to changes in foreign currency exchange rates that have reduced the purchasing power of the U.S. dollar and, to a lesser extent,

to increases in selling, general and administrative expenses, particularly with regard to employee benefits, and increases in fuel prices

and costs impacted by increases in fuel prices, such as freight and transportation costs.

We purchase a substantial portion of our inventory from foreign suppliers whose costs are affected by the fluctuation of their

local currency against the dollar or who price their merchandise in currencies other than the dollar. Fluctuations in the Euro-U.S.

dollar exchange rate affect us most significantly; however, we source goods from numerous countries and thus are affected by changes

in numerous currencies and, generally, by fluctuations in the U.S. dollar relative to such currencies. Accordingly, changes in the value

of the dollar relative to foreign currencies may increase the retail prices of goods offered for sale and/or increase our cost of goods

sold. If our customers reduce their levels of spending in response to increases in retail prices and/or we are unable to pass such cost

increases to our customers, our revenues, gross margins, and ultimately our earnings, could decrease. Foreign currency fluctuations

could have a material adverse effect on our business, financial condition and results of operations in the future.

35