Neiman Marcus 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

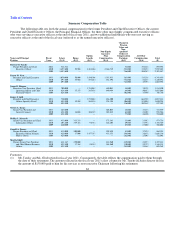

(2)

For fiscal year 2011, the amount shown for Ms. Katz represents a one-time bonus payable in connection with the terms of her

employment contract. The amount for Mr. Maxwell for fiscal year 2011 represents an installment payment paid pursuant to a

retention bonus payable in three annual installments in 2010, 2011, and 2012. The amount for Mr. Maxwell in fiscal year 2010

includes the retention bonus installment of $333,333 plus $16,128 for a discretionary bonus. The amount shown for Marita

Glodt for fiscal year 2011 represents a retention bonus payable pursuant to a letter agreement wherein she agreed to postpone

retirement for a one-year period. The amount shown for Mr. Barnes represents a retention bonus to ensure leadership continuity

during the search for a division president. For fiscal year 2010, the amounts shown represent discretionary bonuses awarded by

the Compensation Committee.

(3)

For new option awards in fiscal year 2011, these amounts reflect the aggregate grant date fair value for the awards computed in

accordance with ASC Topic 718. The amounts for the fiscal year 2010 stock option awards, which were made in connection

with a tender offer, reflect the incremental aggregate grant date fair value of the modified awards over the grant date fair value

of the original awards. Assumptions used in calculating the fiscal year 2011 amounts are described under the caption Stock-

Based Compensation in Note 10 of the Notes to Consolidated Financial Statements beginning on page F-31 of this Annual

Report on Form 10-K. No stock option awards were made in fiscal year 2009 to the named executive officers. These amounts

reflect the grant date fair value and do not represent the actual value that may be realized by the named executive officers.

(4)

The amounts reported in the Non-Equity Incentive Plan Compensation column reflect the actual amounts earned under the

bonus plan described in the "Compensation Discussion and Analysis" section beginning on page 53.

(5)

The amounts in this column represent the change in the actuarial value of the named executive officers' benefits under our

retirement and supplemental executive retirement plans from August 1, 2010 to July 30, 2011. This "change in the actuarial

value" is the difference between the fiscal year 2010 and fiscal year 2011 present value of the pension benefits accumulated as

of year-end by the named executive officers, assuming that benefit is not paid until age 65. The totals reflect Mr. Tansky's

retirement as of November 1, 2010 and Ms. Glodt's retirement as of July 1, 2011. These amounts were computed using the

same assumptions used for financial statement reporting purposes under ASC Subtopic 715-30, "Defined Benefit Plans —

Pension" as described in Note 9 of the Notes to Consolidated Financial Statements beginning on page F-25 of this Annual

Report on Form 10-K.

For fiscal year 2011, no earnings of each of the named executive officers in the KEDC plan exceeded 120 percent of the

applicable federal long-term rate.

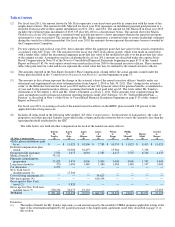

(6)

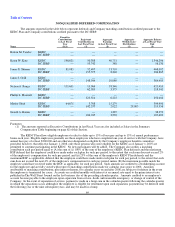

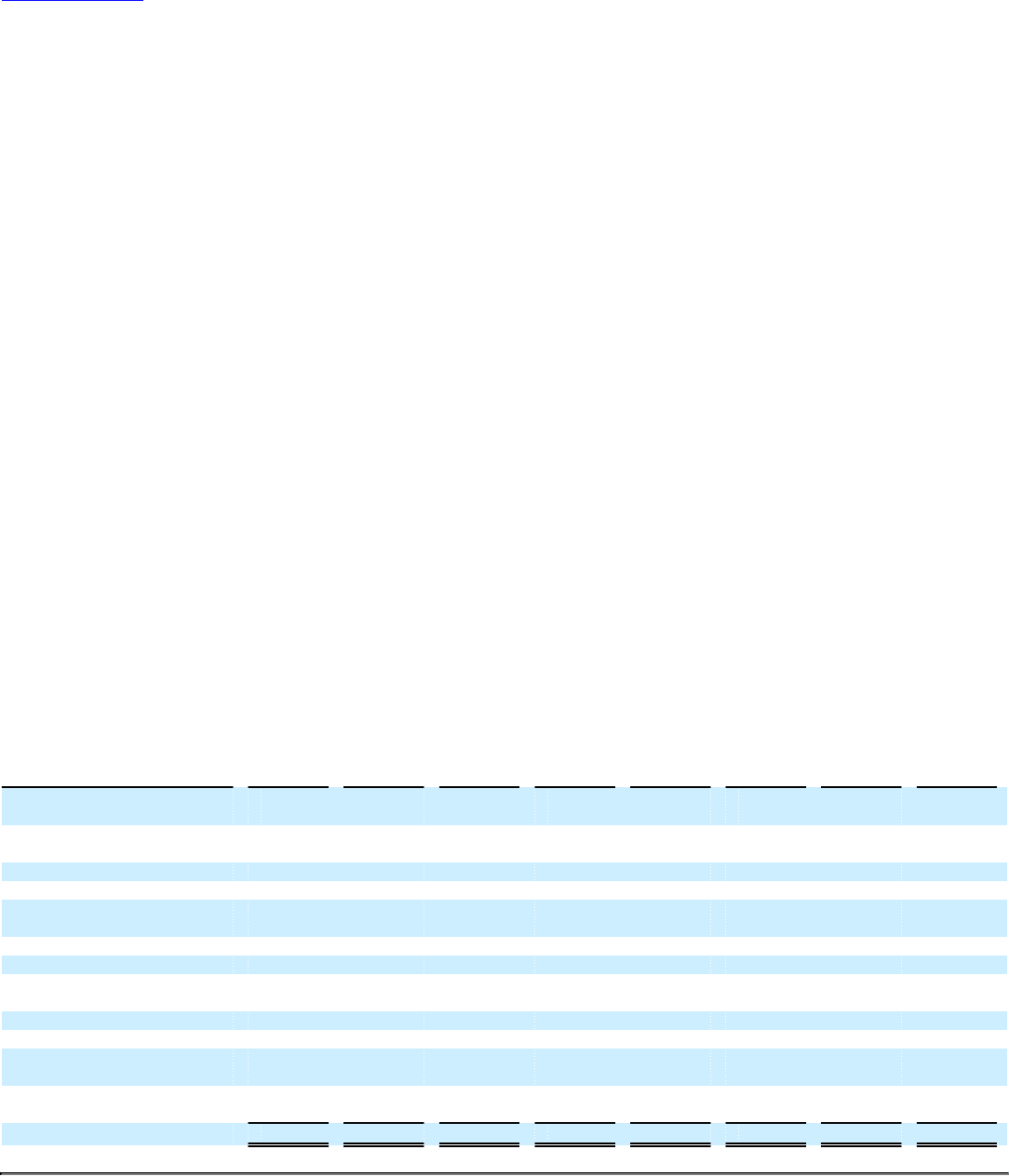

Includes all items listed in the following table entitled "All Other Compensation." In the interest of transparency, the value of

perquisites and other personal benefits is provided in this column and in the footnotes below even if the amount is less than the

reporting threshold established by the SEC.

The table below sets forth all other compensation for each of the named executive officers.

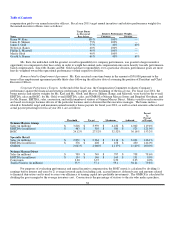

All Other Compensation

Burton

M.

Tansky

($)

Karen

W.

Katz

($)

James

E.

Skinner

($)

James

J.

Gold

($)

Nelson

A.

Bangs

($)

Phillip

L.

Maxwell

($)

Marita

Glodt

($)

Gerald

A.

Barnes

($)

401(k) plan contributions paid

by us $ — $ 11,025 $ 10,806 $ 7,788 $ 10,555 $ 11,025 $ 8,415 $ 11,025

Deferred compensation plan

match — 50,388 32,497 — 13,964 — 5,708 —

Group term life insurance 7,523 3,075 4,094 1,565 4,475 7,507 6,746 4,337

Medical benefit (1) 58,111

Financial counseling/tax

preparation 53,028 5,475 3,000 3,000 3,000 3,000 1,745 3,000

Long-term disability 370 1,480 1,480 1,480 1,480 1,480 1,357 1,480

Car allowance 2,250 — — — — — — —

New York travel

reimbursement (2) — 17,500 — — — — — —

Cost of living adjustment (3) — — — 34,615 — — — —

Moving expenses (4) — — — 616,144 — — — —

Gross-ups for New York

travel (2) — 9,820 — — — — — —

Gross ups for New York non-

resident taxes (5) 230,134 34,475 19,101 — — — — 17,283

TOTALS $ 351,416 $ 133,238 $ 70,978 $ 664,592 $ 33,474 $ 23,012 $ 23,971 $ 37,125

Footnotes:

(1)

The medical benefit for Mr. Tansky represents a cash amount equal to the monthly COBRA premium applicable to him at the

time of his retirement multiplied by 60, payable pursuant to his employment agreement, more fully described on page 71 of

this section.